Form it 203 GR Group Return for Nonresident Partners Tax Year 2022

What is the Form IT 203 GR Group Return For Nonresident Partners Tax Year

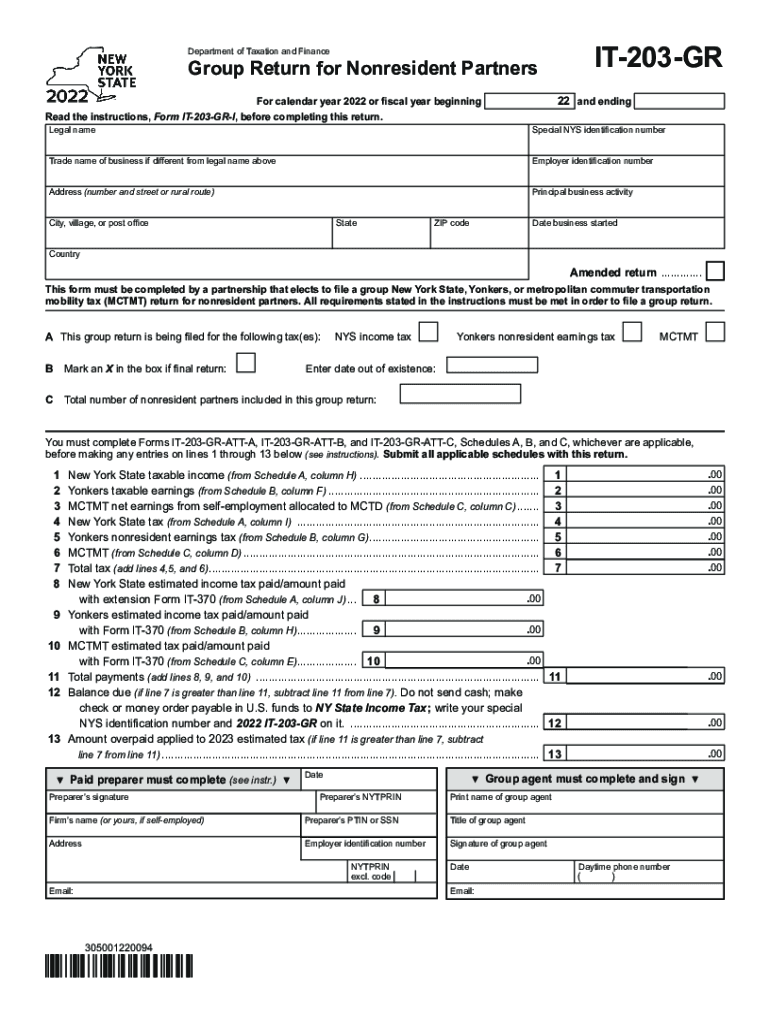

The Form IT 203 GR is a tax document specifically designed for partnerships that have nonresident partners. This form allows partnerships to file a group return for their nonresident members, simplifying the reporting process. By using this form, partnerships can report income, deductions, and credits on behalf of their nonresident partners, ensuring compliance with New York State tax regulations. It is particularly important for partnerships operating in New York that include partners who do not reside in the state, as it helps clarify tax obligations and streamline the filing process.

Steps to complete the Form IT 203 GR Group Return For Nonresident Partners Tax Year

Completing the Form IT 203 GR involves several key steps to ensure accurate reporting. First, gather all necessary information regarding the partnership's income, deductions, and the details of each nonresident partner. Next, accurately fill out the form, ensuring that each partner's share of income and deductions is correctly reported. Include any applicable credits that the partnership may qualify for. After completing the form, review it carefully for any errors or omissions. Finally, submit the form by the designated deadline to avoid penalties.

Key elements of the Form IT 203 GR Group Return For Nonresident Partners Tax Year

The Form IT 203 GR contains several crucial elements that must be accurately reported. These include the partnership's federal employer identification number (EIN), the names and addresses of all nonresident partners, and their respective shares of income and deductions. Additionally, the form requires the partnership to report any credits that may apply. Each element is essential for ensuring that the tax return is complete and compliant with state regulations.

Legal use of the Form IT 203 GR Group Return For Nonresident Partners Tax Year

The legal use of the Form IT 203 GR is grounded in compliance with New York State tax laws. This form is recognized as a legitimate means for partnerships to report the income and tax liabilities of their nonresident partners. To ensure that the form is legally binding, it must be completed accurately and submitted on time. Utilizing reliable electronic tools, such as airSlate SignNow, can enhance the security and validity of the submission, ensuring adherence to eSignature laws and regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 GR are critical for ensuring compliance with New York State tax laws. Generally, the form must be filed by the fifteenth day of the third month following the close of the partnership's tax year. For partnerships operating on a calendar year, this typically means a deadline of March 15. It is essential to stay informed about any changes to these deadlines, as late submissions may incur penalties and interest.

Who Issues the Form

The Form IT 203 GR is issued by the New York State Department of Taxation and Finance. This agency is responsible for administering tax laws in New York and provides the necessary forms for tax reporting. Partnerships can access the form through the department's official website or through authorized tax professionals. It is important to ensure that the most current version of the form is used to comply with state regulations.

Quick guide on how to complete form it 203 gr group return for nonresident partners tax year 2021

Effortlessly Prepare Form IT 203 GR Group Return For Nonresident Partners Tax Year on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Form IT 203 GR Group Return For Nonresident Partners Tax Year on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Form IT 203 GR Group Return For Nonresident Partners Tax Year

- Find Form IT 203 GR Group Return For Nonresident Partners Tax Year and click on Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with the specialized tools provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, and errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form IT 203 GR Group Return For Nonresident Partners Tax Year and maintain effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 gr group return for nonresident partners tax year 2021

Create this form in 5 minutes!

How to create an eSignature for the form it 203 gr group return for nonresident partners tax year 2021

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 203 gr. in relation to airSlate SignNow?

The term 'it 203 gr.' refers to a specific feature or catalog code associated with airSlate SignNow's eSigning solutions. It showcases the document types and formats supported by our service, ensuring you can manage your eSignatures efficiently. Understanding this terminology helps businesses optimize their document processes.

-

How much does it 203 gr. cost?

Pricing for the it 203 gr. functionality within airSlate SignNow varies depending on your subscription plan. We offer various pricing tiers to accommodate different business sizes and needs, ensuring a cost-effective solution for eSigning documents. For the most accurate pricing details, visit our pricing page.

-

What are the key features of the it 203 gr. offering?

The it 203 gr. offering includes a range of powerful features like secure eSignatures, document templates, and real-time tracking. These features help streamline your workflow, making the process of sending and signing documents simple and efficient. This package is designed to cater to professionals who need quick access to essential tools.

-

What benefits does using it 203 gr. provide for businesses?

Utilizing the it 203 gr. service can accelerate your document turnaround times and improve compliance with digital signature laws. It fosters better collaboration among teams, enabling them to focus on core business activities rather than paperwork. Overall, it's an investment in efficiency and functionality.

-

Can it 203 gr. be integrated with other software applications?

Yes, the it 203 gr. functionality supports integration with various third-party applications like CRM systems and project management tools. This allows businesses to create a seamless workflow where document signing is incorporated into existing processes. Integration not only saves time but also enhances productivity.

-

Is it 203 gr. suitable for small businesses?

Absolutely! The it 203 gr. service is designed to be scalable, making it ideal for small businesses looking for cost-effective eSigning solutions. It provides all the essential tools needed to manage documents without overwhelming users, ensuring that businesses of all sizes can benefit from our services.

-

How secure is the it 203 gr. eSigning process?

The security of the it 203 gr. eSigning process is a top priority for airSlate SignNow. We utilize industry-standard encryption and comply with legal regulations to ensure that your documents are safe and secure. You can trust that your sensitive information remains protected while using our platform.

Get more for Form IT 203 GR Group Return For Nonresident Partners Tax Year

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services south dakota form

- Temporary lease agreement to prospective buyer of residence prior to closing south dakota form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497326206 form

- Letter from landlord to tenant returning security deposit less deductions south dakota form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return south dakota form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return south dakota form

- Letter from tenant to landlord containing request for permission to sublease south dakota form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages south form

Find out other Form IT 203 GR Group Return For Nonresident Partners Tax Year

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History