Rita Form 2018

What is the Rita Form

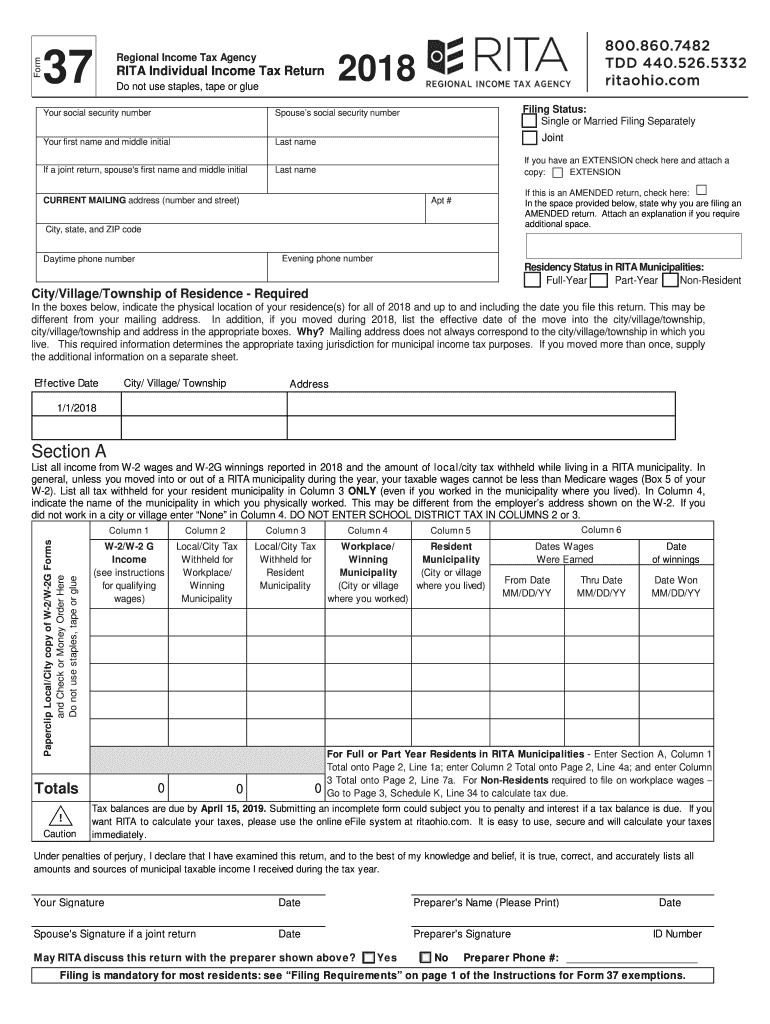

The Rita Form, specifically the form 37 for 2016, is a tax document used by residents of Ohio to report municipal income taxes. This form is essential for individuals who earn income in municipalities that participate in the Regional Income Tax Agency (RITA). The form captures various income sources and allows taxpayers to calculate their tax liability accurately. Understanding the purpose of this form is crucial for compliance with local tax regulations.

How to Obtain the Rita Form

To obtain the Rita Form 37 for 2016, taxpayers can visit the official RITA website, where the form is available for download. The form can be accessed in a fillable PDF format, allowing users to complete it electronically. Additionally, physical copies may be available at local tax offices or municipal buildings. Ensuring you have the correct version of the form is important, as different years may have varying requirements.

Steps to Complete the Rita Form

Completing the Rita Form 37 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill in personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and interest.

- Calculate the total income and apply any applicable deductions or credits.

- Determine the tax owed based on the municipality's tax rate.

- Review the completed form for accuracy before signing and dating it.

Legal Use of the Rita Form

The Rita Form 37 is legally recognized for reporting municipal income taxes in Ohio. It is essential for compliance with local tax laws, and failure to file this form can result in penalties. The form must be completed accurately and submitted by the designated filing deadline to avoid any legal repercussions. Taxpayers are encouraged to keep a copy of the submitted form for their records.

Filing Deadlines / Important Dates

For the Rita Form 37 for 2016, the filing deadline typically aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any specific deadlines set by their municipality, as local rules may vary. Timely submission is crucial to avoid late fees and interest charges.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Rita Form 37. The form can be filed online through the RITA e-filing system, which offers a secure and efficient way to submit tax information. Alternatively, taxpayers may choose to mail the completed form to the appropriate RITA office or submit it in person at designated locations. Each submission method has its own advantages, and taxpayers should choose the one that best suits their needs.

Quick guide on how to complete rita form 37 tax 2018 2019

Your assistance manual on how to prepare your Rita Form

If you’re looking to discover how to create and submit your Rita Form, here are a few concise instructions on how to simplify tax processing.

To begin, you simply need to set up your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow offers a highly intuitive and powerful document solution that enables you to modify, create, and finalize your tax forms effortlessly. With its editor, you can switch between text, checkboxes, and electronic signatures, and return to modify details as necessary. Optimize your tax handling with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Rita Form within moments:

- Create your account and start editing PDFs in no time.

- Utilize our catalog to locate any IRS tax form; browse through variations and schedules.

- Click Get form to open your Rita Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that paper filing can lead to errors in returns and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct rita form 37 tax 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

Create this form in 5 minutes!

How to create an eSignature for the rita form 37 tax 2018 2019

How to create an electronic signature for your Rita Form 37 Tax 2018 2019 in the online mode

How to generate an electronic signature for your Rita Form 37 Tax 2018 2019 in Google Chrome

How to create an electronic signature for signing the Rita Form 37 Tax 2018 2019 in Gmail

How to generate an eSignature for the Rita Form 37 Tax 2018 2019 straight from your smart phone

How to generate an eSignature for the Rita Form 37 Tax 2018 2019 on iOS

How to make an electronic signature for the Rita Form 37 Tax 2018 2019 on Android devices

People also ask

-

What is the Rita Form and how does it work?

The Rita Form is a seamless digital form solution offered by airSlate SignNow that allows users to create, send, and eSign documents effortlessly. With its intuitive interface, you can easily customize forms to collect information, signatures, and payments, all in one place. It streamlines the document workflow, making it ideal for businesses looking to enhance their efficiency.

-

Is the Rita Form affordable for small businesses?

Yes, the Rita Form is designed to be a cost-effective solution for businesses of all sizes, including small enterprises. airSlate SignNow offers competitive pricing plans that provide access to the Rita Form features without breaking the bank. You can choose a plan that fits your budget while still benefiting from robust eSigning capabilities.

-

What features does the Rita Form offer?

The Rita Form comes packed with features such as customizable templates, automated workflows, and secure eSignatures. You can easily integrate various fields and conditional logic into your forms to tailor them to your specific needs. Additionally, the Rita Form ensures compliance and security, protecting sensitive information.

-

Can I integrate the Rita Form with other applications?

Absolutely! The Rita Form integrates seamlessly with numerous applications, including CRM systems, payment platforms, and cloud storage services. This ensures that your workflows remain smooth and efficient, allowing you to connect the Rita Form with tools you already use for better productivity.

-

What are the benefits of using the Rita Form for document management?

Using the Rita Form for document management brings numerous benefits, including increased efficiency, reduced turnaround times, and improved accuracy. By automating the document signing process, businesses can save time and minimize errors associated with manual handling. Additionally, the Rita Form helps enhance customer satisfaction through quick and easy document transactions.

-

How secure is the Rita Form for handling sensitive information?

The Rita Form prioritizes security and compliance, ensuring that all documents are encrypted and safely stored. airSlate SignNow follows industry-standard security protocols, including GDPR compliance, to protect your data. You can trust that the Rita Form is designed to keep your sensitive information secure during the entire eSigning process.

-

What types of documents can I create using the Rita Form?

You can create a variety of documents using the Rita Form, including contracts, agreements, applications, and surveys. The flexibility of the Rita Form allows for customized fields and templates that cater to different business needs. Whether you need a simple signature or a complex multi-step approval process, the Rita Form can handle it.

Get more for Rita Form

- Sample management review form elsmar

- Verizon wireless government phone form

- John amp mary fleming scholarship bperryb public schools perry k12 ok form

- Dsp competencies checklist template rev 3 6 20 dmas form

- Evaluating logarithms worksheet pdf form

- Sample payslip tft tft earth form

- Revolving credit facility agreement template form

- Ria solicitor agreement template form

Find out other Rita Form

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure