Form 592 B 2017

What is the Form 592 B

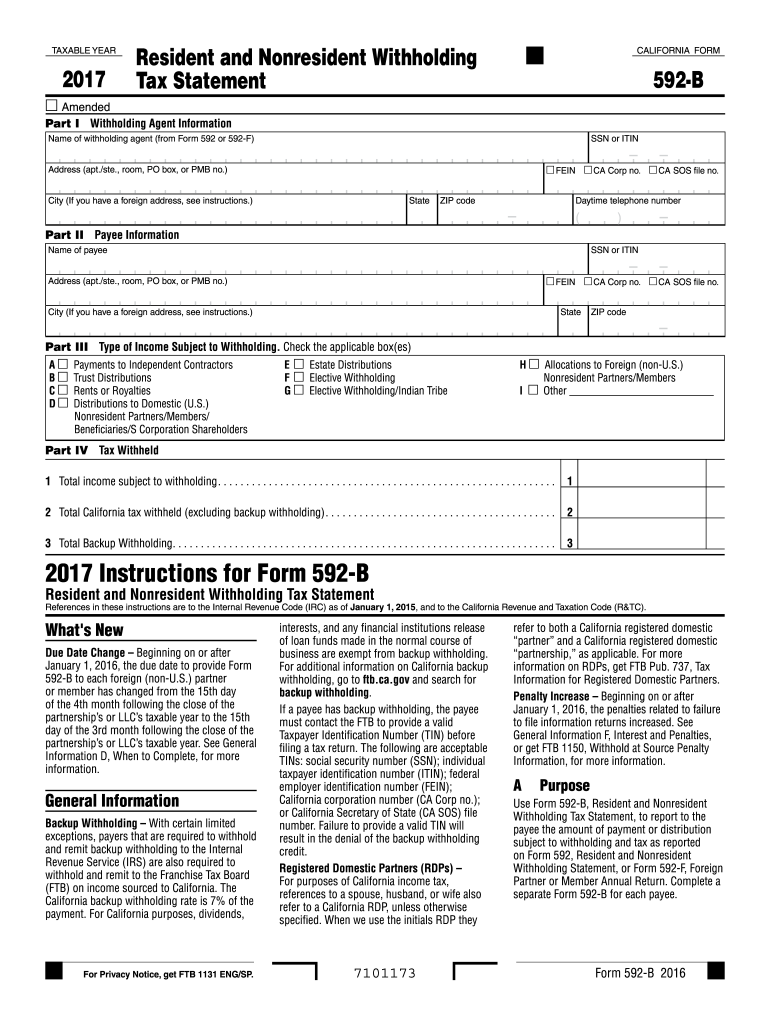

The Form 592 B is a tax document used in the United States, specifically for reporting income that is subject to withholding. This form is essential for non-resident individuals and entities who earn income from sources within California. It serves to ensure that the correct amount of tax is withheld from payments made to these individuals and entities. By accurately completing this form, taxpayers can comply with state tax regulations and avoid potential penalties.

How to use the Form 592 B

To use the Form 592 B effectively, taxpayers must first gather all necessary information regarding their income and the withholding amounts. The form requires details such as the taxpayer's name, address, and taxpayer identification number. Additionally, it includes sections for reporting the type of income received and the corresponding withholding amounts. Once completed, the form must be submitted to the appropriate tax authority to ensure compliance with state tax laws.

Steps to complete the Form 592 B

Completing the Form 592 B involves several key steps:

- Gather all relevant income documentation, including any 1099 forms.

- Enter your personal information, including name, address, and taxpayer identification number.

- Detail the types of income received and the amounts withheld for each type.

- Review the completed form for accuracy to avoid errors that could lead to penalties.

- Submit the form to the California Franchise Tax Board by the specified deadline.

Legal use of the Form 592 B

The Form 592 B is legally recognized by the California Franchise Tax Board as a valid method for reporting income subject to withholding. It complies with state tax regulations, ensuring that taxpayers fulfill their obligations. Using this form correctly helps avoid legal issues and potential fines associated with improper reporting. It is crucial for taxpayers to be aware of the legal implications of their submissions to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 592 B are critical to avoid penalties. Typically, the form must be filed by the 15th day of the third month following the end of the tax year. For example, if the tax year ends on December 31, the form should be submitted by March 15 of the following year. It is important for taxpayers to keep track of these dates to ensure timely compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 592 B. The form can be filed online through the California Franchise Tax Board's website, which offers a secure method for submission. Alternatively, taxpayers may choose to mail the completed form to the appropriate address provided by the tax authority. In-person submissions are also accepted at designated tax offices. Each method ensures that the form is received and processed in accordance with state regulations.

Quick guide on how to complete form 592 b 2017

Your assistance manual on how to prepare your Form 592 B

If you’re interested in learning how to finalize and submit your Form 592 B, here are a few quick guidelines to simplify tax submission.

To get started, all you need is to create your airSlate SignNow account to transform the way you handle documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and complete your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to adjust details as necessary. Enhance your tax administration with advanced PDF modifications, eSigning, and easy sharing.

Follow the steps below to complete your Form 592 B in just a few minutes:

- Create your account and begin working on PDFs swiftly.

- Utilize our catalog to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Form 592 B in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-recognized eSignature (if required).

- Review your document and correct any inaccuracies.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and slow down reimbursements. Naturally, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 592 b 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

What is the last date to fill out the management form in BVM and GCET for B.tech admission 2017?

BVM, GCET and ADIT- all these three colleges have common form for management admissions. You can refer website of BVM or GCET or ADIT to get the form and details precisely!Even if you will make a call they will furnish information. (Get college’s contact number from website. )If nothing works out, drop me a message- I have personal contacts.:)

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the form 592 b 2017

How to generate an eSignature for the Form 592 B 2017 online

How to create an electronic signature for the Form 592 B 2017 in Google Chrome

How to make an electronic signature for putting it on the Form 592 B 2017 in Gmail

How to make an electronic signature for the Form 592 B 2017 from your mobile device

How to create an eSignature for the Form 592 B 2017 on iOS

How to make an electronic signature for the Form 592 B 2017 on Android OS

People also ask

-

What is Form 592 B and why is it important?

Form 592 B is a tax form used in California to report the withholding of California income tax for non-residents. It is crucial for businesses to accurately complete Form 592 B to ensure compliance with state tax laws and avoid penalties. Using airSlate SignNow makes it easy to eSign and send this form securely.

-

How can airSlate SignNow help with completing Form 592 B?

airSlate SignNow simplifies the process of completing Form 592 B by providing an intuitive platform for eSigning and sending documents. Our solution allows users to fill out the form digitally, ensuring accuracy and efficiency. Additionally, you can track the status of the form after it has been sent.

-

Is there a cost associated with using airSlate SignNow for Form 592 B?

Yes, airSlate SignNow offers a cost-effective subscription model that caters to various business needs. Pricing plans are designed to fit different budgets while providing the necessary features to manage documents like Form 592 B efficiently. You can explore our pricing options to find the best fit for your organization.

-

What features does airSlate SignNow offer for handling Form 592 B?

airSlate SignNow offers a range of features designed to streamline the management of Form 592 B. Key features include customizable templates, secure eSignature options, and real-time document tracking. These tools help ensure that your tax forms are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for Form 592 B processing?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing for efficient processing of Form 592 B. You can connect with popular platforms such as Google Drive, Salesforce, and more, enhancing your workflow by automating document handling.

-

How secure is my information when using airSlate SignNow for Form 592 B?

Security is a top priority at airSlate SignNow. When handling Form 592 B, your data is protected with industry-leading encryption and compliance measures to ensure your information remains confidential and secure. We adhere to all necessary legal standards for data protection.

-

What benefits does airSlate SignNow provide for businesses dealing with Form 592 B?

Using airSlate SignNow for Form 592 B processing offers numerous benefits, including reduced turnaround time, increased accuracy, and enhanced collaboration among team members. Our platform allows businesses to streamline their document workflows, saving time and resources while ensuring compliance.

Get more for Form 592 B

Find out other Form 592 B

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation