Form it 203 GR Group Return for Nonresident Partners Tax 2021

What is the Form IT 203 GR Group Return For Nonresident Partners Tax

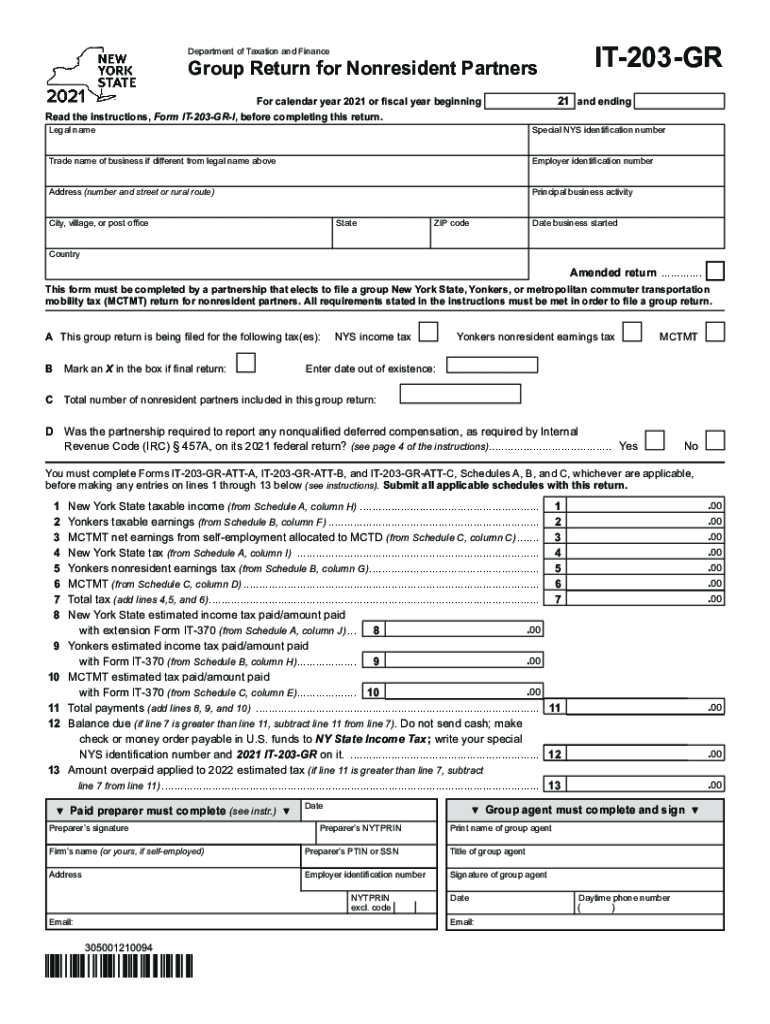

The Form IT 203 GR is a tax document specifically designed for nonresident partners of partnerships that operate in New York. This form allows partnerships to file a group return on behalf of their nonresident partners, simplifying the tax process. It is essential for ensuring that nonresident partners meet their tax obligations in New York State without the need for each partner to file separately.

How to use the Form IT 203 GR Group Return For Nonresident Partners Tax

Using the Form IT 203 GR involves a few key steps. First, the partnership must determine the eligibility of its nonresident partners to file a group return. Once eligibility is confirmed, the partnership should gather all necessary information about each nonresident partner, including their share of income and any applicable deductions. The completed form should then be submitted to the New York State Department of Taxation and Finance by the required deadline.

Steps to complete the Form IT 203 GR Group Return For Nonresident Partners Tax

Completing the Form IT 203 GR requires careful attention to detail. Follow these steps:

- Gather all relevant financial information for each nonresident partner.

- Fill out the form with accurate income figures and deductions.

- Ensure that all partners included in the group return meet eligibility criteria.

- Review the completed form for accuracy before submission.

- Submit the form to the appropriate tax authority by the specified deadline.

Legal use of the Form IT 203 GR Group Return For Nonresident Partners Tax

The Form IT 203 GR is legally recognized for tax purposes in New York State. When completed accurately and submitted on time, it satisfies the tax obligations of nonresident partners. It is crucial that partnerships adhere to the legal requirements outlined by the New York State Department of Taxation and Finance to avoid penalties or issues with compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 GR are typically aligned with the tax year deadlines for partnerships. It is important for partnerships to be aware of these dates to ensure timely submission. Generally, the form must be filed by the 15th day of the third month following the close of the partnership's tax year. Keeping track of these deadlines helps avoid late fees and ensures compliance with state tax regulations.

Required Documents

To complete the Form IT 203 GR, certain documents are necessary. These include:

- Financial statements for the partnership.

- Individual income details for each nonresident partner.

- Any supporting documentation for deductions claimed.

- Previous tax returns, if applicable.

Eligibility Criteria

Eligibility to file the Form IT 203 GR is limited to nonresident partners of partnerships that derive income from New York sources. Each nonresident partner must meet specific criteria, including having no other tax obligations in New York State and being part of a partnership that has elected to file a group return. Understanding these criteria is essential for ensuring compliance and avoiding unnecessary complications.

Quick guide on how to complete form it 203 gr group return for nonresident partners tax

Prepare Form IT 203 GR Group Return For Nonresident Partners Tax seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Form IT 203 GR Group Return For Nonresident Partners Tax on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest method to edit and eSign Form IT 203 GR Group Return For Nonresident Partners Tax effortlessly

- Locate Form IT 203 GR Group Return For Nonresident Partners Tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method of sharing your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form IT 203 GR Group Return For Nonresident Partners Tax and ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 gr group return for nonresident partners tax

Create this form in 5 minutes!

How to create an eSignature for the form it 203 gr group return for nonresident partners tax

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The best way to generate an e-signature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the it 203 gr. offered by airSlate SignNow?

The it 203 gr. refers to our specialized service that allows seamless electronic signing of documents. With airSlate SignNow, businesses can efficiently manage digital signatures while ensuring compliance and security.

-

How much does the it 203 gr. cost?

Pricing for the it 203 gr. varies depending on your business needs. Our plans are designed to be cost-effective, ensuring that you get value for your investment while enjoying all the essential features of airSlate SignNow.

-

What features are included in the it 203 gr. plan?

The it 203 gr. plan comes with a robust set of features, including easy document creation, automated workflows, and template management. These features enhance your efficiency and streamline your document signing process.

-

What are the benefits of using the it 203 gr. for businesses?

With the it 203 gr. by airSlate SignNow, businesses can experience increased productivity, reduced turnaround time for document signing, and heightened security. It enables you to focus more on your core operations rather than paperwork.

-

Does the it 203 gr. integrate with other software?

Yes, the it 203 gr. is designed to seamlessly integrate with various business applications, such as CRM systems and cloud storage solutions. This integration helps streamline workflows and enhance your overall operational efficiency.

-

Is the it 203 gr. suitable for small businesses?

Absolutely! The it 203 gr. is tailored to be user-friendly and affordable, making it an ideal choice for small businesses. It empowers them to manage documents efficiently without investing heavily in infrastructure.

-

How can I get support for the it 203 gr. services?

Our customer support team is readily available to assist with any queries related to the it 203 gr. services. You can signNow out through multiple channels, and we ensure prompt responses to help you with any issues you may encounter.

Get more for Form IT 203 GR Group Return For Nonresident Partners Tax

Find out other Form IT 203 GR Group Return For Nonresident Partners Tax

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free