Efile Rhode Island State Tax Returns ESmart Tax 2022

Understanding the Efile Rhode Island State Tax Returns

The Efile Rhode Island State Tax Returns is a digital method for submitting your state tax documents electronically. This process simplifies the filing experience, allowing taxpayers to complete their returns from the comfort of their homes. E-filing is designed to be user-friendly, ensuring that individuals can navigate the necessary forms without confusion. The system is compliant with state regulations, making it a secure option for taxpayers.

Steps to Complete the Efile Rhode Island State Tax Returns

Completing your Efile Rhode Island State Tax Returns involves several straightforward steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any relevant deductions.

- Access the Efile system through a compatible tax software or the official state website.

- Input your personal information, including your name, address, and Social Security number.

- Fill in your income details and any deductions or credits you qualify for.

- Review your information for accuracy before submitting the return.

- Submit your return electronically and save the confirmation for your records.

Key Elements of the Efile Rhode Island State Tax Returns

When preparing your Efile Rhode Island State Tax Returns, it is essential to include specific key elements:

- Personal Information: Ensure that your name, address, and Social Security number are accurate.

- Income Reporting: Include all sources of income, such as wages, interest, and dividends.

- Deductions and Credits: Identify any deductions or credits applicable to your situation, such as education credits or mortgage interest deductions.

- Signature: An electronic signature is required to validate your submission.

Required Documents for Efile Rhode Island State Tax Returns

To successfully complete your Efile Rhode Island State Tax Returns, you will need several documents:

- W-2 forms from employers

- 1099 forms for additional income

- Documentation for deductions, such as receipts or statements

- Last year’s tax return for reference

Filing Deadlines for Efile Rhode Island State Tax Returns

Staying aware of filing deadlines is crucial for compliance. The typical deadline for submitting your Efile Rhode Island State Tax Returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to the filing schedule each tax season.

Penalties for Non-Compliance with Efile Rhode Island State Tax Returns

Failing to file your Efile Rhode Island State Tax Returns by the deadline can result in penalties. Common penalties include:

- Late filing fees, which can accumulate over time

- Interest on any unpaid taxes

- Potential legal action for persistent non-compliance

Quick guide on how to complete efile rhode island state tax returns esmart tax

Complete Efile Rhode Island State Tax Returns ESmart Tax effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the correct template and securely save it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without complications. Handle Efile Rhode Island State Tax Returns ESmart Tax on any platform with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to modify and electronically sign Efile Rhode Island State Tax Returns ESmart Tax with ease

- Obtain Efile Rhode Island State Tax Returns ESmart Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and electronically sign Efile Rhode Island State Tax Returns ESmart Tax and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct efile rhode island state tax returns esmart tax

Create this form in 5 minutes!

How to create an eSignature for the efile rhode island state tax returns esmart tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

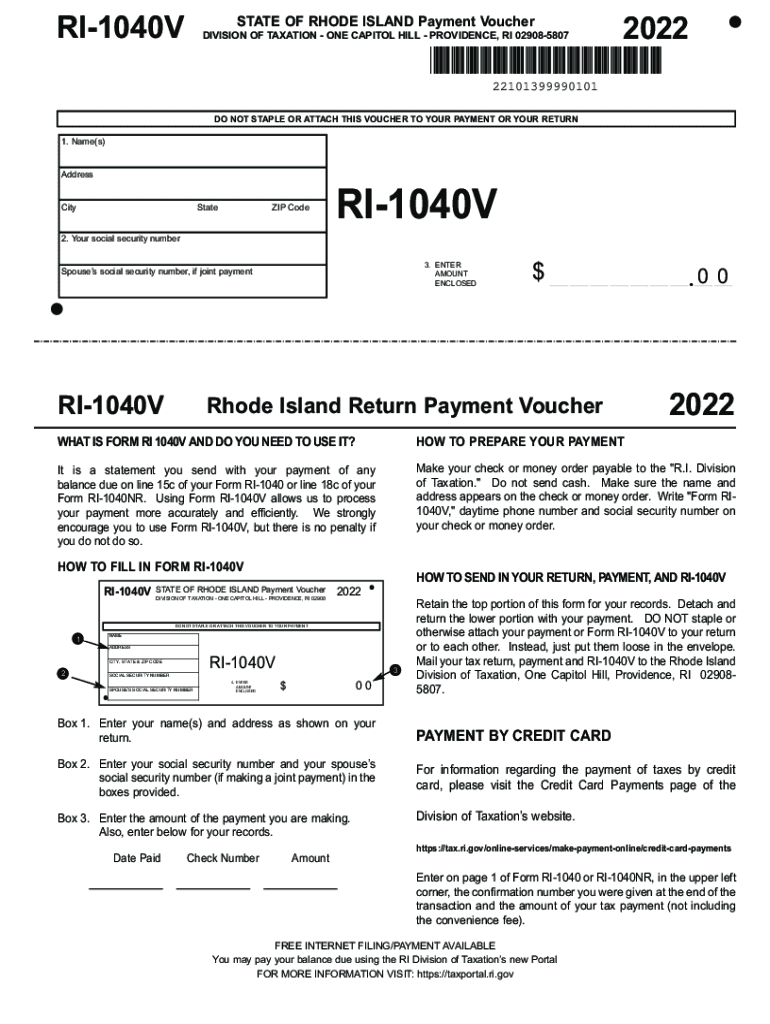

What is the RI 1040V online and how does it work?

The RI 1040V online is a digital form used for making payments with your Rhode Island personal income tax return. By using airSlate SignNow, you can easily fill out and sign this form electronically, ensuring a quick and hassle-free process. Additionally, our platform allows you to securely store and manage all your tax documents in one place.

-

What are the benefits of using airSlate SignNow for RI 1040V online?

Using airSlate SignNow to complete your RI 1040V online offers numerous benefits, such as ease of use, time savings, and enhanced security. Our intuitive interface allows you to fill out and sign the form effortlessly, while end-to-end encryption ensures your sensitive information is protected. Plus, you can access your documents anytime, anywhere.

-

Is there a cost associated with filing the RI 1040V online through airSlate SignNow?

Yes, there is a cost for using airSlate SignNow to file your RI 1040V online, but it is designed to be cost-effective. Our pricing plans are competitive and offer various options to fit your needs, whether you’re an individual or a business. The investment comes with the convenience of easy document management and secure electronic signatures.

-

Can I integrate airSlate SignNow with other software for managing the RI 1040V online?

Absolutely! airSlate SignNow supports integrations with a variety of popular software programs, making it convenient to manage your tax documents. By connecting with accounting tools and CRMs, you can streamline the process of filing your RI 1040V online, saving you time and reducing the chance of errors.

-

How secure is the information when filing the RI 1040V online?

Security is a top priority at airSlate SignNow. When you file your RI 1040V online, your data is protected by advanced encryption protocols, ensuring that your personal information remains confidential. We comply with industry standards to keep your financial details safe throughout the eSigning process.

-

Can I track the status of my RI 1040V online submission?

Yes, you can easily track the status of your RI 1040V online submission using airSlate SignNow. Our platform provides real-time updates, so you can stay informed about any changes or requirements related to your filing. This helps in managing your tax responsibilities efficiently.

-

What types of documents can I prepare besides the RI 1040V online?

In addition to the RI 1040V online, airSlate SignNow allows you to prepare a variety of documents, such as contracts, waivers, and consent forms. This enables you to handle all your eSigning needs in one platform, making it a versatile tool for both personal and business use.

Get more for Efile Rhode Island State Tax Returns ESmart Tax

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries pennsylvania form

- Warranty deed from limited partnership or llc is the grantor or grantee pennsylvania form

- Warranty deed executors deed pennsylvania form

- Warranty deed wife 497324898 form

- Warranty deed from individual to four individuals pennsylvania form

- Pa husband wife form

- Pennsylvania quitclaim form

- Pennsylvania limited form

Find out other Efile Rhode Island State Tax Returns ESmart Tax

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form