California State Tax Return Amendment on Form 540 or NR, X 2022

Understanding the California State Tax Return Amendment on Form 540 or NR, X

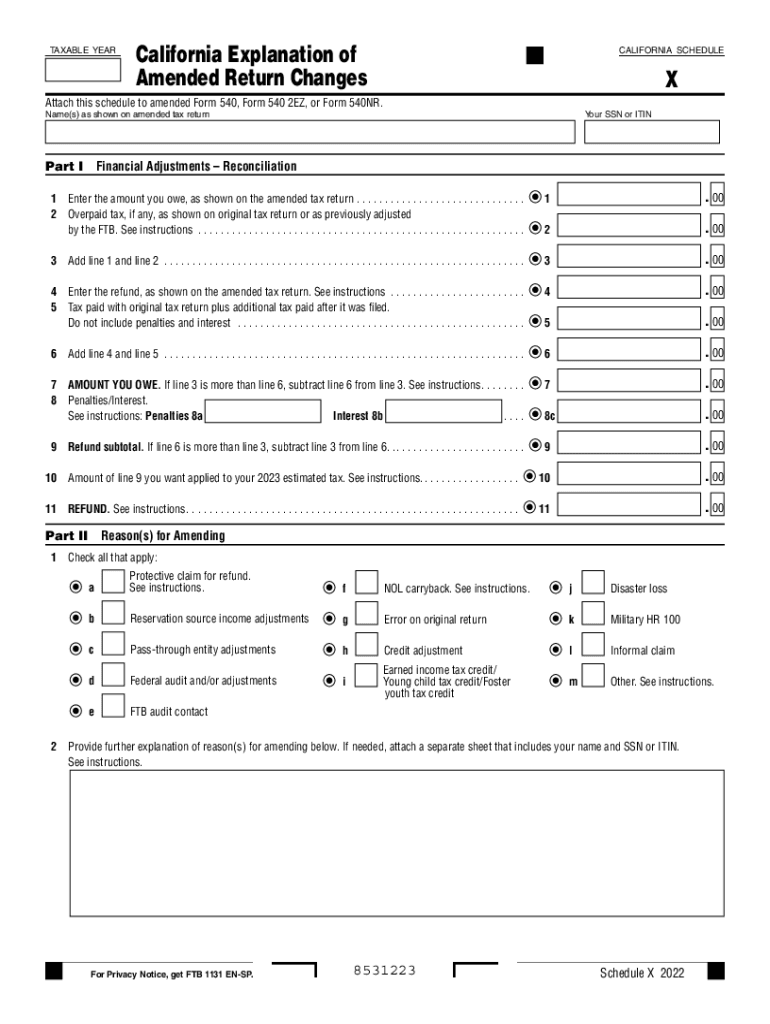

The California State Tax Return Amendment on Form 540 or NR, X is a crucial document that allows taxpayers to correct or modify their previously filed tax returns. This form is essential for ensuring that any discrepancies, whether due to errors or changes in financial circumstances, are properly addressed. Taxpayers may need to amend their returns for various reasons, including changes in income, deductions, or credits that were not accurately reported in the original submission.

Form 540 is typically used by California residents, while Form NR, X is designated for non-residents. Understanding the distinctions between these forms is vital for accurate filing and compliance with state tax regulations.

Steps to Complete the California State Tax Return Amendment on Form 540 or NR, X

Completing the California State Tax Return Amendment involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant documentation, including your original tax return and any supporting documents that pertain to the changes being made.

Next, clearly indicate the changes on the amendment form. This may involve filling out specific sections that correspond to the areas of your original return that require correction. Be sure to provide detailed explanations for each change, as this will help clarify your amendments to the tax authorities.

After completing the form, review it thoroughly for any errors before submission. This ensures that all information is accurate and that you have included all necessary documentation. Finally, submit the amended return according to the instructions provided, whether online, by mail, or in person.

Filing Deadlines and Important Dates for Amendments

It is essential to be aware of the filing deadlines for submitting an amended tax return using Form 540 or NR, X. Generally, taxpayers have up to four years from the original filing deadline to amend their returns. For example, for tax year 2019, the deadline to file an amendment would typically fall in April 2024.

Additionally, if you are seeking a refund due to the amendments, it is crucial to file the amendment as soon as possible to avoid missing the deadline. Keeping track of these important dates can help ensure compliance and facilitate any potential refunds.

Required Documents for the Amendment Process

When preparing to file an amendment using Form 540 or NR, X, it is important to gather all required documents. This includes your original tax return, any W-2 forms, 1099 forms, and any other relevant financial documents that support the changes you are making.

Additionally, if you are claiming new deductions or credits, you will need to provide documentation that substantiates these claims. Having all necessary documents on hand will streamline the amendment process and reduce the likelihood of delays or complications.

Legal Use of the California State Tax Return Amendment on Form 540 or NR, X

The legal use of the California State Tax Return Amendment on Form 540 or NR, X is governed by state tax laws. Taxpayers are permitted to amend their returns to correct errors, claim additional deductions, or adjust their tax liability based on new information.

It is important to note that filing an amendment does not guarantee a refund or a reduction in tax liability. The California Franchise Tax Board reviews all amendments and may require additional information or documentation to support the changes being made. Compliance with all legal requirements is essential to avoid penalties or complications.

Examples of Using the California State Tax Return Amendment on Form 540 or NR, X

There are various scenarios in which a taxpayer might need to use the California State Tax Return Amendment on Form 540 or NR, X. For instance, if a taxpayer discovers that they failed to report additional income from freelance work, they would need to amend their return to accurately reflect this income.

Another example could involve a taxpayer who initially claimed a standard deduction but later realized they qualified for itemized deductions. In such cases, filing an amendment would allow them to recalculate their tax liability based on the more beneficial deduction method.

Quick guide on how to complete california state tax return amendment on form 540 or nr x

Effortlessly Prepare California State Tax Return Amendment On Form 540 Or NR, X on Any Device

Managing documents online has gained popularity among companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage California State Tax Return Amendment On Form 540 Or NR, X across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Way to Alter and eSign California State Tax Return Amendment On Form 540 Or NR, X Smoothly

- Find California State Tax Return Amendment On Form 540 Or NR, X and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically available from airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, the hassle of searching for forms, or errors that necessitate printing additional copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign California State Tax Return Amendment On Form 540 Or NR, X to ensure smooth communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california state tax return amendment on form 540 or nr x

Create this form in 5 minutes!

How to create an eSignature for the california state tax return amendment on form 540 or nr x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2019 explanation return?

A 2019 explanation return is a type of tax return that provides detailed information regarding certain financial activities for the year 2019. Businesses often need to file this return to clarify their financial standings to tax authorities. With airSlate SignNow, you can easily manage and eSign all related documents securely and efficiently.

-

How does airSlate SignNow help with 2019 explanation return processes?

airSlate SignNow streamlines the process of handling your 2019 explanation return by allowing you to send, receive, and eSign documents effortlessly. Our cost-effective solution ensures that you can manage your tax documents without any hassle, making compliance easier and less time-consuming. Say goodbye to paper clutter and hello to digital efficiency!

-

What features does airSlate SignNow offer for managing tax documents like the 2019 explanation return?

airSlate SignNow offers features like document templates, customizable workflows, and secure cloud storage to keep your 2019 explanation return and other tax documents organized. The intuitive interface allows for easy collaboration among team members, ensuring that everyone stays informed and engaged. You'll also enjoy advanced tracking options to oversee document status at a glance.

-

Is there a free trial available for airSlate SignNow's services related to the 2019 explanation return?

Yes, airSlate SignNow offers a free trial that allows you to test our services before committing to a plan. You can explore how our platform can facilitate your 2019 explanation return process and other document-related tasks. Sign up today and discover the efficiencies our solution provides!

-

What are the pricing options for using airSlate SignNow to manage my 2019 explanation return?

airSlate SignNow provides various pricing plans to cater to different business needs, making it cost-effective for managing your 2019 explanation return. Plans range from basic to advanced, allowing you to choose the best fit for your business size and document volume. Contact our sales team for detailed pricing and personalized recommendations.

-

Can airSlate SignNow integrate with accounting software for my 2019 explanation return?

Absolutely! airSlate SignNow integrates seamlessly with several accounting software solutions, which can enhance the management of your 2019 explanation return. This integration ensures that all your financial data is connected and up-to-date, making the preparation and filing process more efficient. Check our website for a list of supported integrations.

-

Are documents signed with airSlate SignNow legally binding for my 2019 explanation return?

Yes, documents signed with airSlate SignNow are legally binding under the ESIGN Act and UETA. This means that your 2019 explanation return and other important documents can be securely signed electronically, saving you time and ensuring compliance. Our platform adheres to stringent security standards to protect your sensitive information.

Get more for California State Tax Return Amendment On Form 540 Or NR, X

Find out other California State Tax Return Amendment On Form 540 Or NR, X

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe