Form it 261 Claim for Empire State Film Post Production 2023

What is the Form IT-261 Claim for Empire State Film Post Production

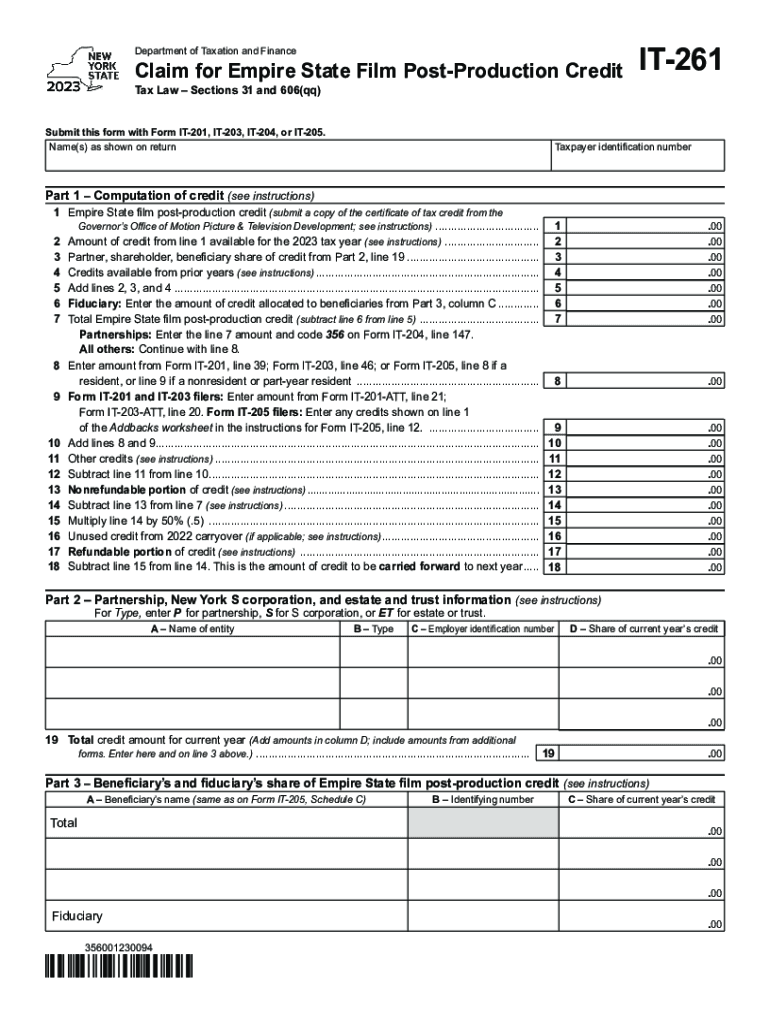

The Form IT-261 is a tax form used in New York State specifically for claiming credits related to film post-production expenses. This form is designed for production companies that have incurred eligible costs while completing their film projects in New York. The Empire State Film Post Production Credit aims to encourage filmmakers to utilize New York's resources, thereby boosting the local economy and creating jobs. By filing this form, businesses can potentially receive significant tax credits that can offset their state tax liabilities.

How to Use the Form IT-261 Claim for Empire State Film Post Production

To effectively use the Form IT-261, businesses must first ensure they meet the eligibility criteria set by New York State. Once eligibility is confirmed, the form should be filled out accurately, detailing all qualifying post-production expenses. It is crucial to maintain thorough documentation of these expenses, as they may be required for verification. After completing the form, it should be submitted alongside the appropriate tax return to the New York State Department of Taxation and Finance. This ensures that the credit is applied correctly to the business's tax obligations.

Steps to Complete the Form IT-261 Claim for Empire State Film Post Production

Completing the Form IT-261 involves several key steps:

- Gather documentation: Collect all receipts and records of eligible post-production expenses.

- Fill out the form: Provide accurate information regarding the business and the expenses incurred.

- Calculate the credit: Determine the amount of credit based on the total qualifying expenses.

- Review for accuracy: Ensure all information is complete and correct to avoid delays.

- Submit the form: File the completed form with the business's tax return to the appropriate state agency.

Key Elements of the Form IT-261 Claim for Empire State Film Post Production

The Form IT-261 includes several essential components that must be accurately completed:

- Business information: Name, address, and tax identification number of the production company.

- Expense details: A breakdown of all eligible post-production costs, including editing, sound design, and visual effects.

- Credit calculation: The formula used to determine the total credit based on eligible expenses.

- Signature: An authorized representative of the business must sign the form to validate the claims made.

Eligibility Criteria for the Form IT-261 Claim for Empire State Film Post Production

To qualify for the Form IT-261, production companies must meet specific eligibility criteria set forth by New York State. These include:

- The film must be produced in New York State.

- Eligible expenses must be incurred during the post-production phase.

- The production company must be registered and in good standing with the state.

- All claims must be substantiated with proper documentation.

Form Submission Methods for IT-261 Claim for Empire State Film Post Production

The Form IT-261 can be submitted through various methods, ensuring convenience for businesses. Options include:

- Online submission: Filing through the New York State Department of Taxation and Finance online portal.

- Mail: Sending a paper copy of the completed form to the designated address provided by the state.

- In-person: Delivering the form directly to a local tax office, if preferred.

Quick guide on how to complete form it 261 claim for empire state film post production

Easily prepare Form IT 261 Claim For Empire State Film Post Production on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Handle Form IT 261 Claim For Empire State Film Post Production on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Form IT 261 Claim For Empire State Film Post Production effortlessly

- Locate Form IT 261 Claim For Empire State Film Post Production and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form searches, or mistakes that require creating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form IT 261 Claim For Empire State Film Post Production and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 261 claim for empire state film post production

Create this form in 5 minutes!

How to create an eSignature for the form it 261 claim for empire state film post production

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 261 Claim For Empire State Film Post Production?

The Form IT 261 Claim For Empire State Film Post Production is a tax incentive application designed to help productions claim tax credits for eligible film production expenses in New York State. By utilizing this form, filmmakers can recoup signNow costs associated with post-production activities. Understanding how to correctly fill out this form can maximize your potential tax benefits.

-

How can airSlate SignNow help with submitting the Form IT 261 Claim For Empire State Film Post Production?

airSlate SignNow simplifies the process of preparing and submitting the Form IT 261 Claim For Empire State Film Post Production. Our platform allows users to electronically sign documents and securely store them, ensuring all necessary submissions are easily accessible and compliant with regulations. This streamlines the filing process, saving you time and reducing potential errors.

-

What are the benefits of using airSlate SignNow for the Form IT 261 Claim For Empire State Film Post Production?

Using airSlate SignNow for the Form IT 261 Claim For Empire State Film Post Production offers numerous benefits including efficiency, cost-effectiveness, and enhanced security. Our platform not only speeds up the signing process but also ensures that your documents are securely stored and tracked. This means less worry about document misplacement and more time focusing on your film project.

-

Is there a cost associated with using airSlate SignNow for the Form IT 261 Claim For Empire State Film Post Production?

airSlate SignNow offers competitive pricing plans that cater to various business needs. While there is a subscription fee, the cost is often offset by the time and resources saved through our user-friendly eSigning and document management features. You can choose a plan that best fits your production budget, especially when preparing your Form IT 261 Claim For Empire State Film Post Production.

-

Can I integrate airSlate SignNow with other tools for preparing the Form IT 261 Claim For Empire State Film Post Production?

Yes, airSlate SignNow integrates seamlessly with a variety of other software tools commonly used in the film industry, streamlining the process of preparing the Form IT 261 Claim For Empire State Film Post Production. By connecting to accounting or project management platforms, you can ensure all necessary data and documents are readily available for your tax claims. This integration enhances productivity and reduces manual input.

-

What features of airSlate SignNow are specifically useful for the Form IT 261 Claim For Empire State Film Post Production?

Key features of airSlate SignNow that are particularly useful for the Form IT 261 Claim For Empire State Film Post Production include easy document uploads, custom templates, and real-time tracking of document status. These features facilitate a smoother workflow when completing your claims, ensuring that you do not miss deadlines and that your submissions are accurate and timely.

-

How does airSlate SignNow ensure the security of my Form IT 261 Claim For Empire State Film Post Production documents?

Security is a top priority at airSlate SignNow. All documents, including the Form IT 261 Claim For Empire State Film Post Production, are encrypted and stored in a secure environment. Additionally, we provide compliance with various regulations, giving users peace of mind that their sensitive information is protected throughout the document management process.

Get more for Form IT 261 Claim For Empire State Film Post Production

Find out other Form IT 261 Claim For Empire State Film Post Production

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now