HOW to SEND in YOUR RETURN, PAYMENT, and RI 1040V 2015

What is the HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V

The HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V is a crucial document for taxpayers in Rhode Island, designed to facilitate the submission of tax returns along with payment. This form is essential for ensuring that individuals meet their tax obligations while providing the state with necessary financial information. It is specifically tailored for residents who need to report their income and calculate their tax liabilities accurately. Understanding this form is vital for compliance with state tax laws.

Steps to complete the HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V

Completing the HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V involves several key steps:

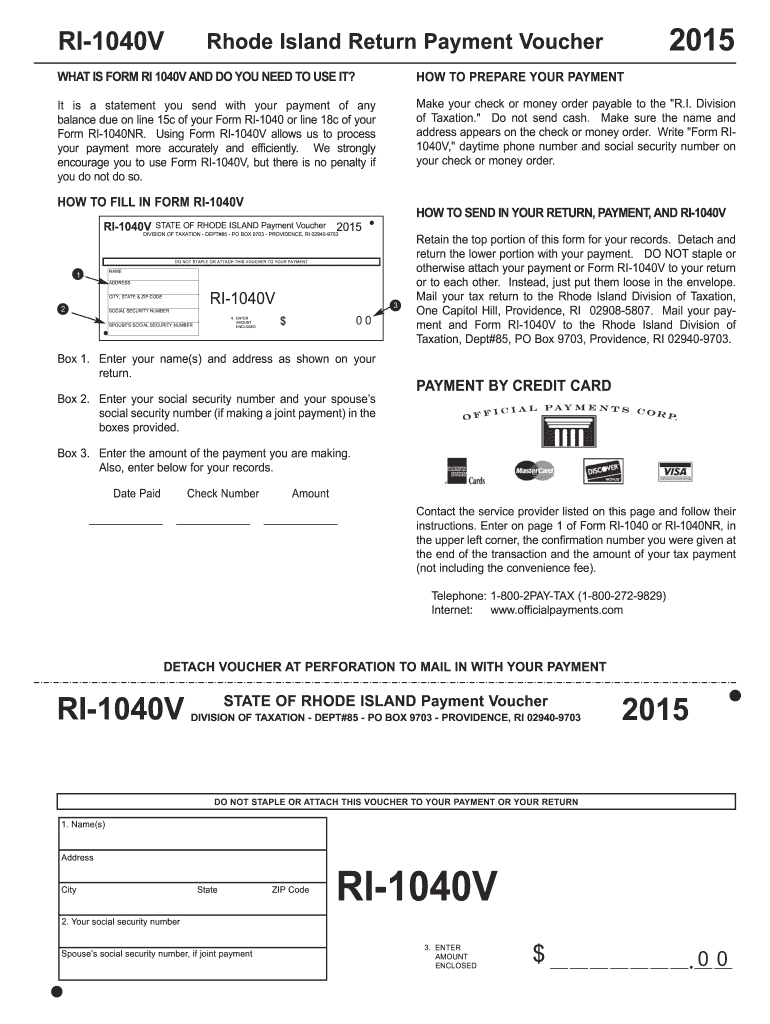

- Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

- Fill out the form accurately, ensuring that all personal and financial information is correct.

- Calculate your total tax liability based on the information provided.

- Include any payments due, whether by check or electronic payment methods.

- Review the completed form for accuracy before submission.

Form Submission Methods (Online / Mail / In-Person)

There are multiple ways to submit the HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V. Taxpayers can choose from the following methods:

- Online Submission: Many taxpayers prefer to file electronically through authorized e-filing services, which can expedite the process and reduce errors.

- Mail: You can print the completed form and send it via postal mail to the appropriate state tax office. Ensure that you use the correct address and include any required payments.

- In-Person: For those who prefer face-to-face interactions, submitting the form in person at designated tax offices is an option.

IRS Guidelines

When completing the HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V, it is essential to adhere to IRS guidelines. These guidelines provide clarity on acceptable practices for reporting income, claiming deductions, and ensuring compliance with federal tax regulations. Familiarizing yourself with IRS requirements can help avoid common pitfalls and ensure that your submission is accurate and complete.

Legal use of the HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V

The legal use of the HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V is governed by state tax laws. This form must be completed and submitted in accordance with these laws to be considered valid. Proper execution includes providing accurate information and signatures, which are necessary for the form to hold legal weight. Utilizing a reliable platform for e-signatures can enhance the legitimacy of your submission.

Filing Deadlines / Important Dates

Staying informed about filing deadlines for the HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V is crucial. Typically, the deadline for submitting this form aligns with federal tax deadlines, which is usually April 15th. However, it is advisable to check for any state-specific extensions or changes that may apply. Marking these dates on your calendar can help ensure timely compliance and avoid penalties.

Quick guide on how to complete how to send in your return payment and ri 1040v

Effortlessly Prepare HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to obtain the correct form and safely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The Simplest Way to Modify and eSign HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V with Ease

- Find HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to send in your return payment and ri 1040v

Create this form in 5 minutes!

How to create an eSignature for the how to send in your return payment and ri 1040v

How to make an electronic signature for your How To Send In Your Return Payment And Ri 1040v in the online mode

How to make an electronic signature for your How To Send In Your Return Payment And Ri 1040v in Google Chrome

How to make an eSignature for signing the How To Send In Your Return Payment And Ri 1040v in Gmail

How to make an eSignature for the How To Send In Your Return Payment And Ri 1040v from your mobile device

How to generate an electronic signature for the How To Send In Your Return Payment And Ri 1040v on iOS

How to make an eSignature for the How To Send In Your Return Payment And Ri 1040v on Android devices

People also ask

-

What is the process for HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V?

To send in your return, payment, and RI 1040V using airSlate SignNow, first ensure all documents are prepared and signed. Upload the documents to our platform, then choose the method of delivery, such as email or direct submission to the tax authority. Follow the prompts to finalize the submission securely.

-

Are there any fees associated with sending in your return, payment, and RI 1040V?

Yes, airSlate SignNow offers various pricing plans that include fees for sending in your return, payment, and RI 1040V. However, our service is designed to be cost-effective, ensuring you get the best value for your document management needs. Review our pricing page for detailed information on options.

-

What features does airSlate SignNow provide to streamline HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V?

AirSlate SignNow provides features such as document templates, eSigning capabilities, and tracking for submissions. These tools are designed to simplify the process of HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V, making it fast and efficient. Our user-friendly interface ensures that all tasks can be completed with ease.

-

Can I integrate airSlate SignNow with other software to assist with HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage documents related to HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V. This enables you to combine workflows and automate your document management effectively.

-

Is airSlate SignNow secure for handling sensitive information when sending in my return, payment, and RI 1040V?

Yes, airSlate SignNow prioritizes the security of your documents. We use advanced encryption and secure servers to ensure that your sensitive information, including details about HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V, is protected throughout the process.

-

How can I ensure my documents are correctly submitted when I send in my return, payment, and RI 1040V?

To ensure correct submission when you send in your return, payment, and RI 1040V, confirm that all fields are properly filled and documents are signed before submission. Utilize airSlate SignNow's preview feature to double-check everything. Our platform will notify you of any issues that need addressing.

-

What benefits does airSlate SignNow offer for sending in my return, payment, and RI 1040V?

Using airSlate SignNow to send in your return, payment, and RI 1040V allows for efficient and streamlined processes. You benefit from reduced paperwork, quicker transactions, and access to a comprehensive dashboard that helps manage your documents effectively. Plus, real-time tracking provides peace of mind.

Get more for HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V

Find out other HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI 1040V

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP