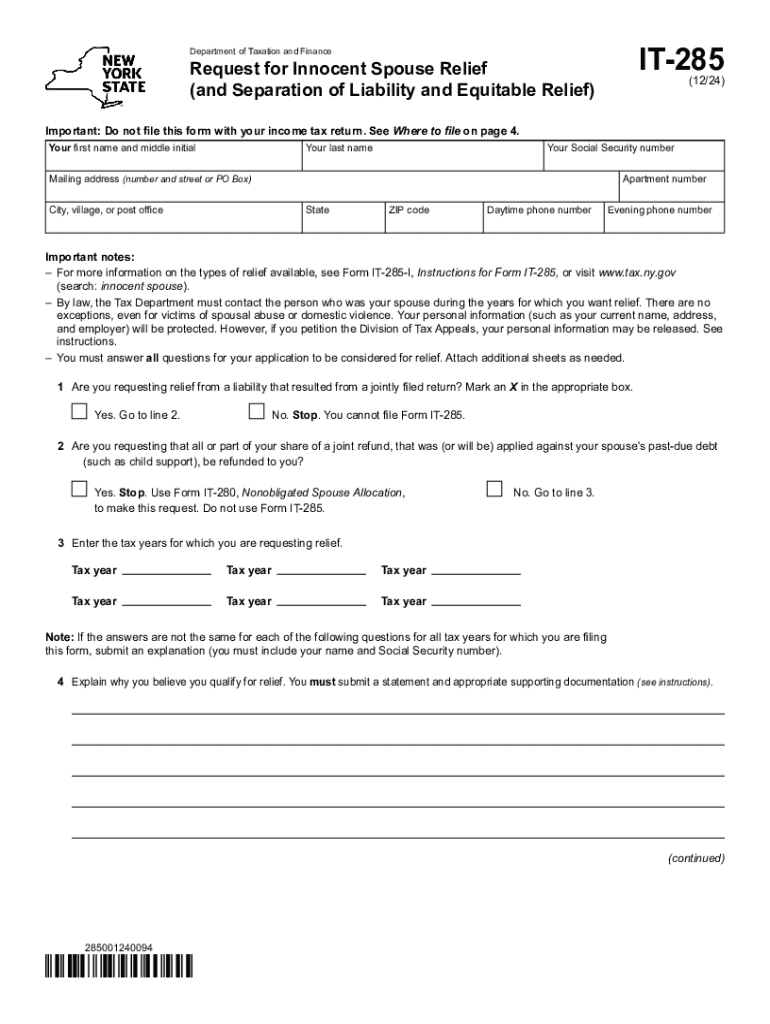

Form it 285 Request for Innocent Spouse Relief and Separation of Liability of Equitable Relief Revised 1224

What is the Form IT-285 Request for Innocent Spouse Relief?

The Form IT-285 is a request for Innocent Spouse Relief, which allows individuals to seek relief from tax liabilities incurred by their spouse or former spouse. This form is crucial for those who believe they should not be held responsible for taxes owed due to erroneous or fraudulent information provided by their spouse. The form also addresses Separation of Liability and Equitable Relief, ensuring that individuals can protect their financial interests when filing jointly with a spouse who may have committed tax errors.

How to Use the Form IT-285

To utilize Form IT-285 effectively, individuals need to carefully complete each section, providing accurate information regarding their marital status, the tax liabilities in question, and the reasons for seeking relief. It is essential to gather all relevant documentation, such as tax returns and any correspondence with the IRS, to support the request. The completed form can then be submitted to the appropriate tax authority for review.

Steps to Complete the Form IT-285

Completing Form IT-285 involves several key steps:

- Gather necessary documents, including tax returns and any notices from the IRS.

- Fill out personal information, including your name, address, and Social Security number.

- Provide details about your spouse or former spouse, including their name and Social Security number.

- Clearly state the tax years for which you are requesting relief.

- Explain the basis for your request, detailing why you believe you qualify for relief.

- Review the form for accuracy before submission.

Eligibility Criteria for Form IT-285

To qualify for relief under Form IT-285, individuals must meet specific eligibility criteria. Generally, they must have filed a joint return with their spouse or former spouse and must not have had knowledge of the tax understatement at the time of filing. Additionally, individuals must demonstrate that it would be unfair to hold them liable for the tax debt. Understanding these criteria is essential for a successful application.

Required Documents for Form IT-285 Submission

When submitting Form IT-285, individuals should include supporting documents to strengthen their case. Required documents typically include:

- Copies of relevant tax returns for the years in question.

- Any IRS notices or correspondence related to the tax liabilities.

- Documentation proving the spouse's financial situation, if applicable.

- Any additional evidence that supports the claim for relief.

Form Submission Methods

Form IT-285 can be submitted through various methods, depending on the preferences of the individual. Options include:

- Online submission through the state tax authority's website.

- Mailing the completed form to the designated address provided by the tax authority.

- In-person submission at local tax offices, if available.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 285 request for innocent spouse relief and separation of liability of equitable relief revised 1224

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NY form relief and how can airSlate SignNow help?

NY form relief refers to the assistance provided for managing and submitting forms in New York. airSlate SignNow simplifies this process by allowing users to easily eSign and send documents, ensuring compliance and efficiency in handling NY forms.

-

How much does airSlate SignNow cost for NY form relief services?

airSlate SignNow offers competitive pricing plans tailored for businesses seeking NY form relief. Our plans are designed to be cost-effective, providing essential features without breaking the bank, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for NY form relief?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all essential for effective NY form relief. These tools streamline the document management process, making it easier for businesses to handle their paperwork.

-

Can airSlate SignNow integrate with other software for NY form relief?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your NY form relief experience. This allows you to connect with tools you already use, improving workflow efficiency and document management.

-

Is airSlate SignNow secure for handling sensitive NY forms?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive NY forms. You can trust that your documents are safe while using our platform for eSigning and document management.

-

How does airSlate SignNow improve the efficiency of NY form relief?

By automating the eSigning process and providing easy access to templates, airSlate SignNow signNowly improves the efficiency of NY form relief. This reduces the time spent on paperwork, allowing businesses to focus on their core operations.

-

What are the benefits of using airSlate SignNow for NY form relief?

Using airSlate SignNow for NY form relief offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced collaboration. These advantages help businesses streamline their operations and improve overall productivity.

Get more for Form IT 285 Request For Innocent Spouse Relief and Separation Of Liability Of Equitable Relief Revised 1224

- Knust letterhead form

- Risk assessment and method statement rams form

- Fillable 21p 509 form

- Ex parte petition for court order to release the remains of a decedent 244786 form

- State the type of polynomials math worksheets for kids form

- Maine board of dental practice report to the joint standing form

- Arbitration agreement template form

- Architectural design agreement template form

Find out other Form IT 285 Request For Innocent Spouse Relief and Separation Of Liability Of Equitable Relief Revised 1224

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online