Form 4549E Rev 122004Department of the Treasury

What is the Form 4549E Rev 122004 Department Of The Treasury

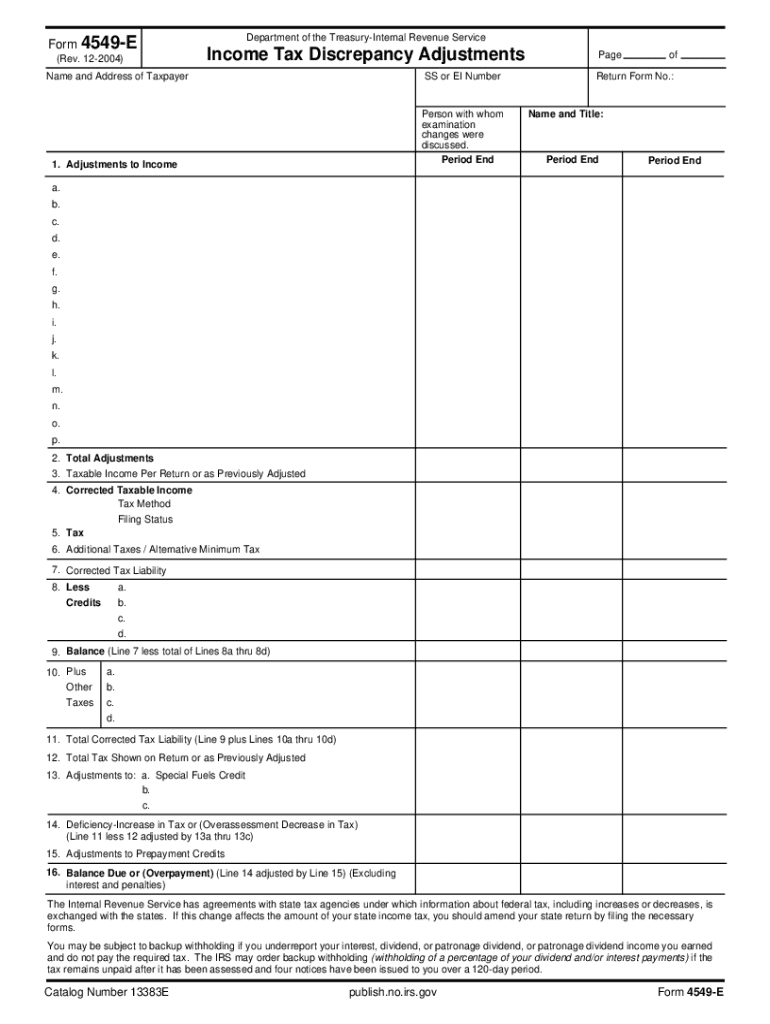

The Form 4549E Rev 122004 is an official document issued by the Department of the Treasury, specifically used for tax-related purposes. This form is typically associated with the Internal Revenue Service (IRS) and is utilized to communicate information regarding tax assessments and liabilities. It serves as a notice to taxpayers about potential discrepancies or issues identified during the IRS review process.

How to use the Form 4549E Rev 122004 Department Of The Treasury

Using the Form 4549E Rev 122004 involves several key steps. Taxpayers should first read the notice carefully to understand the specific issues raised by the IRS. Once the taxpayer has reviewed the information, they may need to gather supporting documents that address the discrepancies highlighted in the form. It is crucial to respond promptly to any requests for additional information or clarification to avoid penalties or further complications.

Steps to complete the Form 4549E Rev 122004 Department Of The Treasury

Completing the Form 4549E Rev 122004 requires careful attention to detail. Here are the steps to follow:

- Review the form thoroughly to understand the IRS's findings.

- Gather all necessary documentation that supports your case.

- Fill out any required sections of the form accurately.

- Double-check all entries for accuracy before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Legal use of the Form 4549E Rev 122004 Department Of The Treasury

The legal use of the Form 4549E Rev 122004 is essential for ensuring compliance with IRS regulations. This form acts as a formal communication from the IRS regarding potential tax liabilities. Taxpayers are legally obligated to respond to the form in a timely manner and provide any requested information. Failure to do so may result in penalties or additional legal action from the IRS.

Key elements of the Form 4549E Rev 122004 Department Of The Treasury

Key elements of the Form 4549E Rev 122004 include the taxpayer's identification information, details of the tax discrepancies, and any proposed adjustments to the taxpayer's account. The form also outlines the taxpayer's rights and responsibilities in responding to the notice. Understanding these elements is crucial for effectively addressing the issues raised by the IRS.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form 4549E Rev 122004. The IRS typically specifies a response deadline within the notice. Taxpayers should adhere to this timeline to avoid penalties. Additionally, keeping track of any related tax filing deadlines is essential for maintaining compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 4549E Rev 122004 can be submitted through various methods. Taxpayers may choose to send the completed form via traditional mail, ensuring it is sent to the appropriate IRS address. In some cases, electronic submission options may be available, depending on the specific circumstances outlined in the notice. It is advisable to check the IRS guidelines for the most current submission methods and requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4549e rev 122004department of the treasury

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4549E Rev 122004Department Of The Treasury?

Form 4549E Rev 122004Department Of The Treasury is a document used for tax purposes, specifically for reporting certain financial information to the IRS. Understanding this form is crucial for businesses to ensure compliance with federal regulations. airSlate SignNow provides an efficient way to manage and eSign this form securely.

-

How can airSlate SignNow help with Form 4549E Rev 122004Department Of The Treasury?

airSlate SignNow simplifies the process of completing and signing Form 4549E Rev 122004Department Of The Treasury. Our platform allows users to fill out the form electronically, ensuring accuracy and saving time. Additionally, you can easily send the form for eSignature, streamlining your workflow.

-

What are the pricing options for using airSlate SignNow for Form 4549E Rev 122004Department Of The Treasury?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and teams. Each plan provides access to features that facilitate the completion and signing of documents like Form 4549E Rev 122004Department Of The Treasury. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Form 4549E Rev 122004Department Of The Treasury?

Our platform includes features such as customizable templates, secure cloud storage, and real-time tracking for documents like Form 4549E Rev 122004Department Of The Treasury. These tools enhance efficiency and ensure that your documents are handled securely and professionally. You can also integrate with other applications to streamline your processes.

-

Is airSlate SignNow secure for handling Form 4549E Rev 122004Department Of The Treasury?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like Form 4549E Rev 122004Department Of The Treasury. We utilize advanced encryption and authentication measures to protect your data. You can trust that your information is secure while using our platform.

-

Can I integrate airSlate SignNow with other software for Form 4549E Rev 122004Department Of The Treasury?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to connect your workflow seamlessly. This means you can easily manage Form 4549E Rev 122004Department Of The Treasury alongside your existing tools, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for Form 4549E Rev 122004Department Of The Treasury?

Using airSlate SignNow for Form 4549E Rev 122004Department Of The Treasury provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. Our platform allows for quick eSigning and document management, which can save your business time and resources. Additionally, you can ensure compliance with ease.

Get more for Form 4549E Rev 122004Department Of The Treasury

- And form

- Codicil to last will and testament of witforg form

- Settlement statements explained seller land title guarantee form

- Notice to pay rent or surrender possession of the premises form

- At end of specified term residential form

- Pennsylvania probate forms state specificus legal forms

- Right to inherit free legal forms uslegal

- As the trustor of the revocable trust dated form

Find out other Form 4549E Rev 122004Department Of The Treasury

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document