Print AFFIDAVIT of INDIVIDUAL TAX EXEMPTION Clear Form

What is the dor 82514 affidavit?

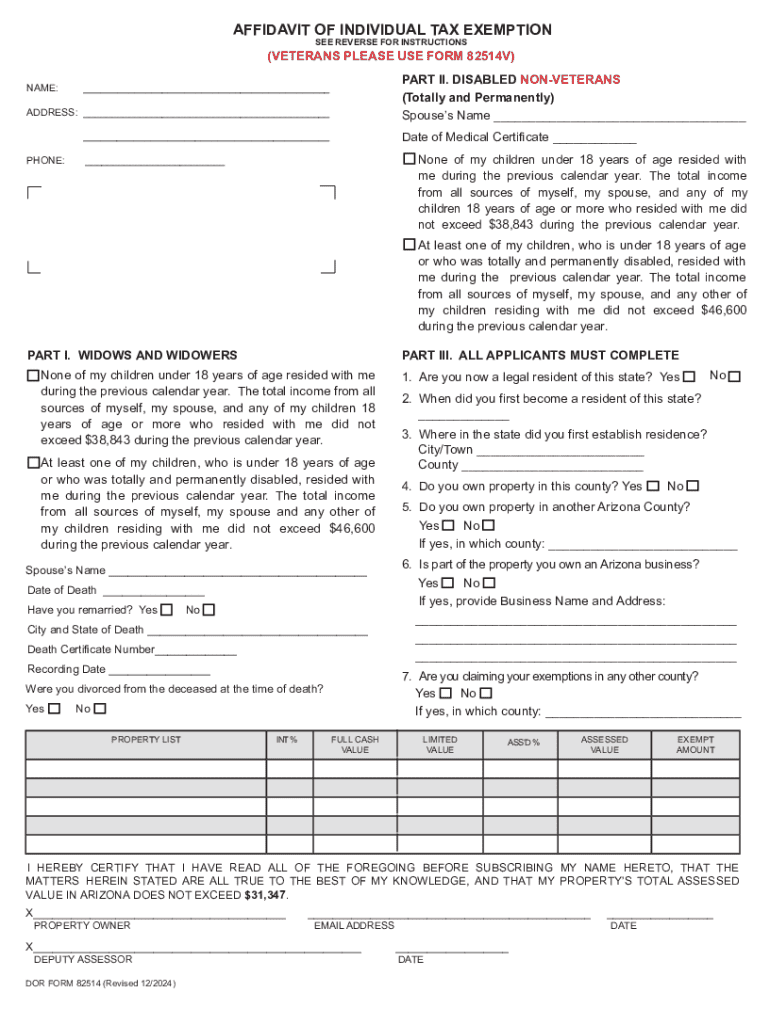

The dor 82514 affidavit, also known as the Affidavit of Individual Tax Exemption, is a legal document used in Arizona to declare an individual's eligibility for tax exemption. This form is essential for individuals who wish to assert their status as exempt from certain taxes, particularly in relation to income or property taxes. By completing this affidavit, individuals provide a formal declaration that they meet specific criteria set forth by the Arizona Department of Revenue.

Key elements of the dor 82514 affidavit

Several key elements are included in the dor 82514 affidavit that must be accurately completed for it to be valid:

- Personal Information: The form requires the individual's full name, address, and Social Security number.

- Exemption Reason: A clear statement of the reason for claiming the tax exemption must be provided.

- Signature and Date: The affidavit must be signed by the individual claiming the exemption and dated appropriately.

- Notary Acknowledgment: In some cases, a notary public may need to witness the signing of the affidavit.

Steps to complete the dor 82514 affidavit

Completing the dor 82514 affidavit involves several straightforward steps:

- Obtain the dor 82514 affidavit form from the Arizona Department of Revenue website or local office.

- Fill out the personal information section accurately, ensuring all details are correct.

- Clearly state the reason for the tax exemption in the designated section.

- Sign and date the affidavit. If required, have the document notarized.

- Submit the completed affidavit to the appropriate tax authority as instructed.

Legal use of the dor 82514 affidavit

The dor 82514 affidavit serves a significant legal purpose in asserting an individual's tax-exempt status. When submitted correctly, it can protect individuals from unnecessary tax liabilities. It is crucial to ensure that all information provided is truthful and accurate, as providing false information may lead to legal repercussions, including penalties or fines.

Eligibility criteria for the dor 82514 affidavit

To qualify for the exemptions stated in the dor 82514 affidavit, individuals must meet specific eligibility criteria set by the Arizona Department of Revenue. Common eligibility factors include:

- Income level: Individuals must demonstrate that their income falls below a certain threshold.

- Type of exemption: The reason for exemption must align with categories defined by state law.

- Residency status: Applicants must be residents of Arizona and provide proof of residency if required.

Form submission methods for the dor 82514 affidavit

The dor 82514 affidavit can be submitted through various methods, depending on the preferences of the individual and the requirements of the Arizona Department of Revenue:

- Online Submission: Some individuals may have the option to submit the affidavit electronically through the Arizona Department of Revenue's online portal.

- Mail: The completed affidavit can be mailed to the appropriate tax authority's address.

- In-Person: Individuals may also choose to deliver the affidavit in person at designated tax offices.

Handy tips for filling out Print AFFIDAVIT OF INDIVIDUAL TAX EXEMPTION Clear online

Quick steps to complete and e-sign Print AFFIDAVIT OF INDIVIDUAL TAX EXEMPTION Clear online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Get access to a GDPR and HIPAA compliant service for maximum simplicity. Use signNow to electronically sign and send Print AFFIDAVIT OF INDIVIDUAL TAX EXEMPTION Clear for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the print affidavit of individual tax exemption clear

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a dor 82514 affidavit?

The dor 82514 affidavit is a legal document used to affirm the truthfulness of certain statements or claims. It is often required in various legal and business transactions to ensure compliance and authenticity. Understanding how to properly complete a dor 82514 affidavit is crucial for maintaining legal integrity.

-

How can airSlate SignNow help with the dor 82514 affidavit?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning the dor 82514 affidavit. With its user-friendly interface, you can easily customize the affidavit to meet your specific needs. This streamlines the process, ensuring that your documents are signed quickly and securely.

-

What are the pricing options for using airSlate SignNow for the dor 82514 affidavit?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and teams. Each plan provides access to features that simplify the creation and management of documents like the dor 82514 affidavit. You can choose a plan that fits your budget while still benefiting from our comprehensive eSigning solutions.

-

Are there any integrations available for the dor 82514 affidavit with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your workflow for the dor 82514 affidavit. You can connect with popular tools like Google Drive, Salesforce, and more, allowing for easy document management and collaboration. These integrations help streamline your processes and improve efficiency.

-

What features does airSlate SignNow offer for managing the dor 82514 affidavit?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage specifically for documents like the dor 82514 affidavit. These tools help you manage your documents efficiently, ensuring that you can easily access and edit them as needed. Additionally, the platform provides tracking and notifications for signed documents.

-

Is airSlate SignNow secure for handling the dor 82514 affidavit?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the dor 82514 affidavit. Our platform is designed to ensure that your sensitive information remains confidential and secure throughout the signing process.

-

Can I use airSlate SignNow on mobile devices for the dor 82514 affidavit?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage the dor 82514 affidavit on the go. Whether you are using a smartphone or tablet, you can easily create, send, and eSign documents from anywhere. This flexibility ensures that you can handle important paperwork without being tied to a desktop.

Get more for Print AFFIDAVIT OF INDIVIDUAL TAX EXEMPTION Clear

- Hhs tx forms

- Texas c 3 form

- Registered nurse application 2011 form

- Washington state cis form fillable 2011

- Pud3 masonpud3 form

- Washington state immunization fillable form 2006

- Washington state department of health home care aide prometric form

- Wisconsin marriage certificate application for mail or in find laws form

Find out other Print AFFIDAVIT OF INDIVIDUAL TAX EXEMPTION Clear

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT