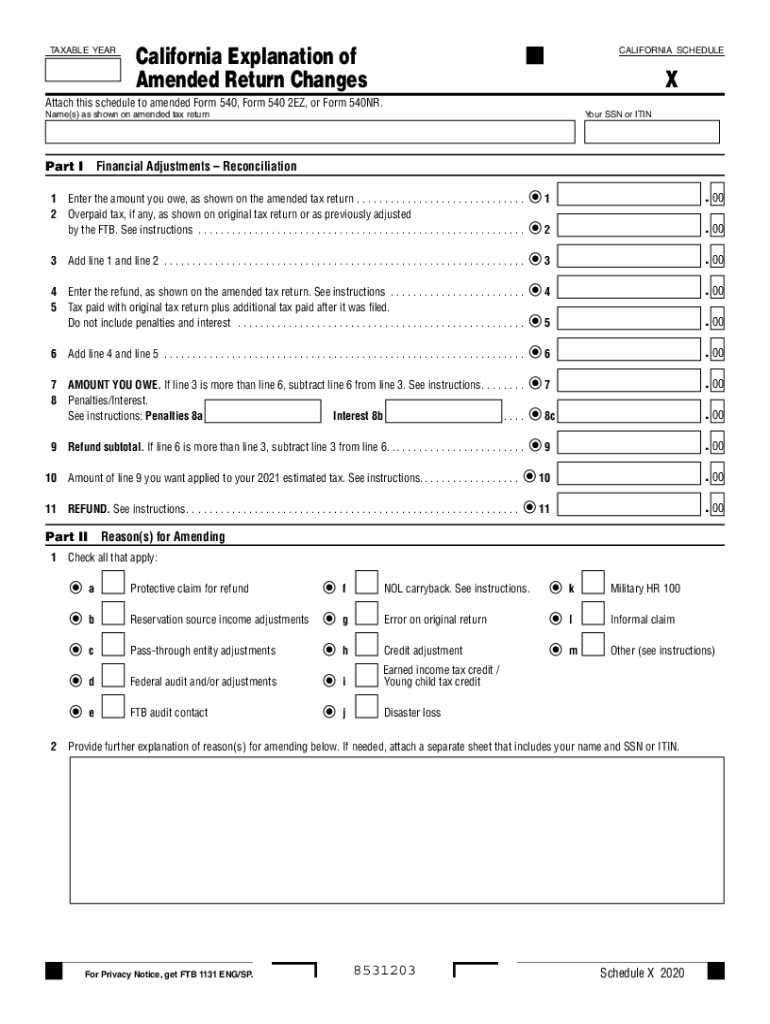

Schedule X California Explanation of Amended Return Changes 2020

What is the Schedule X California Explanation of Amended Return Changes

The Schedule X California Explanation of Amended Return Changes is a form used by taxpayers to explain any amendments made to their previously filed California tax returns. This form is essential for clarifying adjustments that may affect tax liability, deductions, or credits. It provides the California Franchise Tax Board (FTB) with a detailed account of the reasons for changes, ensuring that the amended return is processed correctly and efficiently. Understanding this form is crucial for maintaining compliance with California tax laws.

Steps to Complete the Schedule X California Explanation of Amended Return Changes

Completing the Schedule X requires careful attention to detail to ensure accuracy. Here are the steps to follow:

- Gather all relevant documents, including your original tax return and any supporting documentation for the changes.

- Clearly state the reasons for the amendments in the designated sections of the form.

- Provide any necessary calculations that support your changes, including adjustments to income or deductions.

- Review the completed form for accuracy, ensuring all information is correct and complete.

- Submit the form along with your amended return to the FTB, either electronically or by mail.

Legal Use of the Schedule X California Explanation of Amended Return Changes

The Schedule X is legally recognized as a valid document for explaining amendments to tax returns in California. To be considered legally binding, the information provided must be truthful and accurate, as any discrepancies could lead to penalties or audits. It is crucial to comply with all relevant tax laws and regulations when completing this form, as it serves as a formal declaration to the FTB regarding changes made to your tax situation.

Required Documents for the Schedule X California Explanation of Amended Return Changes

When filing the Schedule X, certain documents are necessary to support your explanations and amendments. These may include:

- Your original tax return.

- Any documentation that substantiates the changes, such as W-2s, 1099s, or receipts.

- Calculations that demonstrate how the changes affect your tax liability.

- Previous correspondence with the FTB, if applicable.

Filing Deadlines for the Schedule X California Explanation of Amended Return Changes

Timely submission of the Schedule X is essential to avoid penalties. Generally, amended returns must be filed within four years from the original due date of the tax return. It is important to check the specific deadlines for the tax year in question, as they may vary. Keeping track of these deadlines ensures compliance and helps avoid unnecessary complications with the FTB.

Examples of Using the Schedule X California Explanation of Amended Return Changes

There are various scenarios in which a taxpayer might need to use the Schedule X. Common examples include:

- Correcting income reported due to a missed W-2 or 1099 form.

- Adjusting deductions after discovering additional eligible expenses.

- Updating filing status based on changes in personal circumstances, such as marriage or divorce.

These examples illustrate the importance of accurately reporting changes to ensure compliance with California tax regulations.

Quick guide on how to complete 2020 schedule x california explanation of amended return changes

Prepare Schedule X California Explanation Of Amended Return Changes smoothly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without holdups. Manage Schedule X California Explanation Of Amended Return Changes on any device using airSlate SignNow’s Android or iOS apps and enhance any document-centric process today.

How to modify and eSign Schedule X California Explanation Of Amended Return Changes effortlessly

- Locate Schedule X California Explanation Of Amended Return Changes and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important parts of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or mislaid documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management requirements in a few clicks from your chosen device. Modify and eSign Schedule X California Explanation Of Amended Return Changes and ensure effective communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule x california explanation of amended return changes

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule x california explanation of amended return changes

How to generate an e-signature for your PDF document online

How to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What features does airSlate SignNow offer to help me schedule x efficiently?

airSlate SignNow provides an intuitive interface that simplifies the document signing process, making it easy to schedule x. You'll find features such as customizable templates, automated workflows, and reminders that help ensure your documents are signed on time.

-

How can I integrate airSlate SignNow with my existing tools to better schedule x?

You can seamlessly integrate airSlate SignNow with various applications like Google Drive, Salesforce, and Zapier. This allows you to schedule x directly from your preferred platforms, enhancing collaboration and improving your workflow.

-

Is there a pricing plan that suits businesses looking to schedule x regularly?

Yes, airSlate SignNow offers flexible pricing plans designed for businesses of all sizes looking to schedule x. Plans are cost-effective, providing features that scale with your needs, so you can choose a plan that aligns with your document signing frequency.

-

Can I track the status of my documents when I schedule x using airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your documents in real time. This feature allows you to monitor when recipients open and sign your documents, ensuring that your schedule x is maintained.

-

What are the benefits of using airSlate SignNow to schedule x over traditional methods?

Using airSlate SignNow to schedule x offers signNow benefits over traditional methods, such as reduced turnaround time and enhanced security. Electronic signatures are legally binding and provide a more streamlined process, saving you time and resources.

-

How does airSlate SignNow ensure the security of my documents when I schedule x?

airSlate SignNow takes document security seriously, employing advanced encryption and compliance measures to protect your sensitive information as you schedule x. Rest assured that your documents remain confidential and secure during the entire signing process.

-

What support options are available if I need help scheduling x with airSlate SignNow?

If you encounter any issues while scheduling x, airSlate SignNow offers a range of support options, including a comprehensive help center, customer service chat, and email support. Our team is ready to assist you with any inquiries or challenges you may face.

Get more for Schedule X California Explanation Of Amended Return Changes

- Flooring contract for contractor alaska form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract alaska form

- Notice of intent to enforce forfeiture provisions of contact for deed alaska form

- Final notice of forfeiture and request to vacate property under contract for deed alaska form

- Buyers request for accounting from seller under contract for deed alaska form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed alaska form

- General notice of default for contract for deed alaska form

- Sellers disclosure of forfeiture rights for contract for deed alaska form

Find out other Schedule X California Explanation Of Amended Return Changes

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online