State Corporate Income Tax Obstacles & Potential DIRECT TAX LAW & PRACTICE ICSIState Corporate Income Tax Obstac 2021

Understanding the State Corporate Income Tax Obstacles & Potential

The State Corporate Income Tax Obstacles & Potential refers to various challenges and opportunities businesses face regarding state income tax regulations. These obstacles can include complex tax codes, varying rates across states, and compliance requirements that differ based on business structure. Understanding these elements is critical for businesses to navigate their tax obligations effectively and to identify potential savings or liabilities.

Steps to Complete the State Corporate Income Tax Obstacles & Potential Form

Completing the State Corporate Income Tax Obstacles & Potential form involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Review state-specific tax regulations to ensure compliance with local laws.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check calculations to avoid errors that could lead to penalties.

- Submit the form through the designated method, whether online, by mail, or in person.

Key Elements of the State Corporate Income Tax Obstacles & Potential Form

Several key elements are essential for the State Corporate Income Tax Obstacles & Potential form:

- Tax Identification Number: Required for all businesses filing the form.

- Income Reporting: Accurate reporting of all income sources is crucial.

- Deductions and Credits: Identify any applicable deductions or tax credits.

- Signature: The form must be signed by an authorized representative of the business.

Legal Use of the State Corporate Income Tax Obstacles & Potential Form

The legal use of the State Corporate Income Tax Obstacles & Potential form is governed by state tax laws. This form serves as a declaration of a business's income and tax obligations, making it essential for compliance. Failure to submit the form accurately and on time can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines for the State Corporate Income Tax Obstacles & Potential Form

Filing deadlines for the State Corporate Income Tax Obstacles & Potential form vary by state, but most require submission by the end of the fiscal year. It's important for businesses to be aware of these deadlines to avoid late fees and ensure compliance with state regulations. Some states may offer extensions, but these must be requested in advance.

Penalties for Non-Compliance with the State Corporate Income Tax Obstacles & Potential Form

Non-compliance with the State Corporate Income Tax Obstacles & Potential form can lead to significant penalties. Common consequences include:

- Monetary fines for late submission or inaccuracies.

- Interest charges on unpaid taxes.

- Potential audits by state tax authorities.

Quick guide on how to complete state corporate income tax obstacles ampamp potential direct tax law ampamp practice icsistate corporate income tax obstacles

Complete State Corporate Income Tax Obstacles & Potential DIRECT TAX LAW & PRACTICE ICSIState Corporate Income Tax Obstac effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to generate, modify, and eSign your documents promptly without delays. Manage State Corporate Income Tax Obstacles & Potential DIRECT TAX LAW & PRACTICE ICSIState Corporate Income Tax Obstac on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign State Corporate Income Tax Obstacles & Potential DIRECT TAX LAW & PRACTICE ICSIState Corporate Income Tax Obstac effortlessly

- Obtain State Corporate Income Tax Obstacles & Potential DIRECT TAX LAW & PRACTICE ICSIState Corporate Income Tax Obstac and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign State Corporate Income Tax Obstacles & Potential DIRECT TAX LAW & PRACTICE ICSIState Corporate Income Tax Obstac to guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state corporate income tax obstacles ampamp potential direct tax law ampamp practice icsistate corporate income tax obstacles

Create this form in 5 minutes!

How to create an eSignature for the state corporate income tax obstacles ampamp potential direct tax law ampamp practice icsistate corporate income tax obstacles

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

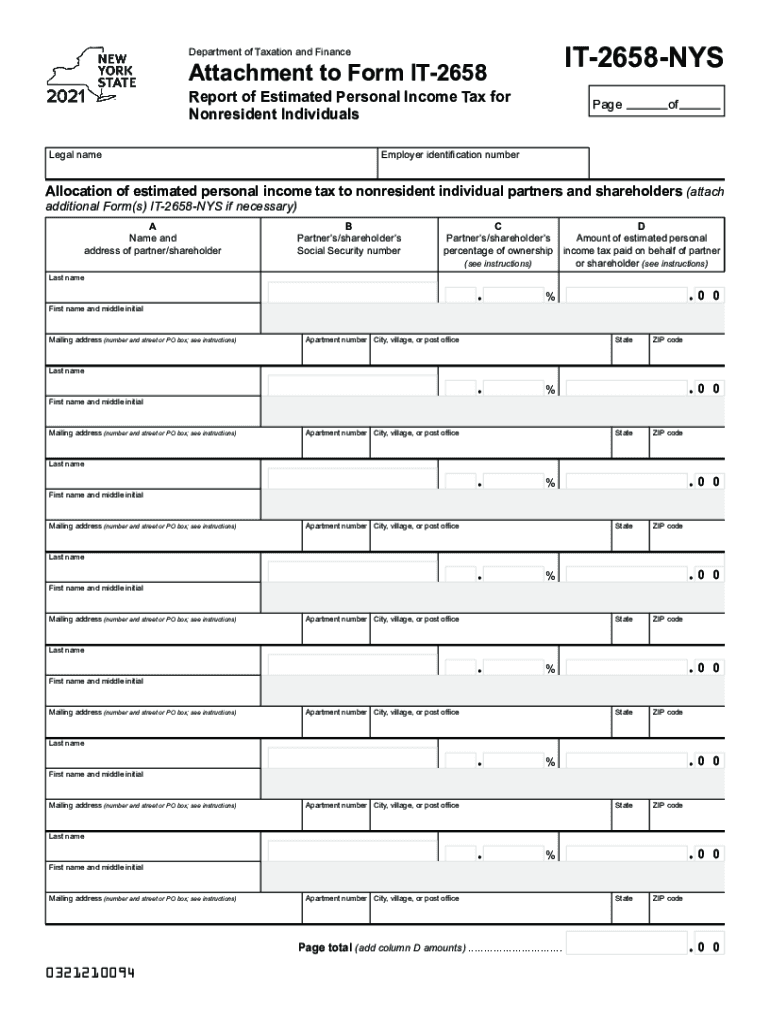

What is the IT 2658 NYS form and who needs it?

The IT 2658 NYS form is a New York State tax form used for specific reporting purposes. Businesses that need to comply with New York tax regulations should consider using this form to ensure proper filing. airSlate SignNow can help you streamline the eSignature process for your IT 2658 NYS submissions.

-

How does airSlate SignNow help with the IT 2658 NYS process?

airSlate SignNow simplifies the signing and submission process for the IT 2658 NYS form. With its user-friendly interface, you can easily prepare, send, and obtain electronic signatures on your documents. This not only saves time but also enhances compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for the IT 2658 NYS form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including those using the IT 2658 NYS form. Plans are designed to be cost-effective, providing features that ensure efficient document management. You'll find that the investment signNowly enhances your operational capabilities.

-

What features does airSlate SignNow offer for the IT 2658 NYS process?

airSlate SignNow provides robust features such as custom templates, real-time tracking, and automated reminders for the IT 2658 NYS form. These features help ensure that documents are completed accurately and on time. Additionally, the platform supports easy collaboration among team members.

-

Can I integrate airSlate SignNow with other software for the IT 2658 NYS form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, which can enhance the workflow for handling the IT 2658 NYS form. Whether you use CRM systems, document management tools, or accounting software, airSlate SignNow can fit into your existing processes smoothly.

-

Is the eSignature provided by airSlate SignNow legally valid for the IT 2658 NYS?

Yes, the eSignature provided by airSlate SignNow is legally valid and compliant with applicable laws for signing the IT 2658 NYS form. This compliance ensures that your electronically signed documents are recognized by regulatory authorities. You can confidently submit your forms without worrying about legal issues.

-

What benefits does airSlate SignNow offer for businesses dealing with IT 2658 NYS filings?

Utilizing airSlate SignNow for your IT 2658 NYS filings brings numerous benefits, such as increased efficiency and reduced paperwork. The platform's automation features help streamline the processes, allowing businesses to focus on their core operations. You'll also experience improved record-keeping and faster turnaround times.

Get more for State Corporate Income Tax Obstacles & Potential DIRECT TAX LAW & PRACTICE ICSIState Corporate Income Tax Obstac

- Consent to minors name change form

- Satisfaction of judgment letter example form

- Utah revocable living trust form eforms

- Motion to enforce settlement form

- Certificate of readiness for adoption hearing doc template form

- Utah quit claim deed form

- Name currently used form

- Title 18 c 3 1201 collection of personal property by affidavit form

Find out other State Corporate Income Tax Obstacles & Potential DIRECT TAX LAW & PRACTICE ICSIState Corporate Income Tax Obstac

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form