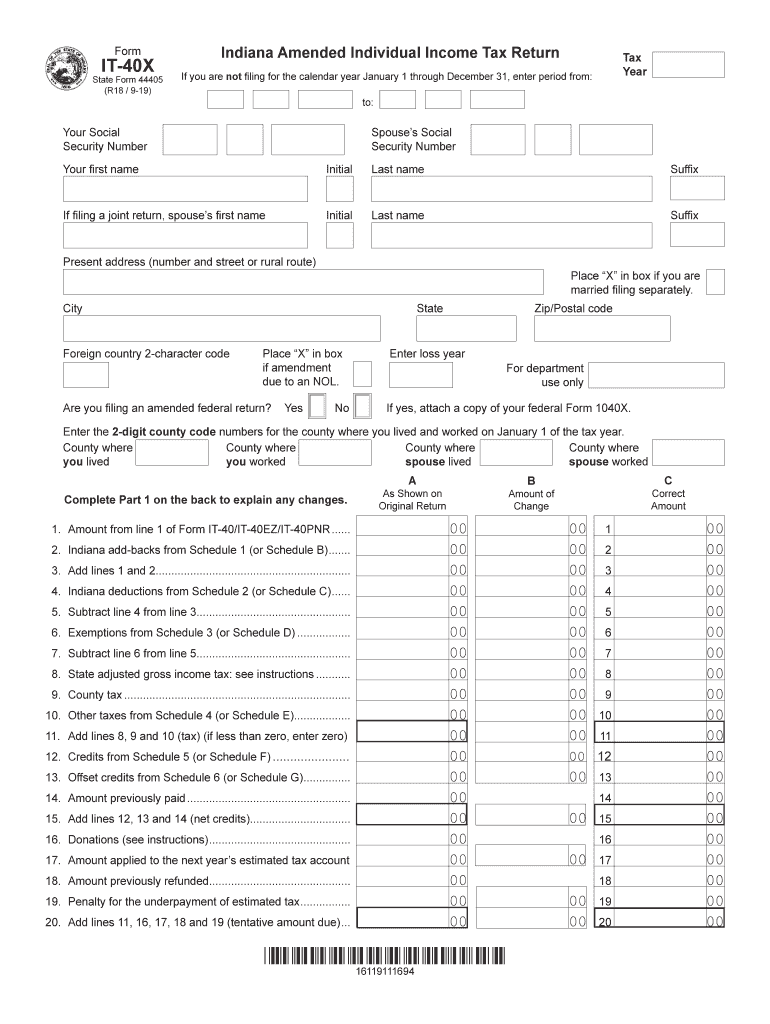

it 40x 2019

What is the IT 40X?

The IT 40X is an Indiana state tax form designed for individuals who have overpaid their state income tax and are seeking a refund. This form is essential for taxpayers who want to claim a refund for the previous tax year. It allows individuals to report their income, deductions, and any taxes that have been withheld, ensuring they receive the correct amount back from the state. Understanding the purpose of the IT 40X is crucial for anyone looking to navigate Indiana's tax system effectively.

How to use the IT 40X

Using the IT 40X involves several straightforward steps. First, gather all necessary documentation, including W-2 forms, 1099 forms, and any records of tax payments made throughout the year. Next, complete the form accurately, ensuring that all information aligns with your financial records. After filling out the IT 40X, review it for any errors before submitting it to the Indiana Department of Revenue. This careful approach helps to ensure that your refund request is processed smoothly and efficiently.

Steps to complete the IT 40X

Completing the IT 40X requires attention to detail. Follow these steps for a successful submission:

- Collect all relevant tax documents, including your W-2 and any 1099 forms.

- Fill out the IT 40X, ensuring that your personal information and income details are accurate.

- Calculate your total refund amount based on the overpayment reported.

- Sign and date the form to validate your submission.

- Submit the completed form to the Indiana Department of Revenue, either online or by mail.

Legal use of the IT 40X

The IT 40X is legally recognized as a valid document for claiming state tax refunds in Indiana. To ensure its legal validity, it must be completed accurately and submitted within the designated timeframe. Compliance with state tax laws is essential, as improper use of the form can lead to delays in processing or potential penalties. By adhering to the guidelines set forth by the Indiana Department of Revenue, taxpayers can confidently utilize the IT 40X to reclaim their overpaid taxes.

Required Documents

To successfully complete the IT 40X, several documents are necessary:

- W-2 forms from all employers for the tax year.

- 1099 forms for any additional income received.

- Records of any estimated tax payments made throughout the year.

- Any other documentation that supports your claim for a refund.

Having these documents ready will streamline the process and help ensure that your IT 40X is accurate and complete.

Filing Deadlines / Important Dates

Being aware of deadlines is crucial for filing the IT 40X. Typically, the form must be submitted by the state tax filing deadline, which is usually April 15 for most taxpayers. However, if the deadline falls on a weekend or holiday, it may be extended. It is important to verify the specific deadlines for the current tax year to avoid any penalties or issues with your refund.

Quick guide on how to complete form indiana amended individual income tax return it 40x not

Complete It 40x effortlessly on any device

Online document management has gained popularity among companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without delays. Manage It 40x on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign It 40x with ease

- Find It 40x and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or mislaid documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign It 40x and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form indiana amended individual income tax return it 40x not

Create this form in 5 minutes!

How to create an eSignature for the form indiana amended individual income tax return it 40x not

How to create an electronic signature for the Form Indiana Amended Individual Income Tax Return It 40x Not in the online mode

How to generate an eSignature for your Form Indiana Amended Individual Income Tax Return It 40x Not in Google Chrome

How to create an eSignature for signing the Form Indiana Amended Individual Income Tax Return It 40x Not in Gmail

How to make an eSignature for the Form Indiana Amended Individual Income Tax Return It 40x Not right from your mobile device

How to generate an eSignature for the Form Indiana Amended Individual Income Tax Return It 40x Not on iOS devices

How to generate an electronic signature for the Form Indiana Amended Individual Income Tax Return It 40x Not on Android

People also ask

-

What is airSlate SignNow and how can it help businesses with it 40x?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents efficiently. By using airSlate SignNow, companies can streamline their workflow and improve productivity, achieving results that can often feel like a 40x increase in efficiency.

-

How does the pricing of airSlate SignNow compare to other eSignature solutions offering it 40x features?

airSlate SignNow offers competitive pricing tailored to suit various business needs. Our plans are designed to be cost-effective, ensuring that you receive maximum value and features that can elevate your document signing process to feel like 40x improvement without breaking the bank.

-

What features of airSlate SignNow contribute to achieving it 40x efficiency?

airSlate SignNow includes features such as bulk sending, advanced templates, and powerful integrations which signNowly enhance document management efficiency. By utilizing these functionalities, businesses can optimize their processes and potentially experience a synergy that resembles a 40x boost in productivity.

-

Can airSlate SignNow integrate with other software to enhance it 40x capabilities?

Yes, airSlate SignNow seamlessly integrates with a variety of popular software applications, including CRMs and project management tools. This integration capability allows for streamlined processes that contribute to achieving greater operational efficiency, thus realizing an impressive 40x impact in reducing turnaround times.

-

Is airSlate SignNow secure enough for handling sensitive documents and it 40x transactional guarantees?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with global regulations. This commitment ensures that your sensitive documents are protected, providing peace of mind while allowing you to focus on the business impact—aiming for that 40x transformation in document handling.

-

How quickly can I start using airSlate SignNow to achieve it 40x results?

Getting started with airSlate SignNow is quick and easy, with most users able to sign up and begin sending documents within minutes. Once onboarded, you'll have access to tools that can signNowly enhance your document workflows and push towards exemplary performance, resulting in what feels like a 40x efficiency uptick.

-

What kind of support does airSlate SignNow offer for maximizing it 40x benefits?

airSlate SignNow offers robust customer support, including resources like tutorials, FAQs, and live assistance to help users maximize their experience. By leveraging our support, businesses can effectively implement the platform’s features and work towards achieving a transformative 40x impact in their operations.

Get more for It 40x

- Dependent verification form eastern washington university ewu

- With the henry foss enrollment packet tacoma public schools form

- Bereavement information form commission

- Race program presenter recommendation form aavsb

- Wbdc micro finance loan application wbdc form

- Bdjh dodgeball tournament waiverregistration form

- Vra fha application dfas home dfas form

- Agri credit application form

Find out other It 40x

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document