Form it 2658 Report of Estimated Tax for Nonresident 2022

What is the Form IT 2658 Report Of Estimated Tax For Nonresident

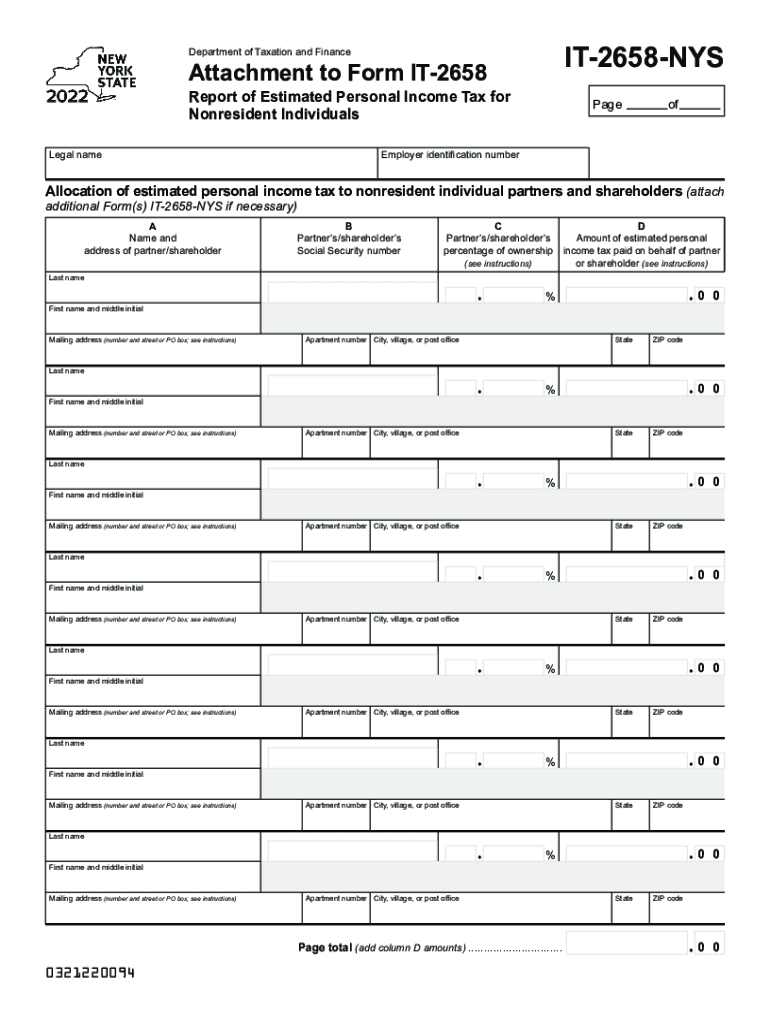

The Form IT 2658 is a crucial document used by nonresidents in the United States to report estimated tax obligations. This form is specifically designed for individuals who earn income from New York sources but do not reside in the state. By filing this form, nonresidents can calculate and pay their estimated tax liabilities, ensuring compliance with New York tax laws. The IT 2658 helps taxpayers avoid penalties by allowing them to report their expected tax payments accurately throughout the year.

How to use the Form IT 2658 Report Of Estimated Tax For Nonresident

Using the Form IT 2658 involves several key steps. First, gather all necessary financial information, including income sources and any deductions applicable to nonresidents. Next, complete the form by entering your estimated income and calculating the corresponding tax liability based on New York tax rates. It is essential to ensure that all figures are accurate to avoid discrepancies. After completing the form, submit it along with any required payments to the New York State Department of Taxation and Finance. This process helps maintain compliance and ensures that you are on track with your tax obligations.

Steps to complete the Form IT 2658 Report Of Estimated Tax For Nonresident

Completing the Form IT 2658 involves a systematic approach:

- Obtain the latest version of the IT 2658 form from the New York State Department of Taxation and Finance website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your estimated income from New York sources, ensuring to include all applicable earnings.

- Calculate your estimated tax liability using the appropriate tax rates for nonresidents.

- Determine any credits or deductions you may qualify for, which can reduce your overall tax burden.

- Sign and date the form, verifying that all information is accurate and complete.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Form IT 2658 Report Of Estimated Tax For Nonresident

The legal use of the Form IT 2658 is governed by New York tax law, which mandates that nonresidents report their income derived from New York sources. Filing this form is not just a recommendation; it is a legal requirement for those who meet specific income thresholds. Properly completing and submitting the IT 2658 ensures that taxpayers fulfill their obligations and avoid potential legal repercussions, such as fines or audits. Compliance with this form is essential for maintaining good standing with state tax authorities.

Filing Deadlines / Important Dates

Adhering to filing deadlines is critical when submitting the Form IT 2658. Typically, estimated tax payments for nonresidents are due quarterly. The deadlines are as follows:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

It is important to note that if a deadline falls on a weekend or holiday, the due date may be extended to the next business day. Meeting these deadlines helps prevent penalties and interest on unpaid taxes.

Key elements of the Form IT 2658 Report Of Estimated Tax For Nonresident

The Form IT 2658 contains several key elements that are essential for accurate reporting:

- Taxpayer Information: Personal details including name, address, and taxpayer identification number.

- Income Reporting: Sections to report estimated income from New York sources.

- Tax Calculation: A detailed area for calculating estimated tax liability based on reported income.

- Credits and Deductions: Space to enter any applicable credits that may reduce tax liability.

- Signature Line: A requirement for the taxpayer to sign and date the form, affirming the accuracy of the information provided.

Quick guide on how to complete form it 2658 report of estimated tax for nonresident

Accomplish Form IT 2658 Report Of Estimated Tax For Nonresident effortlessly on any gadget

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents quickly without delays. Handle Form IT 2658 Report Of Estimated Tax For Nonresident on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Form IT 2658 Report Of Estimated Tax For Nonresident with ease

- Locate Form IT 2658 Report Of Estimated Tax For Nonresident and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Form IT 2658 Report Of Estimated Tax For Nonresident and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 2658 report of estimated tax for nonresident

Create this form in 5 minutes!

How to create an eSignature for the form it 2658 report of estimated tax for nonresident

The best way to generate an e-signature for your PDF document in the online mode

The best way to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to IT 2658?

airSlate SignNow is a powerful e-signature solution that enables businesses to easily send and sign documents. It 2658 refers to a specific aspect of our integration capabilities ensuring compliance and ease-of-use. This makes it a top choice for companies looking to streamline their document workflows.

-

How much does it cost to use airSlate SignNow with IT 2658 features?

The pricing for airSlate SignNow is competitive and varies based on the specific features you require, including those associated with IT 2658 integrations. We offer various plans to suit different business needs, ensuring that you only pay for what you need. Contact our sales team for a customized quote based on your requirements.

-

What features does airSlate SignNow offer under IT 2658?

With airSlate SignNow and its IT 2658 capabilities, you can automate document workflows, track signatures, and manage templates effectively. The platform supports advanced features like mobile signing and integrations with third-party applications. These features contribute to a signNow increase in productivity for your business.

-

How can businesses benefit from using airSlate SignNow in relation to IT 2658?

Businesses benefit from using airSlate SignNow through streamlined e-signature processes that align with IT 2658 compliance standards. This ensures that your document management systems are secure and efficient, reducing turnaround times and enhancing customer satisfaction. The cost-effective approach helps companies save resources while maintaining compliance.

-

Can I integrate airSlate SignNow with my existing software tools and how does IT 2658 support this?

Yes, airSlate SignNow offers seamless integrations with various software tools, enhanced by IT 2658 specifications. This means you can connect with CRMs, cloud storage solutions, and productivity apps effortlessly. These integrations make it easy to centralize your document management processes and improve overall workflow efficiency.

-

What types of documents can I eSign with airSlate SignNow and are they compliant with IT 2658?

You can eSign a wide range of documents using airSlate SignNow, including contracts, agreements, and forms, all compliant with IT 2658 standards. This ensures that your signed documents are legally binding and secure. Our platform adheres to industry standards for encryption and data protection, ensuring your documents are safe.

-

Is there a free trial available for airSlate SignNow with IT 2658 integrations?

Yes, we offer a free trial of airSlate SignNow that includes full access to IT 2658 integrations and features. This allows you to test our platform and experience the benefits firsthand before committing to a plan. Sign up today and see how airSlate SignNow can transform your document management process.

Get more for Form IT 2658 Report Of Estimated Tax For Nonresident

Find out other Form IT 2658 Report Of Estimated Tax For Nonresident

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement