Form it 2658 NYS Attachment to Form it 2658 Report of Estimated Personal Income Tax for Nonresident Individuals Year 2025-2026

Understanding the IT 2658 NYS Form

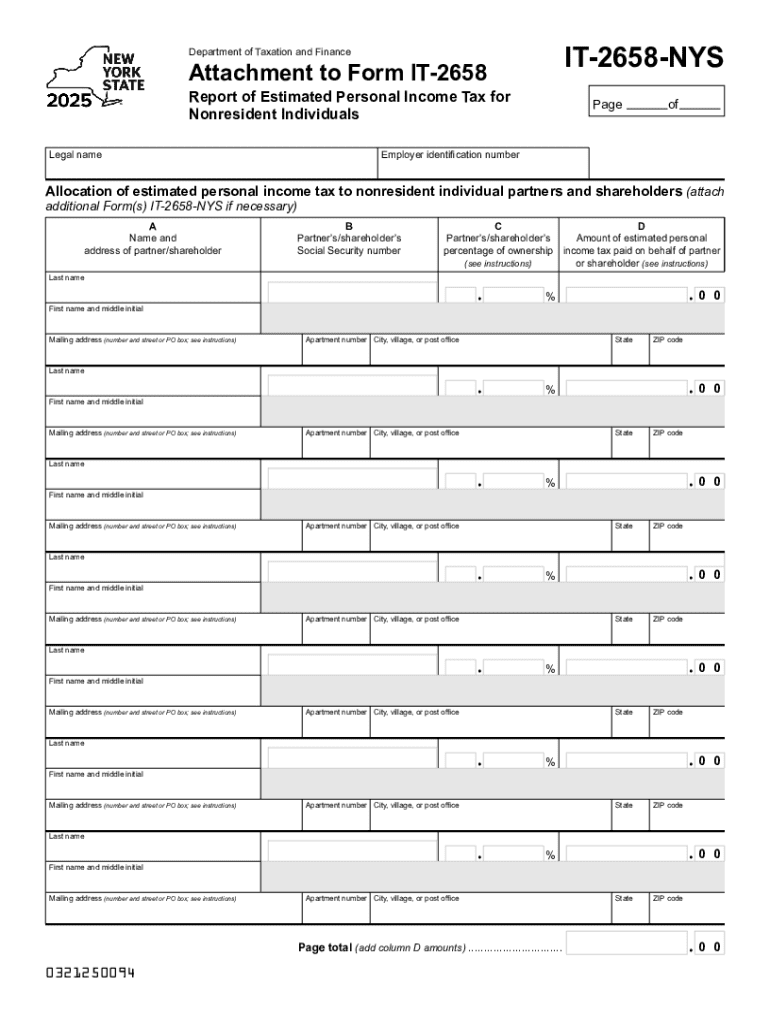

The IT 2658 NYS form, officially known as the Attachment to Form IT 2658 Report of Estimated Personal Income Tax for Nonresident Individuals, is a crucial document for nonresident individuals who earn income in New York State. This form is specifically designed to assist these individuals in reporting their estimated personal income tax obligations accurately. It is essential for ensuring compliance with New York tax laws and avoiding potential penalties.

How to Use the IT 2658 NYS Form

Using the IT 2658 NYS form involves several steps. First, gather all necessary financial documents, including income statements and any relevant tax information. Next, complete the form by accurately reporting your estimated income and calculating the corresponding tax liability. It is important to follow the instructions provided with the form closely to ensure that all information is filled out correctly. Once completed, the form should be submitted to the New York State Department of Taxation and Finance by the specified deadlines.

Steps to Complete the IT 2658 NYS Form

Completing the IT 2658 NYS form requires careful attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Then, report your estimated income from all sources, ensuring that you include only the income earned in New York. Calculate your estimated tax liability based on the provided tax rates. Finally, review the form for accuracy before submitting it. Double-checking your calculations and ensuring all required fields are filled will help prevent delays or issues with your submission.

Filing Deadlines for the IT 2658 NYS Form

Filing deadlines for the IT 2658 NYS form are critical to avoid penalties. Generally, the estimated tax payments are due quarterly, with specific deadlines for each quarter. It is essential to be aware of these dates to ensure timely submission. Failure to file by the deadlines may result in late fees or interest charges on unpaid taxes. Keeping a calendar with these important dates can help you stay organized and compliant with New York tax requirements.

Legal Use of the IT 2658 NYS Form

The IT 2658 NYS form must be used in accordance with New York State tax regulations. It is legally binding once submitted, and the information provided must be accurate and truthful. Noncompliance with the requirements of this form can lead to legal repercussions, including fines or audits. Understanding the legal implications of submitting this form is crucial for nonresident individuals to protect themselves from potential issues with the state tax authorities.

Key Elements of the IT 2658 NYS Form

Key elements of the IT 2658 NYS form include personal identification details, estimated income calculations, and tax liability assessments. The form also requires the taxpayer's signature, affirming that the information provided is accurate. Additionally, any attachments or supporting documents must be included to substantiate the income reported. Familiarity with these elements will streamline the completion process and ensure compliance with New York tax laws.

Create this form in 5 minutes or less

Find and fill out the correct form it 2658 nys attachment to form it 2658 report of estimated personal income tax for nonresident individuals year 772032470

Create this form in 5 minutes!

How to create an eSignature for the form it 2658 nys attachment to form it 2658 report of estimated personal income tax for nonresident individuals year 772032470

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 2658 NYS form and how does airSlate SignNow help with it?

The IT 2658 NYS form is a New York State tax form used for various tax-related purposes. airSlate SignNow simplifies the process of completing and submitting the IT 2658 NYS by allowing users to eSign documents securely and efficiently. With our platform, you can easily manage your tax documents and ensure compliance with state regulations.

-

How much does airSlate SignNow cost for handling IT 2658 NYS forms?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our plans are designed to be cost-effective, ensuring that you can manage your IT 2658 NYS forms without breaking the bank. You can choose from monthly or annual subscriptions, depending on your needs.

-

What features does airSlate SignNow provide for managing IT 2658 NYS documents?

airSlate SignNow provides a range of features to streamline the management of IT 2658 NYS documents, including customizable templates, secure eSigning, and document tracking. These features help ensure that your forms are completed accurately and submitted on time. Additionally, our user-friendly interface makes it easy for anyone to navigate the process.

-

Can I integrate airSlate SignNow with other software for IT 2658 NYS processing?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for IT 2658 NYS processing. You can connect with popular tools like Google Drive, Salesforce, and more to streamline document management. This integration capability allows for a more efficient handling of your tax documents.

-

What are the benefits of using airSlate SignNow for IT 2658 NYS forms?

Using airSlate SignNow for IT 2658 NYS forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and eSign documents quickly, saving you time and effort. Additionally, our secure storage ensures that your sensitive information is protected.

-

Is airSlate SignNow compliant with New York State regulations for IT 2658 NYS?

Yes, airSlate SignNow is fully compliant with New York State regulations regarding the IT 2658 NYS form. We prioritize compliance and security, ensuring that your eSigned documents meet all legal requirements. This gives you peace of mind when managing your tax documents.

-

How can I get support for using airSlate SignNow with IT 2658 NYS forms?

airSlate SignNow offers comprehensive customer support to assist you with any questions regarding IT 2658 NYS forms. Our support team is available via chat, email, or phone to provide guidance and troubleshoot any issues. We also have a robust knowledge base with resources to help you maximize your use of our platform.

Get more for Form IT 2658 NYS Attachment To Form IT 2658 Report Of Estimated Personal Income Tax For Nonresident Individuals Year

Find out other Form IT 2658 NYS Attachment To Form IT 2658 Report Of Estimated Personal Income Tax For Nonresident Individuals Year

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free