Form 199 California Exempt Organization Annual Information Return

What is the Form 199 California Exempt Organization Annual Information Return

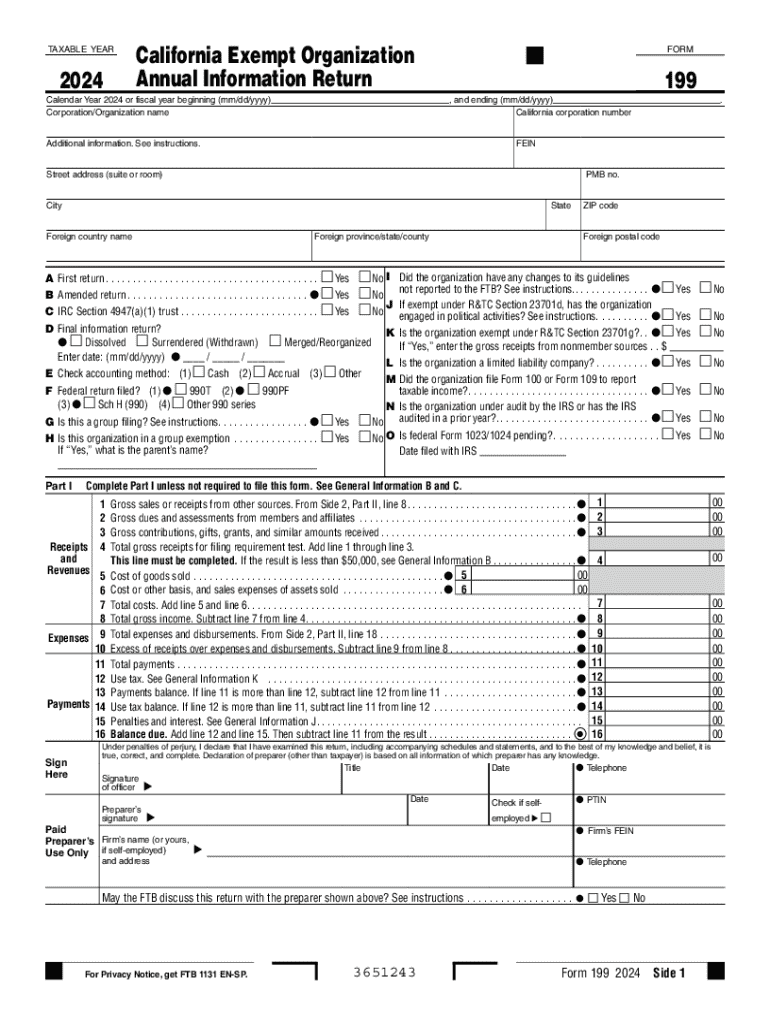

The Form 199 is a crucial document for exempt organizations in California, serving as the Annual Information Return. This form is specifically designed for organizations that are exempt from federal income tax under Section 501(c) of the Internal Revenue Code. It provides the California Franchise Tax Board with essential information about the organization’s activities, finances, and governance. By submitting this form, organizations demonstrate compliance with state regulations and maintain their tax-exempt status.

Steps to complete the Form 199 California Exempt Organization Annual Information Return

Completing Form 199 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements, balance sheets, and details of program activities. Next, fill out the form by providing information such as the organization’s name, address, and federal employer identification number (EIN). Be sure to report revenue, expenses, and any changes in governance. After completing the form, review it for completeness and accuracy before submission. Finally, ensure that the form is filed by the deadline to avoid penalties.

Filing Deadlines / Important Dates

Timely filing of Form 199 is essential for maintaining compliance. The due date for submitting the form is typically the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due by May 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Organizations may request an extension if needed, but they must still file the form by the original deadline to avoid penalties.

Legal use of the Form 199 California Exempt Organization Annual Information Return

Form 199 serves a legal purpose by ensuring that exempt organizations comply with California tax laws. It is a requirement for maintaining tax-exempt status and provides transparency regarding the organization’s financial activities. Failure to file this form can result in penalties, including the loss of tax-exempt status. Organizations must ensure that the information provided is accurate and complete, as misrepresentation can lead to legal consequences.

Key elements of the Form 199 California Exempt Organization Annual Information Return

Form 199 includes several key elements that organizations must complete. These elements encompass basic information about the organization, such as its name, address, and federal EIN. Additionally, organizations must report their total revenue, expenses, and net assets. The form also requires details about the organization’s programs and activities, as well as governance information, including the names and addresses of board members. Completing these sections accurately is vital for compliance and transparency.

How to obtain the Form 199 California Exempt Organization Annual Information Return

Organizations can obtain Form 199 through the California Franchise Tax Board’s official website. The form is available for download in PDF format, allowing organizations to print and complete it manually. Additionally, many tax preparation software programs include the form, providing an electronic option for completion. It is essential to ensure that the most current version of the form is used to meet filing requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 199 california exempt organization annual information return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CA State Form 199?

CA State Form 199 is a tax form used by certain California businesses to report their income and expenses. It is essential for compliance with state tax regulations. Understanding how to properly fill out CA State Form 199 can help ensure your business remains in good standing with the California tax authorities.

-

How can airSlate SignNow help with CA State Form 199?

airSlate SignNow provides an efficient platform for electronically signing and sending CA State Form 199. With its user-friendly interface, you can easily manage your documents and ensure they are securely signed. This streamlines the process, saving you time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for CA State Form 199?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and reflects the value of the features provided, including the ability to manage CA State Form 199 efficiently. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for CA State Form 199?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for handling CA State Form 199. These features enhance productivity and ensure that your documents are processed quickly and securely. Additionally, you can track the status of your forms in real-time.

-

Can I integrate airSlate SignNow with other software for CA State Form 199?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate CA State Form 199 into your existing workflows. Whether you use CRM systems, accounting software, or other tools, you can streamline your processes and enhance efficiency.

-

What are the benefits of using airSlate SignNow for CA State Form 199?

Using airSlate SignNow for CA State Form 199 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows you to manage your documents digitally, which minimizes the risk of loss or damage. Additionally, eSigning speeds up the approval process, helping you meet deadlines.

-

Is airSlate SignNow compliant with California regulations for CA State Form 199?

Yes, airSlate SignNow is designed to comply with California regulations regarding electronic signatures and document management. This ensures that your CA State Form 199 is processed in accordance with state laws. You can trust that your documents are handled securely and legally.

Get more for Form 199 California Exempt Organization Annual Information Return

Find out other Form 199 California Exempt Organization Annual Information Return

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile