Department of Revenue Services State of Connecticu Form

What is the Department of Revenue Services State of Connecticut?

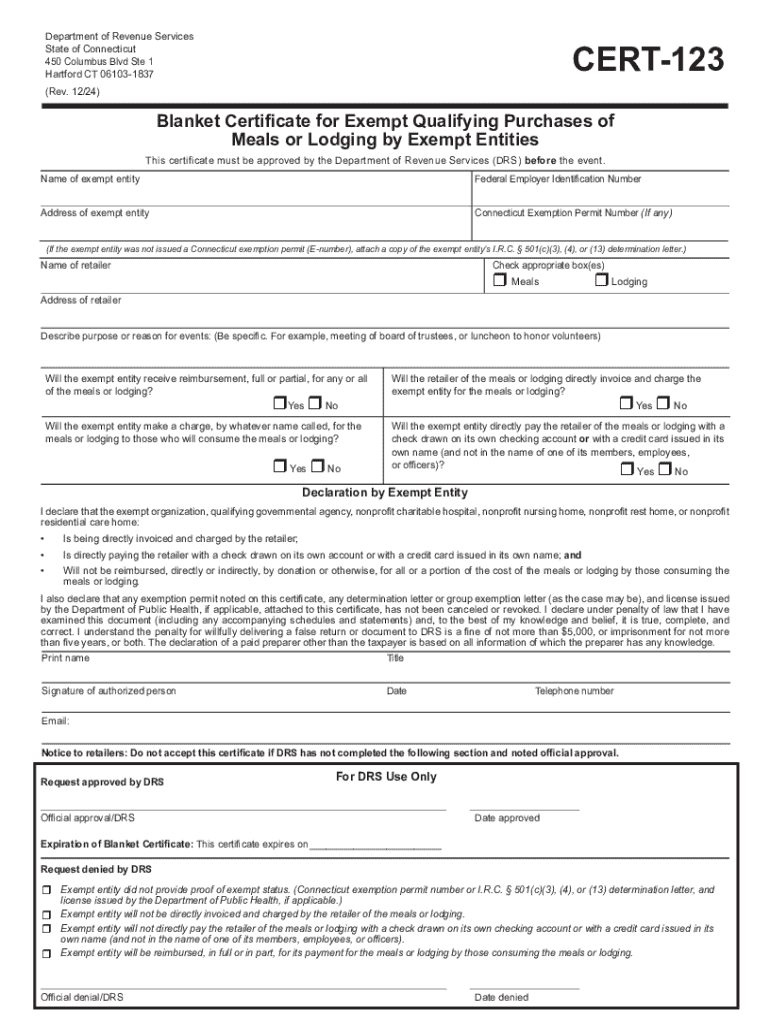

The Department of Revenue Services (DRS) in Connecticut is the state agency responsible for administering tax laws and collecting revenue. This includes overseeing various tax forms, including the cert 123 form, which is essential for taxpayers seeking specific exemptions or benefits related to lodging. The DRS ensures compliance with state tax regulations and provides resources to help taxpayers understand their obligations and rights.

Steps to Complete the Department of Revenue Services State of Connecticut

To complete the cert 123 form, follow these steps:

- Gather necessary information, including your taxpayer identification number and details about the lodging expenses.

- Access the cert 123 form from the DRS website or obtain a physical copy from a local DRS office.

- Fill out the form accurately, ensuring all required fields are completed. This includes providing details about the lodging provider and the nature of the expenses.

- Review the form for any errors or omissions to avoid delays in processing.

- Submit the completed form according to the instructions provided, either online, by mail, or in person.

Legal Use of the Department of Revenue Services State of Connecticut

The legal use of the cert 123 form is primarily for taxpayers in Connecticut who are claiming exemptions on lodging expenses. This form is designed to ensure that taxpayers comply with state tax laws while benefiting from applicable exemptions. It is important to use the form correctly to avoid potential penalties or issues with the DRS.

Required Documents

When filing the cert 123 form, certain documents may be required to support your claim. These typically include:

- Proof of lodging expenses, such as receipts or invoices.

- Your taxpayer identification number or Social Security number.

- Any additional documentation that demonstrates eligibility for the exemption being claimed.

Form Submission Methods

The cert 123 form can be submitted through various methods to accommodate different preferences:

- Online: Submit the form electronically through the DRS website, which is the quickest method.

- Mail: Send the completed form to the designated address provided on the form.

- In-Person: Visit a local DRS office to submit the form directly and receive assistance if needed.

Eligibility Criteria

To qualify for using the cert 123 form, taxpayers must meet specific eligibility criteria set forth by the DRS. This may include:

- Being a resident of Connecticut or having a business presence in the state.

- Incurring lodging expenses that qualify for exemption under state tax laws.

- Providing accurate and truthful information when completing the form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the department of revenue services state of connecticu 772031429

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a cert 123 form?

The cert 123 form is a specific document used for various business and legal purposes. It is essential for ensuring compliance and proper documentation in transactions. Understanding how to use the cert 123 form can streamline your processes and enhance your operational efficiency.

-

How can airSlate SignNow help with cert 123 forms?

airSlate SignNow provides an easy-to-use platform for sending and eSigning cert 123 forms. With our solution, you can quickly prepare, send, and manage these documents securely. This not only saves time but also ensures that your cert 123 forms are handled efficiently.

-

What are the pricing options for using airSlate SignNow for cert 123 forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose a plan that fits your budget while still gaining access to features that enhance your handling of cert 123 forms. Check our website for detailed pricing information and choose the best option for your needs.

-

Are there any features specifically for managing cert 123 forms?

Yes, airSlate SignNow includes features designed to simplify the management of cert 123 forms. These features include customizable templates, automated workflows, and secure storage options. This ensures that your cert 123 forms are not only easy to create but also secure and compliant.

-

Can I integrate airSlate SignNow with other applications for cert 123 forms?

Absolutely! airSlate SignNow offers integrations with various applications that can enhance your workflow for cert 123 forms. Whether you use CRM systems, cloud storage, or other business tools, our platform can seamlessly connect to improve your document management process.

-

What are the benefits of using airSlate SignNow for cert 123 forms?

Using airSlate SignNow for cert 123 forms provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our platform allows you to track document status in real-time, ensuring that your cert 123 forms are processed quickly and accurately. This leads to improved productivity for your business.

-

Is it easy to eSign cert 123 forms with airSlate SignNow?

Yes, eSigning cert 123 forms with airSlate SignNow is incredibly easy. Our user-friendly interface allows you to sign documents electronically in just a few clicks. This convenience not only speeds up the signing process but also ensures that your cert 123 forms are legally binding and secure.

Get more for Department Of Revenue Services State Of Connecticu

Find out other Department Of Revenue Services State Of Connecticu

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free