Form 592 B Resident and Nonresident Withholding Statement 2025-2026

What is the Form 592 B Resident And Nonresident Withholding Statement

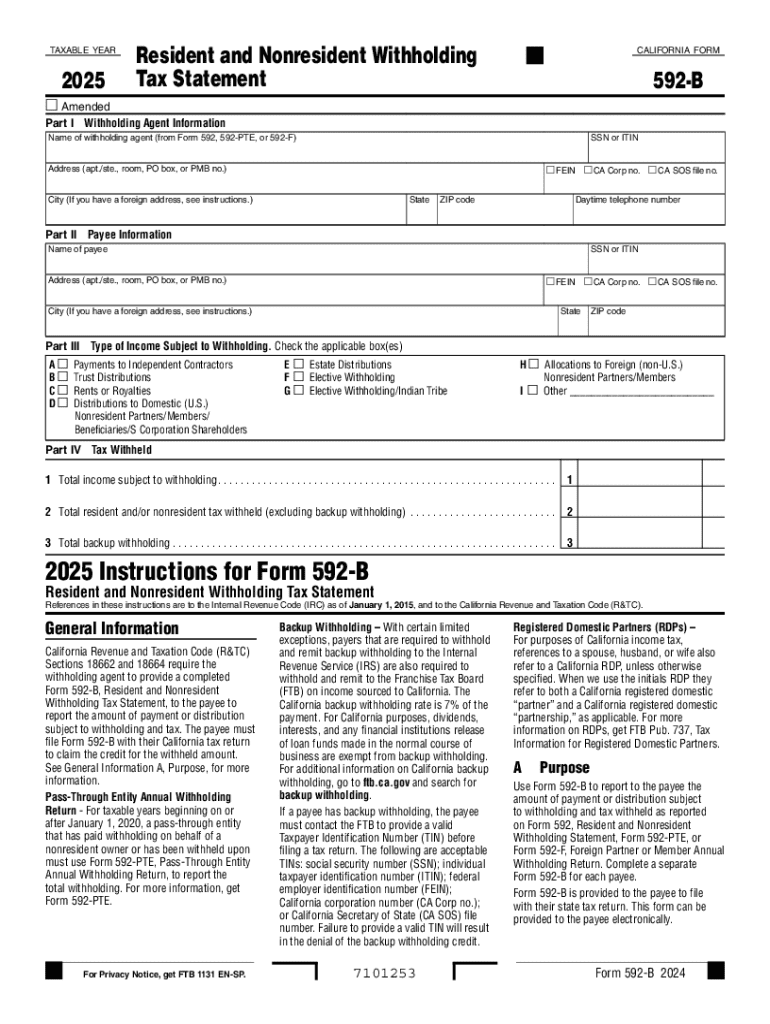

The California Form 592 B is a crucial document used for reporting withholding on payments made to nonresidents and certain residents. It serves as a withholding statement for California tax purposes, ensuring that the appropriate amounts are withheld from payments made to individuals and entities that are not residents of California. This form is essential for ensuring compliance with state tax laws and helps facilitate the correct reporting of income for tax purposes.

How to use the Form 592 B Resident And Nonresident Withholding Statement

The Form 592 B is utilized by payers to report the amount of California income tax withheld from payments made to nonresidents and certain residents. When completing this form, payers must accurately fill out the required fields, including the payee's information and the amount withheld. This form is then submitted to the California Franchise Tax Board (FTB) along with any accompanying payment. It is important for both payers and payees to retain a copy of the form for their records.

Steps to complete the Form 592 B Resident And Nonresident Withholding Statement

Completing the Form 592 B involves several key steps:

- Gather the necessary information, including the payee's name, address, and taxpayer identification number.

- Determine the total amount paid to the payee and the amount of tax withheld.

- Fill out the form accurately, ensuring all information is correct and complete.

- Review the form for any errors before submission.

- Submit the completed form to the FTB along with the payment, if applicable.

Legal use of the Form 592 B Resident And Nonresident Withholding Statement

The legal use of Form 592 B is mandated by California tax regulations. It is required for any entity or individual making payments to nonresidents that are subject to withholding tax. Failure to properly complete and submit this form can result in penalties, making it essential for compliance with state law. Understanding the legal implications of this form helps ensure that all parties involved adhere to the necessary tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 592 B are critical to ensure compliance with California tax regulations. Generally, the form must be submitted to the FTB by the 15th day of the month following the payment. For example, if a payment is made in January, the form must be filed by February 15. It is advisable to keep track of these deadlines to avoid potential penalties and interest charges associated with late submissions.

Form Submission Methods (Online / Mail / In-Person)

The Form 592 B can be submitted through various methods to accommodate different preferences. Payers can file the form online via the California FTB's e-file system, which offers a convenient and efficient way to submit documents. Alternatively, the form can be mailed to the FTB at the address specified in the instructions, or it can be delivered in person at designated FTB offices. Each submission method has its own processing times, so it is beneficial to choose the most suitable option based on individual circumstances.

Create this form in 5 minutes or less

Find and fill out the correct form 592 b resident and nonresident withholding statement

Create this form in 5 minutes!

How to create an eSignature for the form 592 b resident and nonresident withholding statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the california form 592 b?

The california form 592 b is a tax form used by California residents to report income and claim withholding credits. It is essential for ensuring compliance with state tax regulations. Understanding this form is crucial for businesses operating in California.

-

How can airSlate SignNow help with the california form 592 b?

airSlate SignNow simplifies the process of completing and eSigning the california form 592 b. Our platform allows users to fill out the form electronically, ensuring accuracy and efficiency. This streamlines the submission process and helps avoid common errors.

-

Is there a cost associated with using airSlate SignNow for the california form 592 b?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, providing excellent value for businesses that need to manage documents like the california form 592 b. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the california form 592 b?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for forms like the california form 592 b. These features enhance the user experience and ensure that all necessary information is captured accurately.

-

Can I integrate airSlate SignNow with other software for the california form 592 b?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the california form 592 b alongside your existing tools. This flexibility allows for a seamless workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the california form 592 b?

Using airSlate SignNow for the california form 592 b provides numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored safely and can be accessed anytime, anywhere, making tax season less stressful.

-

Is airSlate SignNow compliant with California regulations for the california form 592 b?

Yes, airSlate SignNow is designed to comply with California regulations, ensuring that your use of the california form 592 b meets all legal requirements. Our commitment to compliance helps businesses avoid potential penalties and ensures peace of mind.

Get more for Form 592 B Resident And Nonresident Withholding Statement

Find out other Form 592 B Resident And Nonresident Withholding Statement

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple