Fillable Online Transfer Request Form Bcsc K12 in Us Fax 2019

IRS Guidelines

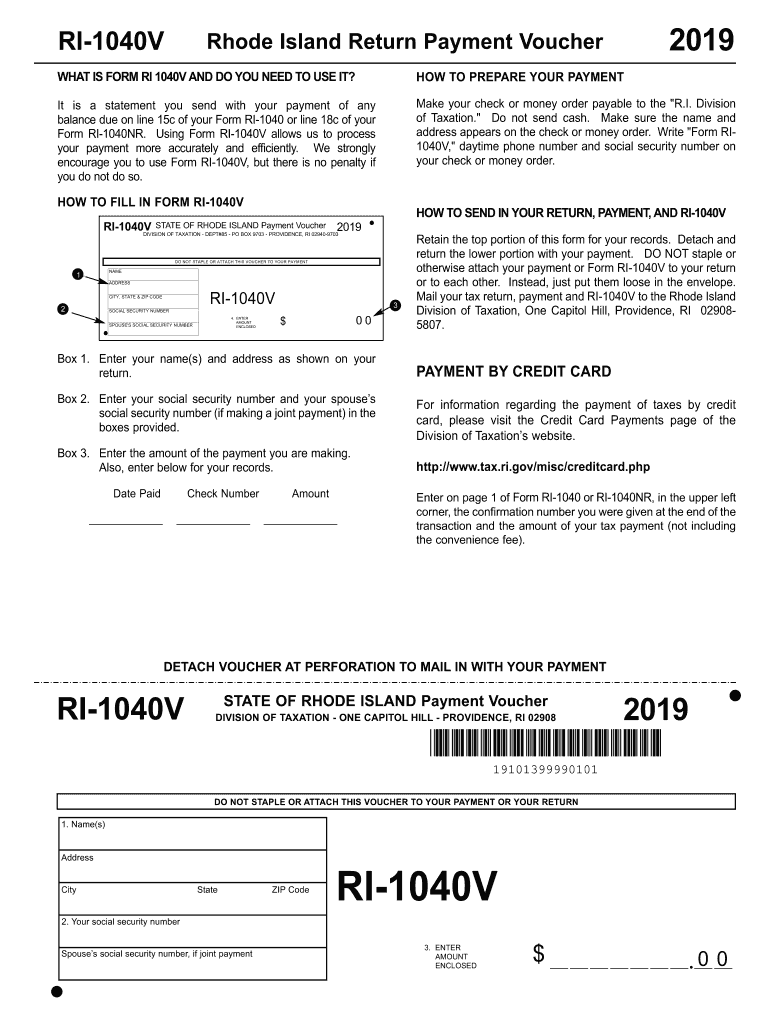

The RI 1040 V serves as a payment voucher for Rhode Island taxpayers. It is essential to understand the IRS guidelines related to this form to ensure compliance and accuracy when filing your state taxes. The IRS mandates that taxpayers report their income accurately and pay any taxes owed by the due date. Failure to adhere to these guidelines can result in penalties and interest charges. Taxpayers should refer to the IRS website for the most current instructions regarding state tax payments and the use of payment vouchers.

Filing Deadlines / Important Dates

Timely submission of the Rhode Island 1040 V is crucial for avoiding penalties. Typically, the deadline for filing state income tax returns falls on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific deadlines associated with estimated tax payments, which may require the use of the payment voucher throughout the year. Keeping a calendar of these important dates can help ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the RI 1040 V through various methods. The most common options include:

- Online Submission: Many taxpayers prefer to file electronically, which can expedite processing times.

- Mail: The form can be printed and mailed to the appropriate Rhode Island tax authority. It is advisable to send it via certified mail to confirm delivery.

- In-Person: Taxpayers may also deliver the form directly to local tax offices if they prefer face-to-face interactions.

Choosing the right submission method depends on individual preferences and circumstances.

Required Documents

When completing the Rhode Island 1040 V, taxpayers should gather necessary documents to ensure accurate reporting. Key documents include:

- W-2 Forms: These forms report wages and taxes withheld from employment.

- 1099 Forms: For reporting income from freelance work or other sources.

- Previous Year Tax Return: This can provide a helpful reference for current filings.

Having these documents ready can streamline the completion of the payment voucher and help avoid errors.

Penalties for Non-Compliance

Failure to submit the RI 1040 V on time or to pay the required amount can lead to significant penalties. Rhode Island imposes interest on unpaid taxes, which accrues daily. Additionally, taxpayers may face a late payment penalty, which can increase the total amount owed. Understanding these potential consequences emphasizes the importance of timely and accurate filing.

Eligibility Criteria

Not all taxpayers are required to file the Rhode Island 1040 V. Eligibility typically includes individuals who owe taxes after filing their income tax return. Taxpayers should assess their financial situation to determine if they need to utilize this payment voucher. Factors such as income level, filing status, and tax liability play a crucial role in this determination.

Quick guide on how to complete fillable online transfer request form bcsck12inus fax

Complete Fillable Online Transfer Request Form Bcsc K12 in us Fax effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents promptly with no delays. Handle Fillable Online Transfer Request Form Bcsc K12 in us Fax on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and electronically sign Fillable Online Transfer Request Form Bcsc K12 in us Fax with ease

- Find Fillable Online Transfer Request Form Bcsc K12 in us Fax and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Fillable Online Transfer Request Form Bcsc K12 in us Fax and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online transfer request form bcsck12inus fax

Create this form in 5 minutes!

How to create an eSignature for the fillable online transfer request form bcsck12inus fax

The best way to make an eSignature for your PDF document in the online mode

The best way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the RI 1040 V form, and why do I need it?

The RI 1040 V form is a payment voucher used for filing income tax in Rhode Island. It is essential for individuals who need to make payments when they file their state tax returns. Utilizing airSlate SignNow simplifies the process of closing your filing with the RI 1040 V, allowing you to securely eSign and send documents seamlessly.

-

How can airSlate SignNow assist with my RI 1040 V filings?

AirSlate SignNow allows you to easily eSign your RI 1040 V form and streamline the submission process. Our platform ensures that you can complete your tax documents efficiently while maintaining a high level of security for your sensitive information. This feature is designed to save you time and reduce the stress of tax season.

-

What are the pricing options for using airSlate SignNow for RI 1040 V eSignatures?

AirSlate SignNow offers various pricing plans to cater to different business needs, starting with a free trial. For frequent users of the RI 1040 V form, our plans provide cost-effective solutions without compromising on features. This makes it an ideal choice for both individuals and businesses managing multiple tax filings.

-

Are there any key features of airSlate SignNow that enhance RI 1040 V processing?

One of the standout features of airSlate SignNow is its user-friendly interface that simplifies the eSigning of forms like the RI 1040 V. Additionally, the ability to track document status in real-time ensures that you never miss critical deadlines for tax submissions. These features provide a comprehensive solution for managing your tax paperwork.

-

Can I integrate airSlate SignNow with my current accounting software for RI 1040 V management?

Yes, airSlate SignNow can seamlessly integrate with various accounting software which aids in the efficient management of your RI 1040 V filings. This integration not only saves you time but also ensures that all your financial documents are organized and accessible. You can easily sync data and streamline your tax preparation process.

-

What are the benefits of using airSlate SignNow for my RI 1040 V compared to traditional methods?

Using airSlate SignNow for your RI 1040 V offers several benefits over traditional paper methods, including faster processing time and reduced paperwork. ESigning documents eliminates the need for printing and mailing, making the process eco-friendly. Moreover, you maintain better control over your documents through secure cloud storage.

-

Is airSlate SignNow compliant with Rhode Island's tax regulations for the RI 1040 V?

Absolutely, airSlate SignNow is designed to comply with Rhode Island tax regulations, ensuring that your RI 1040 V submissions are valid and secure. Our platform adheres to legal standards for electronic signatures, giving you peace of mind that your tax documents meet all necessary compliance requirements. Trust us to handle your important tax documents safely.

Get more for Fillable Online Transfer Request Form Bcsc K12 in us Fax

Find out other Fillable Online Transfer Request Form Bcsc K12 in us Fax

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document