D 2441 Child and Dependent Care Credit for Part Ye Form

What is the D-2441 Child And Dependent Care Credit For Part Year

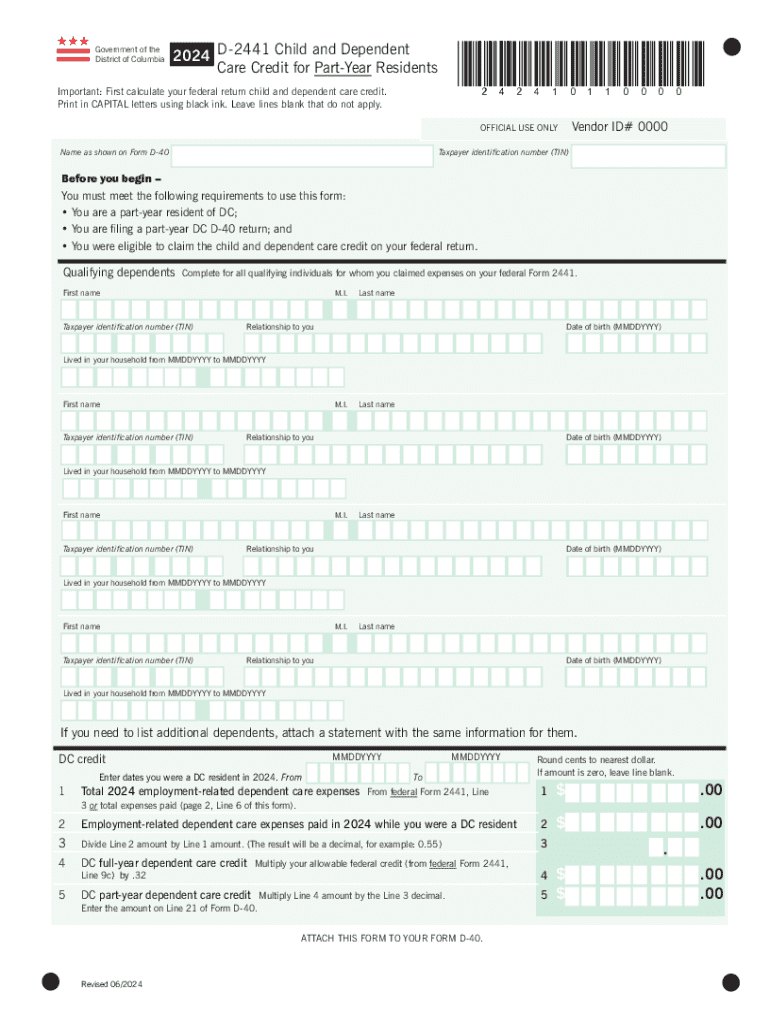

The D-2441 Child and Dependent Care Credit is a tax credit designed to assist taxpayers who incur expenses for the care of qualifying children or dependents while they work or look for work. This credit is particularly relevant for those who have part-year residency in a state that allows for such a deduction. It aims to alleviate some of the financial burdens associated with childcare, making it easier for parents and guardians to balance work and family responsibilities. The credit can be claimed for expenses related to daycare, babysitters, and other forms of care, provided that the care is necessary for the taxpayer to maintain employment or seek employment opportunities.

Eligibility Criteria for the D-2441 Child And Dependent Care Credit

To qualify for the D-2441 Child and Dependent Care Credit, taxpayers must meet specific eligibility criteria. The primary requirements include:

- The taxpayer must have earned income during the tax year.

- The care must be provided for a child under the age of thirteen or for a dependent who is physically or mentally incapable of self-care.

- The care must enable the taxpayer to work or look for work.

- Expenses must be incurred for care provided in the United States.

Additionally, the taxpayer must not have a spouse who is a full-time student or incapable of self-care, as this may affect eligibility.

Steps to Complete the D-2441 Child And Dependent Care Credit

Completing the D-2441 form involves several key steps to ensure accurate reporting of childcare expenses. Follow these steps:

- Gather all necessary documentation, including receipts for childcare expenses and the provider's information.

- Complete the personal information section of the form, including your name, address, and Social Security number.

- List the qualifying individuals for whom care was provided, including their names and ages.

- Detail the care provider's information, including their name, address, and taxpayer identification number.

- Calculate the total amount of qualifying expenses and enter this figure on the form.

- Review the completed form for accuracy before submission.

Required Documents for the D-2441 Child And Dependent Care Credit

When filing for the D-2441 Child and Dependent Care Credit, taxpayers must provide certain documents to support their claims. These documents include:

- Receipts or invoices from childcare providers detailing the services rendered.

- The provider's name, address, and taxpayer identification number.

- Proof of income, such as W-2 forms or pay stubs, to demonstrate eligibility for the credit.

- Any additional documentation that may be required by state tax authorities.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with tax regulations.

IRS Guidelines for the D-2441 Child And Dependent Care Credit

The IRS provides specific guidelines regarding the D-2441 Child and Dependent Care Credit, which include details on how to calculate the credit amount and the types of expenses that qualify. Key points include:

- The credit is based on a percentage of qualifying expenses, which varies depending on the taxpayer's income.

- Expenses must be incurred for care provided during the tax year for which the credit is claimed.

- Taxpayers must ensure that the care provider meets IRS requirements, including proper licensing and registration if applicable.

It is essential for taxpayers to review the IRS guidelines thoroughly to ensure compliance and maximize their credit amount.

Form Submission Methods for the D-2441 Child And Dependent Care Credit

Taxpayers can submit the D-2441 form through various methods, depending on their preferences and circumstances. The submission methods include:

- Online filing through tax preparation software that supports the D-2441 form.

- Mailing a paper copy of the completed form to the appropriate tax authority address.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can help ensure that the form is processed efficiently and accurately.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d 2441 child and dependent care credit for part ye

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the D 2441 Child And Dependent Care Credit For Part Ye?

The D 2441 Child And Dependent Care Credit For Part Ye is a tax credit designed to help families offset the costs of childcare for dependents. This credit can signNowly reduce your tax liability, making it easier for parents to manage work and family responsibilities.

-

How can airSlate SignNow assist with the D 2441 Child And Dependent Care Credit For Part Ye?

airSlate SignNow provides a streamlined solution for managing and eSigning documents related to the D 2441 Child And Dependent Care Credit For Part Ye. Our platform allows you to easily prepare and submit necessary forms, ensuring you meet all requirements efficiently.

-

What features does airSlate SignNow offer for managing tax documents?

With airSlate SignNow, you can enjoy features like customizable templates, secure eSigning, and document tracking. These tools simplify the process of preparing documents for the D 2441 Child And Dependent Care Credit For Part Ye, making it easier to stay organized and compliant.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are flexible, allowing small businesses to access essential features for managing documents related to the D 2441 Child And Dependent Care Credit For Part Ye without breaking the bank.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software, enhancing your workflow. This means you can easily manage documents related to the D 2441 Child And Dependent Care Credit For Part Ye alongside your existing tools.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those for the D 2441 Child And Dependent Care Credit For Part Ye, provides benefits such as increased efficiency, reduced errors, and enhanced security. Our platform ensures that your sensitive information is protected while streamlining the document management process.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure cloud storage. When dealing with sensitive information related to the D 2441 Child And Dependent Care Credit For Part Ye, you can trust that your data is safe and compliant with industry standards.

Get more for D 2441 Child And Dependent Care Credit For Part Ye

- Hcas provider enrollment form 33026929

- Ifcb 2 overnight field trip cobb county school district cobbk12 form

- The aid amp attendance pension veteran benefits consulting shopify form

- Referring a patient to kidneypancreas transplantation program at mayo clinic mcs7657 03 referring patient kidneypancreas form

- Student worksheet for strange days on planet earth volume 1 form

- Idaho application and affidavit for writ of continuing garnishment form

- Form addversion additional card bbhpetrolb x fleet card

- Hawaii quit claim deed form pdfword

Find out other D 2441 Child And Dependent Care Credit For Part Ye

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document