Www Ftb Ca Govforms20212021 Form 592 Resident and Nonresident Withholding Statement 2022

Understanding the Form 592 Resident and Nonresident Withholding Statement

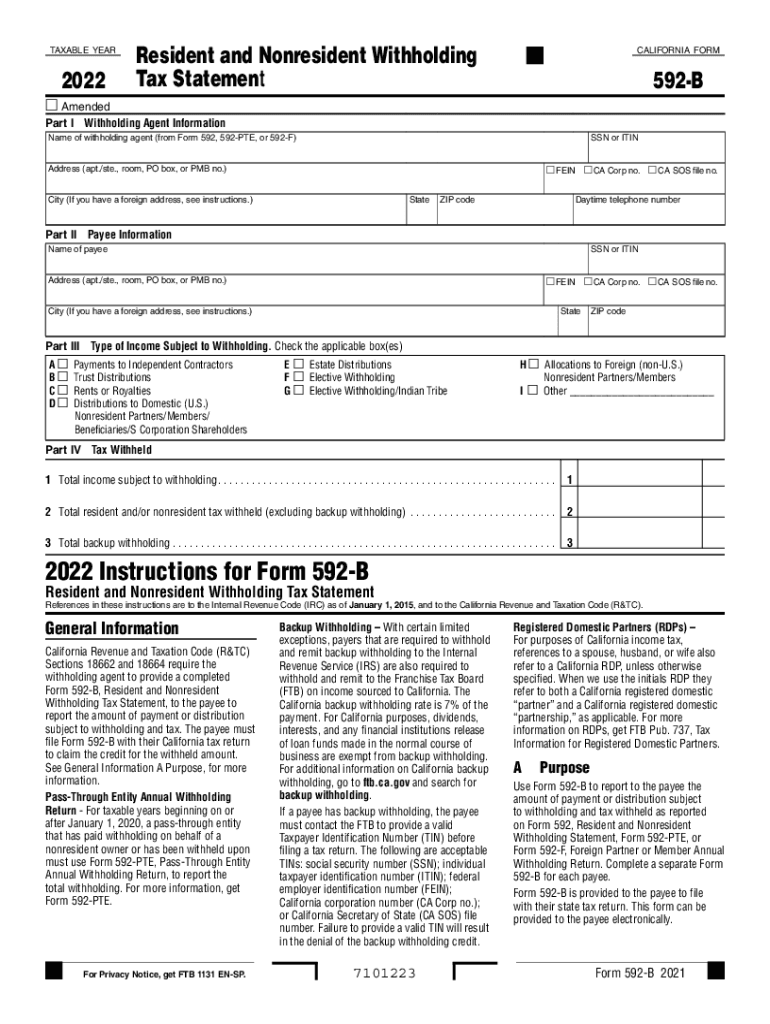

The Form 592, officially known as the Resident and Nonresident Withholding Statement, is a crucial document for tax purposes in California. It is used to report income that is subject to withholding tax for both residents and nonresidents of the state. This form is particularly relevant for individuals and businesses that make payments to nonresidents, ensuring compliance with California tax laws. By accurately completing this form, payers can fulfill their withholding obligations and avoid potential penalties from the California Franchise Tax Board (FTB).

Steps to Complete the Form 592

Completing the Form 592 involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including the payee's details and the amounts paid. Next, fill out the form by entering the required information in the appropriate sections, such as the payee's name, address, and taxpayer identification number. It is essential to calculate the total amount withheld correctly. After filling out the form, review it for any errors before submitting it to the FTB. Finally, retain a copy of the completed form for your records.

Legal Use of the Form 592

The Form 592 serves as a legal document that validates the withholding of taxes on payments made to nonresidents. To be considered legally binding, the form must be completed accurately and submitted to the California FTB by the required deadlines. Compliance with state tax laws is critical, as failure to submit this form can result in penalties and interest charges. The form also provides a record of the taxes withheld, which can be beneficial for both the payer and the payee during tax filing.

Filing Deadlines for Form 592

Timely filing of the Form 592 is essential to avoid penalties. The form must be submitted to the California FTB by the 15th day of the month following the payment to the nonresident. For example, if a payment is made in January, the form should be submitted by February 15. Additionally, it is important to be aware of any specific deadlines that may apply to particular types of payments or circumstances. Staying informed about these deadlines helps ensure compliance and prevents unnecessary complications.

Examples of Using the Form 592

Form 592 is commonly used in various scenarios involving payments to nonresidents. For instance, if a California business hires a contractor from another state, the business must complete and submit Form 592 to report the payments made to the contractor. Another example is when a California resident sells property to a nonresident; the seller must also use this form to report the withholding tax on the sale. These examples illustrate the form's importance in maintaining compliance with California's tax regulations.

Required Documents for Form 592

When completing the Form 592, certain documents may be necessary to ensure accurate reporting. These documents include the payee's taxpayer identification number, which can be a Social Security number or Employer Identification Number. Additionally, any contracts or agreements related to the payments may be helpful for reference. Keeping these documents organized and accessible can simplify the form-filling process and help avoid errors.

Who Issues the Form 592

The California Franchise Tax Board (FTB) is the authority responsible for issuing the Form 592. The FTB oversees the collection of state taxes and ensures compliance with California's tax laws. As the issuing body, the FTB provides guidelines and resources for taxpayers to understand their obligations regarding withholding taxes and the use of Form 592. For any questions or clarifications, taxpayers can refer to the FTB's official resources.

Quick guide on how to complete wwwftbcagovforms20212021 form 592 resident and nonresident withholding statement

Prepare Www ftb ca govforms20212021 Form 592 Resident And Nonresident Withholding Statement effortlessly on any device

The management of online documents has become increasingly popular among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, alter, and electronically sign your documents swiftly without delays. Handle Www ftb ca govforms20212021 Form 592 Resident And Nonresident Withholding Statement on any device using airSlate SignNow's Android or iOS applications and enhance your document-related workflow today.

The easiest way to edit and eSign Www ftb ca govforms20212021 Form 592 Resident And Nonresident Withholding Statement with minimal effort

- Find Www ftb ca govforms20212021 Form 592 Resident And Nonresident Withholding Statement and click Get Form to initiate the process.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using the specialized tools offered by airSlate SignNow.

- Create your signature with the Sign tool, which is completed in seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors requiring you to print new copies. airSlate SignNow meets your document management needs within a few clicks from any device you prefer. Edit and eSign Www ftb ca govforms20212021 Form 592 Resident And Nonresident Withholding Statement to ensure excellent communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwftbcagovforms20212021 form 592 resident and nonresident withholding statement

Create this form in 5 minutes!

People also ask

-

What is b ca ftb and how does it relate to airSlate SignNow?

b ca ftb stands for business compliance and financial transaction benefits. airSlate SignNow integrates these elements by offering a secure platform to eSign important documents, ensuring seamless compliance while optimizing transaction processes.

-

How can airSlate SignNow assist with b ca ftb requirements?

airSlate SignNow provides features that help businesses meet b ca ftb requirements by ensuring documents are signed and stored securely. This technology reduces the risk of compliance issues by providing tracking and audit trails for all signed documents.

-

What pricing options does airSlate SignNow offer for b ca ftb services?

airSlate SignNow offers several pricing plans that cater to various business needs, making it a cost-effective solution for b ca ftb compliance. Each plan includes different features, allowing businesses to choose one that best aligns with their eSigning requirements and budget.

-

What features does airSlate SignNow have for managing b ca ftb documentation?

With airSlate SignNow, businesses can easily create, send, and manage documents related to b ca ftb compliance. Key features include customizable templates, real-time tracking, and an intuitive user interface that simplifies the document signing process.

-

Can airSlate SignNow integrate with other software for b ca ftb?

Yes, airSlate SignNow offers integrations with various third-party applications to streamline operations related to b ca ftb documentation. This enables businesses to automate processes and increase efficiency through seamless data transfer across platforms.

-

What are the benefits of using airSlate SignNow for b ca ftb transactions?

Utilizing airSlate SignNow for b ca ftb transactions helps enhance security and accuracy in document management. The platform's eSigning capabilities not only speed up transaction times but also improve overall customer experience by simplifying the signing process.

-

Is airSlate SignNow suitable for small businesses focusing on b ca ftb?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal choice for small businesses aiming to meet b ca ftb compliance. Its scalable features enable small enterprises to efficiently manage their documents without the need for extensive resources.

Get more for Www ftb ca govforms20212021 Form 592 Resident And Nonresident Withholding Statement

Find out other Www ftb ca govforms20212021 Form 592 Resident And Nonresident Withholding Statement

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free