Payroll Expense Tax FAQs Form

Understanding the Payroll Expense Tax in Pittsburgh

The payroll expense tax in the city of Pittsburgh is a tax levied on employers based on the total compensation paid to employees. This tax applies to businesses operating within the city limits and is designed to fund local services and infrastructure. Employers must be aware of their responsibilities regarding this tax to ensure compliance and avoid penalties.

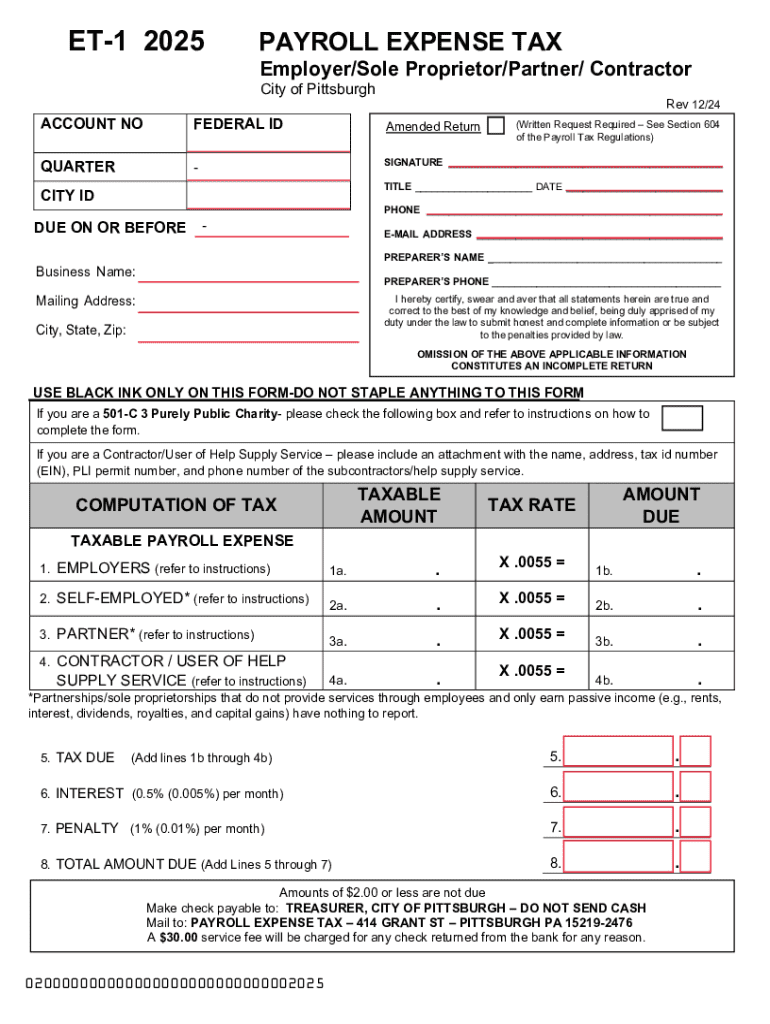

Steps to Complete the Pittsburgh Payroll Expense Tax Form ET-1

Completing the Pittsburgh form ET-1 requires careful attention to detail. Here are the essential steps:

- Gather necessary information about your business, including the total payroll for the reporting period.

- Access the city of Pittsburgh form ET-1, which can be obtained from the official city website or local tax office.

- Fill out the form accurately, ensuring all employee compensation is accounted for.

- Calculate the payroll expense tax owed based on the applicable rates.

- Review the completed form for accuracy before submission.

- Submit the form ET-1 by the specified deadline to avoid late fees.

Required Documents for Filing the Payroll Expense Tax

When filing the payroll expense tax in Pittsburgh, certain documents are essential to ensure a smooth process. These include:

- Payroll records for the reporting period, detailing employee wages and compensation.

- Previous tax filings, if applicable, to maintain consistency in reporting.

- Any correspondence from the city regarding tax obligations or changes in tax rates.

Penalties for Non-Compliance with the Payroll Expense Tax

Failure to comply with the payroll expense tax regulations in Pittsburgh can result in significant penalties. These may include:

- Late filing fees, which increase the longer the form remains unfiled.

- Interest on unpaid taxes, accruing from the due date until payment is made.

- Potential legal action for persistent non-compliance, which may lead to further financial consequences.

Form Submission Methods for the Payroll Expense Tax

Employers in Pittsburgh have several options for submitting the payroll expense tax form ET-1. These methods include:

- Online submission through the city’s official tax portal, which is often the fastest method.

- Mailing the completed form to the city treasurer's office, ensuring it is postmarked by the deadline.

- In-person submission at designated city offices, allowing for immediate confirmation of receipt.

Eligibility Criteria for the Payroll Expense Tax

To determine eligibility for the payroll expense tax in Pittsburgh, consider the following criteria:

- Businesses must operate within the city limits to be subject to the tax.

- Employers must have employees on payroll during the reporting period.

- Specific exemptions may apply, such as for certain non-profit organizations or government entities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll expense tax faqs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it benefit businesses in the city Pittsburgh?

airSlate SignNow is a powerful eSignature solution that enables businesses in the city Pittsburgh to send and sign documents electronically. This platform streamlines the signing process, saving time and reducing paperwork. With its user-friendly interface, businesses can enhance their workflow efficiency and improve customer satisfaction.

-

How much does airSlate SignNow cost for businesses in the city Pittsburgh?

The pricing for airSlate SignNow varies based on the plan you choose, making it a cost-effective solution for businesses in the city Pittsburgh. Plans typically start with a basic option that includes essential features, while advanced plans offer additional functionalities. It's best to check the official website for the most current pricing tailored to your business needs.

-

What features does airSlate SignNow offer for users in the city Pittsburgh?

airSlate SignNow offers a range of features including document templates, real-time tracking, and customizable workflows. Users in the city Pittsburgh can benefit from its mobile compatibility, allowing them to sign documents on-the-go. These features help businesses streamline their operations and enhance productivity.

-

Can airSlate SignNow integrate with other software used by businesses in the city Pittsburgh?

Yes, airSlate SignNow offers seamless integrations with various software applications commonly used by businesses in the city Pittsburgh. This includes CRM systems, cloud storage services, and productivity tools. These integrations help businesses maintain their existing workflows while enhancing document management.

-

Is airSlate SignNow secure for businesses in the city Pittsburgh?

Absolutely, airSlate SignNow prioritizes security, ensuring that all documents signed by businesses in the city Pittsburgh are protected. The platform uses advanced encryption and complies with industry standards to safeguard sensitive information. This commitment to security helps businesses operate with confidence.

-

How can airSlate SignNow improve customer experience for businesses in the city Pittsburgh?

By using airSlate SignNow, businesses in the city Pittsburgh can signNowly enhance their customer experience. The quick and easy eSigning process allows customers to sign documents from anywhere, reducing delays and improving satisfaction. This efficiency can lead to stronger customer relationships and increased loyalty.

-

What types of documents can be signed using airSlate SignNow in the city Pittsburgh?

airSlate SignNow supports a wide variety of documents that can be signed electronically, including contracts, agreements, and forms. Businesses in the city Pittsburgh can utilize this platform for any document that requires a signature, making it versatile for different industries. This flexibility helps streamline various business processes.

Get more for Payroll Expense Tax FAQs

- Dichiarazione garanzia eo form

- Fit to fly certificate thailand form

- Tc 96 182 instructions form

- Social media questionnaire pdf form

- Authentication forms kenya post office savings bank postbank co

- Standard number plates replacement application department of form

- Number plate template printable australia form

- Fisher funds kiwisaver plan product disclosure statement 6 form

Find out other Payroll Expense Tax FAQs

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile