Schedule X 2019

What is the Schedule X

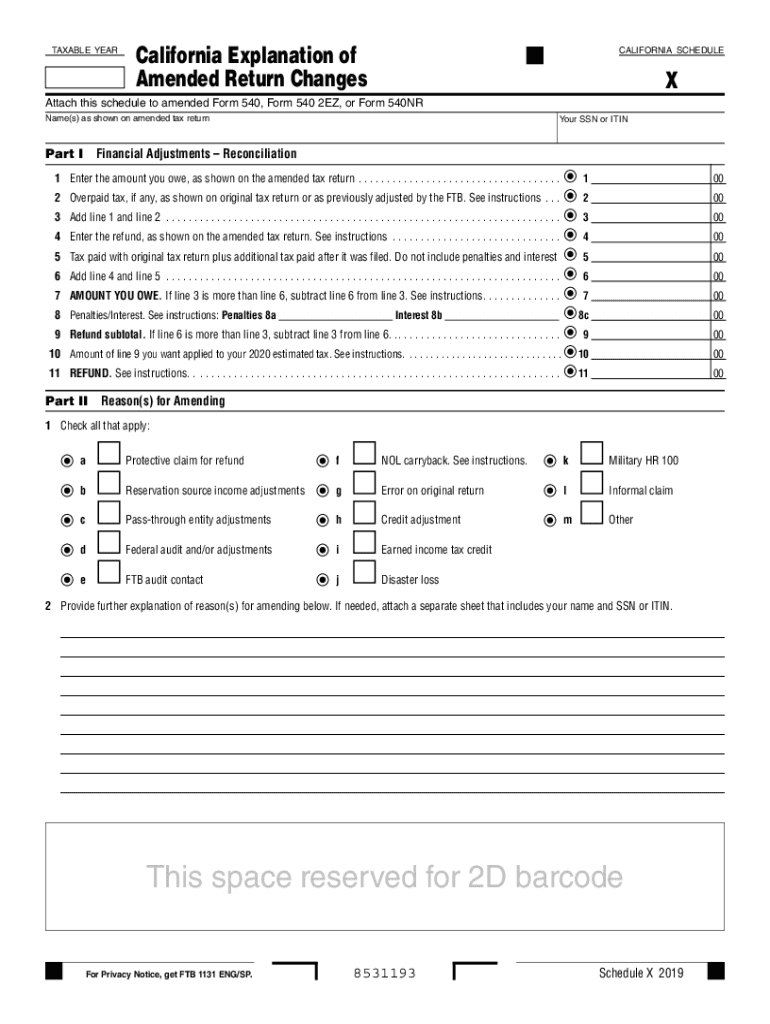

The Schedule X form is a crucial document used by taxpayers in the United States to report adjustments to their income tax returns. Specifically, it is often associated with amended returns, allowing individuals to correct previously filed tax returns. This form is particularly relevant for those who need to make changes due to errors, omissions, or changes in circumstances that affect their tax liability. Understanding the purpose and function of the Schedule X is essential for ensuring compliance with tax regulations.

How to use the Schedule X

Using the Schedule X involves a straightforward process aimed at accurately reflecting your tax situation. To begin, gather all necessary documentation related to your original tax return and any new information that necessitates the amendment. Next, carefully fill out the form, ensuring that all adjustments are clearly noted. It is important to follow the specific instructions provided for the Schedule X to avoid any potential issues with the Internal Revenue Service (IRS). Once completed, the form should be submitted alongside your amended return.

Steps to complete the Schedule X

Completing the Schedule X requires attention to detail. Here are the essential steps:

- Gather your original tax return and any supporting documents.

- Identify the specific changes that need to be made.

- Obtain the Schedule X form from the IRS or a reliable source.

- Fill out the form, clearly indicating the adjustments and providing explanations where necessary.

- Review the completed form for accuracy.

- Submit the Schedule X along with your amended return to the appropriate IRS address.

Legal use of the Schedule X

The Schedule X is legally recognized as a valid method for taxpayers to amend their returns. To ensure that the changes made are accepted by the IRS, it is crucial to adhere to the legal guidelines governing the use of this form. This includes providing accurate information, meeting filing deadlines, and maintaining compliance with all applicable tax laws. Failure to follow these legal requirements may result in penalties or rejection of the amended return.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule X are critical to avoid penalties. Generally, taxpayers have up to three years from the original filing date to submit an amended return using the Schedule X. However, specific deadlines may vary based on individual circumstances, such as the type of tax return being amended. It is advisable to stay informed about any changes to tax laws or deadlines that may affect your filing requirements.

Key elements of the Schedule X

Several key elements define the Schedule X form. These include:

- Taxpayer Information: Basic identification details of the taxpayer.

- Amendment Details: Specific adjustments being made to the original return.

- Reason for Amendment: A clear explanation of why the changes are necessary.

- Signature: Required for the form to be legally binding.

Examples of using the Schedule X

Common scenarios for using the Schedule X include correcting income amounts, claiming missed deductions, or addressing errors in filing status. For instance, if a taxpayer realizes they failed to report additional income from freelance work, they can use the Schedule X to amend their return and accurately reflect their total income. Such adjustments ensure compliance and help avoid potential issues with the IRS.

Quick guide on how to complete schedule x

Effortlessly Prepare Schedule X on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Schedule X on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Alter and eSign Schedule X Smoothly

- Find Schedule X and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to store your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Schedule X to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule x

Create this form in 5 minutes!

How to create an eSignature for the schedule x

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is a schedule x form?

A schedule x form is a document used for various purposes, including tax filings and business reporting. With airSlate SignNow, you can easily create, customize, and manage your schedule x forms electronically, ensuring a seamless workflow. Our platform simplifies the entire process, making it easier for you to handle important documentation.

-

How can I schedule x forms with airSlate SignNow?

To schedule x forms with airSlate SignNow, simply log in to your account and select the 'Create Document' option. You can then choose a template or upload your existing schedule x form. The user-friendly interface allows you to fill out, sign, and send the document quickly and efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. You can choose from various subscription tiers, which all include features for managing schedule x forms efficiently. Visit our pricing page to explore the plans and find the one that best suits your needs.

-

Can I integrate schedule x forms with other applications?

Yes, airSlate SignNow allows you to integrate your schedule x forms with various applications and tools like Google Drive, Salesforce, and more. These integrations enable seamless document management and ensure that your workflow remains uninterrupted. Boost your productivity by connecting your favorite apps with our platform.

-

What are the benefits of using airSlate SignNow for scheduling x forms?

Using airSlate SignNow for scheduling x forms ensures that you benefit from a streamlined process, reduced paperwork, and improved efficiency. With features like electronic signatures and real-time notifications, you can track document status and expedite approvals. Our platform is designed to enhance your overall document management experience.

-

Is airSlate SignNow secure for signing sensitive schedule x forms?

Absolutely! airSlate SignNow employs industry-standard security protocols, including encryption and secure cloud storage, to protect your schedule x forms. We prioritize the confidentiality of your documents, ensuring that your sensitive information remains safe. Compliance with regulations, such as GDPR and HIPAA, further bolsters our security measures.

-

Can I edit my schedule x form after sending it for eSignature?

Once a schedule x form has been sent for eSignature via airSlate SignNow, it cannot be edited. This is to uphold the integrity of the signed document. However, you can create a new version of the form if changes are necessary and send it again for signatures.

Get more for Schedule X

- Form 16 waterproofing example

- Ndis forms and templates

- Coal lsl number form

- Nab telegraphic transfer form

- Myocardial perfusion scan form

- Lung vq scannational heart lung and blood institute form

- Appendix 3 medical declaration for entrylevel certificate divers form

- State of vermont license drivercom form

Find out other Schedule X

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter