963004A R1018azdot GovRefund Period Beginning Dat 2024-2026

What is the 963004A R1018azdot govRefund Period Beginning Dat

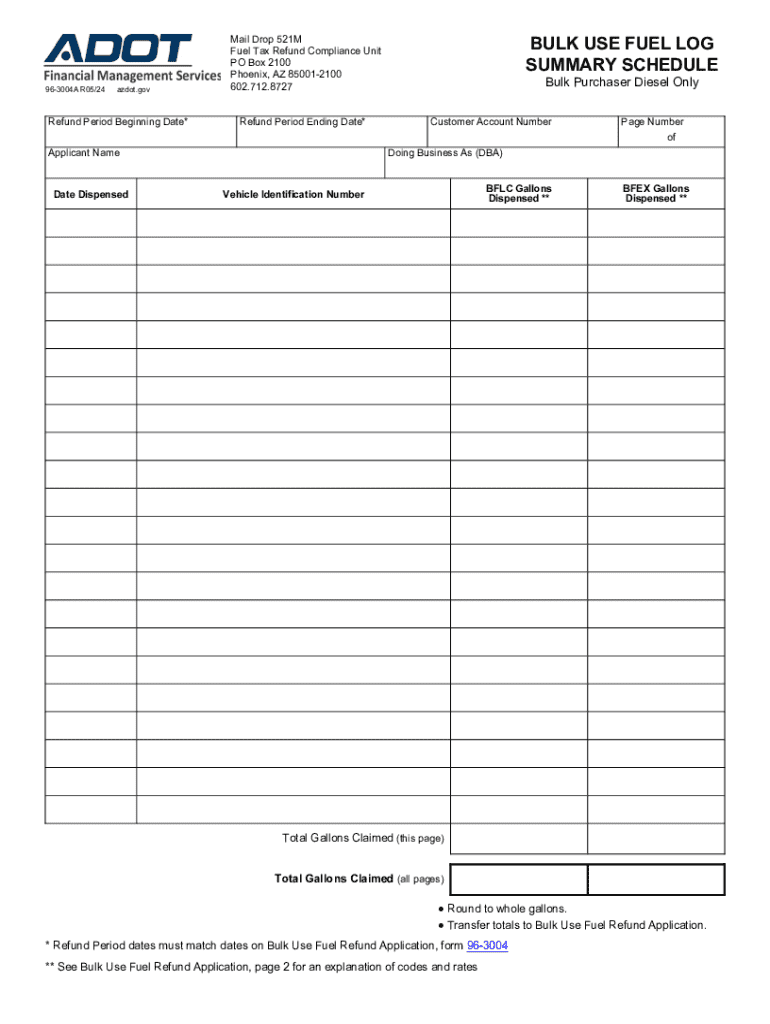

The 963004A R1018azdot govRefund Period Beginning Dat is a specific form utilized in the context of tax refunds and related financial transactions. This form is essential for individuals and businesses seeking to document and process refund requests with the appropriate government agency. Understanding the purpose and function of this form is crucial for ensuring compliance with tax regulations and facilitating timely refunds.

How to use the 963004A R1018azdot govRefund Period Beginning Dat

To effectively use the 963004A R1018azdot govRefund Period Beginning Dat, individuals should first ensure they have all necessary information at hand, including personal identification details and relevant financial records. The form requires users to input specific data regarding the refund period and the reasons for the request. It is important to follow the instructions carefully to avoid errors that could delay processing.

Steps to complete the 963004A R1018azdot govRefund Period Beginning Dat

Completing the 963004A R1018azdot govRefund Period Beginning Dat involves several key steps:

- Gather all relevant financial documents, including prior tax returns and receipts.

- Fill in your personal information, ensuring accuracy to prevent processing delays.

- Provide details regarding the refund period and any pertinent explanations.

- Review the form for completeness and accuracy before submission.

- Submit the form through the designated method, whether online or via mail.

Legal use of the 963004A R1018azdot govRefund Period Beginning Dat

The legal use of the 963004A R1018azdot govRefund Period Beginning Dat is governed by federal and state tax laws. It is crucial for users to ensure that the information provided is truthful and accurate, as submitting false information can lead to penalties. This form serves as an official document that can be referenced in case of audits or disputes regarding tax refunds.

Filing Deadlines / Important Dates

Filing deadlines for the 963004A R1018azdot govRefund Period Beginning Dat vary depending on the specific tax year and the type of refund being requested. It is important to stay informed about these dates to ensure timely submission. Generally, forms should be filed as soon as the relevant tax documents are available to avoid missing critical deadlines.

Required Documents

When completing the 963004A R1018azdot govRefund Period Beginning Dat, several documents are typically required, including:

- Previous tax returns for the relevant period.

- Proof of income, such as W-2s or 1099 forms.

- Receipts or documentation supporting the refund claim.

- Identification documents, such as a driver's license or Social Security card.

Create this form in 5 minutes or less

Find and fill out the correct 963004a r1018azdot govrefund period beginning dat

Create this form in 5 minutes!

How to create an eSignature for the 963004a r1018azdot govrefund period beginning dat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 963004A R1018azdot govRefund Period Beginning Dat?

The 963004A R1018azdot govRefund Period Beginning Dat refers to a specific timeframe for processing refunds related to government transactions. Understanding this period is crucial for businesses to manage their finances effectively and ensure compliance with regulations.

-

How does airSlate SignNow facilitate the 963004A R1018azdot govRefund Period Beginning Dat?

airSlate SignNow streamlines the documentation process associated with the 963004A R1018azdot govRefund Period Beginning Dat. Our platform allows users to easily send, sign, and manage documents, ensuring that all necessary paperwork is completed efficiently and accurately.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Each plan provides access to features that support processes like the 963004A R1018azdot govRefund Period Beginning Dat, ensuring you get the best value for your investment.

-

What features does airSlate SignNow provide for managing refunds?

Our platform includes features such as document templates, automated workflows, and real-time tracking, all of which are essential for managing the 963004A R1018azdot govRefund Period Beginning Dat. These tools help businesses streamline their refund processes and maintain compliance.

-

Can airSlate SignNow integrate with other software for refund management?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage the 963004A R1018azdot govRefund Period Beginning Dat. This integration allows for better data flow and improved efficiency in handling refunds.

-

What benefits does airSlate SignNow offer for businesses dealing with government refunds?

By using airSlate SignNow, businesses can simplify the complexities of the 963004A R1018azdot govRefund Period Beginning Dat. Our solution not only saves time but also reduces errors, ensuring that your refund processes are smooth and compliant with government regulations.

-

Is airSlate SignNow user-friendly for new users?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for new users to navigate and utilize features related to the 963004A R1018azdot govRefund Period Beginning Dat. Our intuitive interface ensures that anyone can start managing documents quickly.

Get more for 963004A R1018azdot govRefund Period Beginning Dat

Find out other 963004A R1018azdot govRefund Period Beginning Dat

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form