Form it 261 Claim for Empire State Film Post Production Credit Tax Year 2024-2026

Understanding the Form IT 261 for Empire State Film Post Production Credit

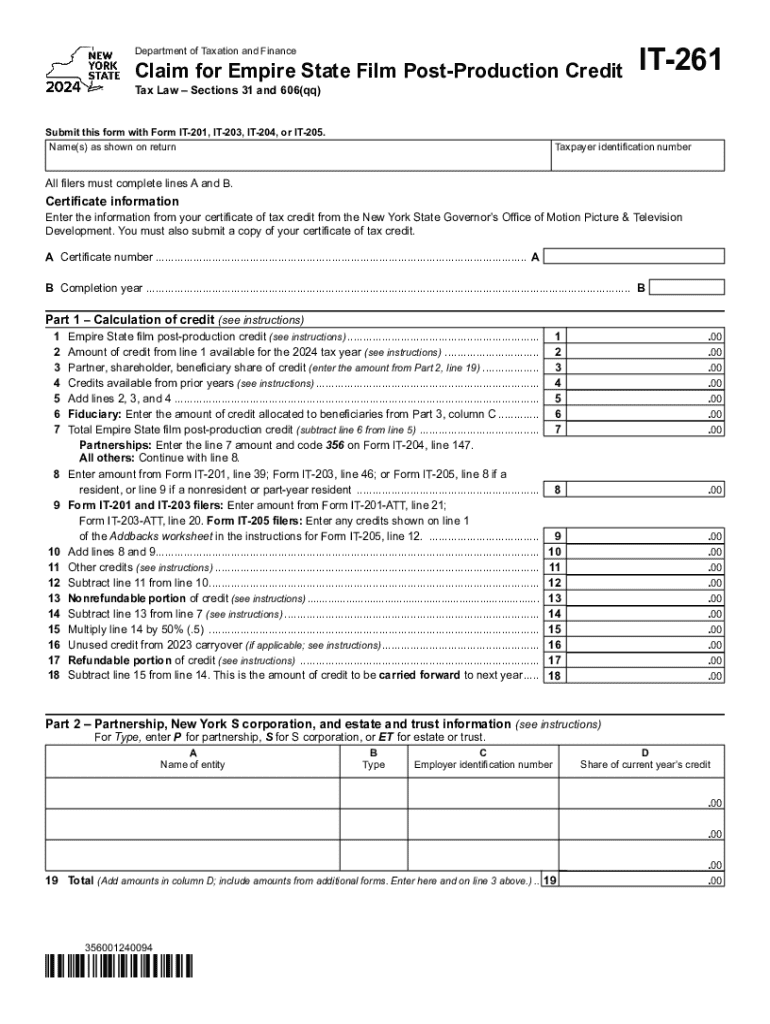

The Form IT 261 is specifically designed for claiming the Empire State Film Post Production Credit. This tax credit is available to eligible production companies that incur qualified post-production expenses in New York State. The purpose of this form is to facilitate the process of claiming the credit, which can significantly reduce the tax liability for qualifying film and television productions. Understanding the eligibility criteria and the specific requirements outlined in the form is essential for maximizing the benefits of this tax incentive.

Steps to Complete the Form IT 261

Completing the Form IT 261 involves several key steps:

- Gather necessary documentation, including proof of qualified post-production expenses.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach supporting documents, such as invoices and receipts, that validate the expenses claimed.

- Review the form for accuracy before submission to avoid delays or penalties.

Each section of the form must be completed with precise information to ensure compliance with state regulations.

Eligibility Criteria for the Form IT 261

To qualify for the Empire State Film Post Production Credit, production companies must meet specific eligibility criteria:

- The production must be filmed in New York State.

- Qualified post-production expenses must exceed a minimum threshold.

- The production must meet the definition of a qualified film or television project as outlined by the New York State tax regulations.

It is important to review the detailed eligibility requirements to ensure compliance before filing the form.

Required Documents for Form IT 261

When submitting the Form IT 261, certain documents must be included to support the claim:

- Invoices detailing qualified post-production expenses.

- Proof of payment for all claimed expenses, such as bank statements or cancelled checks.

- A completed production budget that outlines all expenses incurred during post-production.

Providing comprehensive documentation helps streamline the review process and enhances the likelihood of approval.

Filing Deadlines for Form IT 261

Timely submission of the Form IT 261 is crucial. The filing deadlines are generally aligned with the tax year in which the expenses were incurred. Productions must ensure that the form is submitted by the specified deadline to be considered for the tax credit. Late submissions may result in denial of the credit.

Form Submission Methods for IT 261

The Form IT 261 can be submitted using various methods:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a physical copy of the completed form and supporting documents to the designated address.

- In-person submission at local tax offices, if applicable.

Choosing the appropriate submission method can impact the processing time for the tax credit claim.

Create this form in 5 minutes or less

Find and fill out the correct form it 261 claim for empire state film post production credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 261 claim for empire state film post production credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 261?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. The term 'it 261' refers to the integration of technology in document management, which airSlate SignNow excels at by providing a seamless and efficient way to handle paperwork.

-

How much does airSlate SignNow cost for users interested in it 261?

The pricing for airSlate SignNow varies based on the plan you choose, but it offers competitive rates that cater to different business needs. For those focusing on it 261, the cost-effective solutions provided by airSlate SignNow can signNowly reduce operational expenses related to document handling.

-

What features does airSlate SignNow offer that support it 261?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all of which enhance the document signing process. These features align with the principles of it 261 by streamlining workflows and improving efficiency in document management.

-

What are the benefits of using airSlate SignNow for it 261?

Using airSlate SignNow for it 261 provides numerous benefits, including faster turnaround times for document approvals and enhanced security for sensitive information. Additionally, it helps businesses maintain compliance with legal standards, making it a reliable choice for electronic signatures.

-

Can airSlate SignNow integrate with other software for it 261?

Yes, airSlate SignNow offers integrations with various software applications, enhancing its functionality for it 261. This allows users to connect their existing tools and streamline their document workflows, making it easier to manage and sign documents across platforms.

-

Is airSlate SignNow user-friendly for those new to it 261?

Absolutely! airSlate SignNow is designed with user experience in mind, making it accessible for individuals who may be new to it 261. The intuitive interface and straightforward navigation ensure that users can quickly learn how to send and sign documents without extensive training.

-

How does airSlate SignNow ensure the security of documents related to it 261?

airSlate SignNow prioritizes security by implementing advanced encryption protocols and secure cloud storage for all documents. This commitment to security is crucial for businesses dealing with it 261, as it protects sensitive information from unauthorized access.

Get more for Form IT 261 Claim For Empire State Film Post Production Credit Tax Year

Find out other Form IT 261 Claim For Empire State Film Post Production Credit Tax Year

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word