RI 1040V Personal Income Tax Payment Voucher 2024-2026

What is the RI 1040V Personal Income Tax Payment Voucher

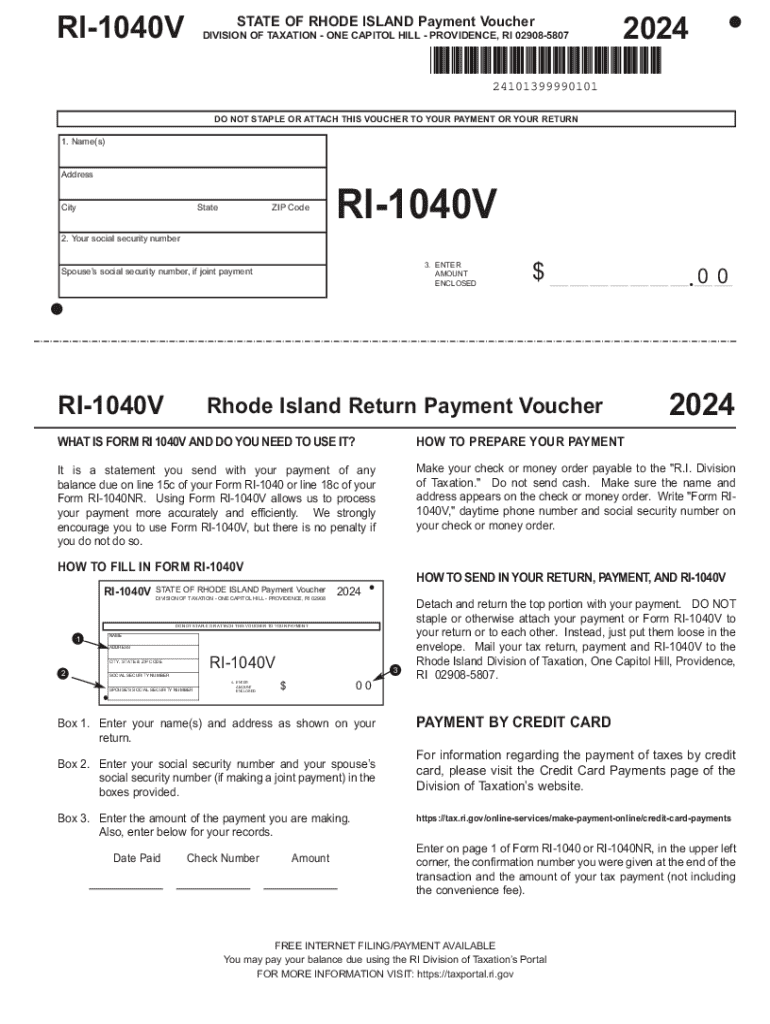

The RI 1040V is a personal income tax payment voucher used by residents of Rhode Island to submit payments for their state income taxes. This form is essential for taxpayers who owe taxes and prefer to make payments separately from their tax returns. It helps ensure that payments are properly credited to the taxpayer's account, facilitating a smoother tax process.

How to use the RI 1040V Personal Income Tax Payment Voucher

To use the RI 1040V, taxpayers need to fill out the form with their personal information, including name, address, and Social Security number. The voucher requires the amount being paid, which should match the payment due as calculated on the taxpayer's return. Once completed, the voucher must be included with the payment when submitted to the Rhode Island Division of Taxation.

Steps to complete the RI 1040V Personal Income Tax Payment Voucher

Completing the RI 1040V involves several straightforward steps:

- Download the form from the Rhode Island Division of Taxation website or obtain a physical copy.

- Fill in your personal details, including your full name, address, and Social Security number.

- Indicate the payment amount owed on the form.

- Sign and date the voucher to validate your payment.

- Attach your payment, ensuring it is made out to the Rhode Island Division of Taxation.

Key elements of the RI 1040V Personal Income Tax Payment Voucher

The RI 1040V contains several key elements that are crucial for proper submission:

- Taxpayer Information: This includes your name, address, and Social Security number.

- Payment Amount: The total amount you are remitting.

- Signature: Your signature is required to authorize the payment.

- Date: The date of the payment submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the RI 1040V. Payments made using this voucher should be submitted by the tax due date, which typically aligns with the federal tax deadline. For the 2024 tax year, the due date for filing and payment is April 15, 2024. Late payments may incur penalties and interest, so timely submission is crucial.

Form Submission Methods

Taxpayers can submit the RI 1040V in several ways:

- By Mail: Send the completed voucher and payment to the Rhode Island Division of Taxation via the address specified on the form.

- In-Person: Payments can also be made in person at designated tax offices.

It is advisable to keep a copy of the voucher and payment for personal records.

Create this form in 5 minutes or less

Find and fill out the correct ri 1040v personal income tax payment voucher

Create this form in 5 minutes!

How to create an eSignature for the ri 1040v personal income tax payment voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI 1040V 2024 form and why is it important?

The RI 1040V 2024 form is a payment voucher used by Rhode Island taxpayers to submit their tax payments. It is essential for ensuring that your tax payments are processed correctly and on time, helping you avoid penalties and interest.

-

How can airSlate SignNow help with the RI 1040V 2024 form?

airSlate SignNow simplifies the process of completing and eSigning the RI 1040V 2024 form. With our user-friendly platform, you can easily fill out the form, sign it electronically, and send it securely, ensuring compliance and efficiency.

-

What are the pricing options for using airSlate SignNow for the RI 1040V 2024?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small business or a large enterprise, you can find a cost-effective solution to manage your RI 1040V 2024 form and other documents efficiently.

-

Are there any integrations available for managing the RI 1040V 2024 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage your RI 1040V 2024 form alongside your existing workflows. This integration enhances productivity and ensures that all your documents are in one place.

-

What features does airSlate SignNow offer for the RI 1040V 2024 form?

airSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage specifically for the RI 1040V 2024 form. These features streamline the signing process and enhance document management.

-

Can I track the status of my RI 1040V 2024 form with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your RI 1040V 2024 form in real-time. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

-

Is airSlate SignNow secure for handling the RI 1040V 2024 form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the RI 1040V 2024 form. Our platform uses advanced encryption and security protocols to protect your sensitive information.

Get more for RI 1040V Personal Income Tax Payment Voucher

Find out other RI 1040V Personal Income Tax Payment Voucher

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later