Form 540 California Resident Income Tax Return 2024-2026

What is the Form 540 California Resident Income Tax Return

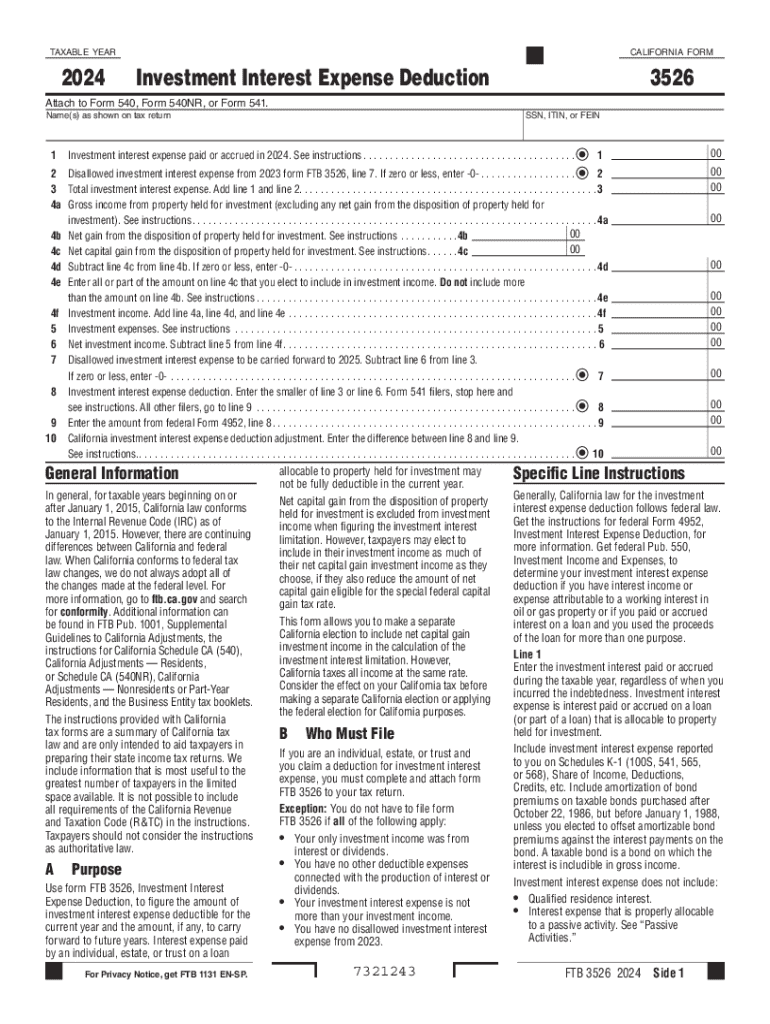

The Form 540 is the California Resident Income Tax Return used by residents of California to report their income, claim deductions, and calculate their tax liability. This form is essential for individuals who earn income in California and need to file their state taxes. It encompasses various income types, including wages, interest, dividends, and capital gains, ensuring that all taxable income is accounted for in compliance with state tax laws.

Steps to complete the Form 540 California Resident Income Tax Return

Completing the Form 540 involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which could be single, married filing jointly, married filing separately, or head of household.

- Report your total income on the form, ensuring you include all sources of income.

- Claim any deductions you qualify for, such as the California investment deduction or other specific deductions related to your financial situation.

- Calculate your total tax liability based on your income and deductions.

- Sign and date the form before submitting it to the California Franchise Tax Board (FTB).

Required Documents

To accurately complete the Form 540, you will need several documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental income or interest from investments.

- Documentation for deductions, including receipts for business expenses and proof of any investment deductions.

- Last year's tax return for reference.

Eligibility Criteria

Eligibility to file the Form 540 generally requires that you are a resident of California for the entire tax year. Additionally, you must meet specific income thresholds based on your filing status. If you are a part-year resident or a non-resident earning income in California, you may need to use a different form, such as the Form 540NR. Understanding these criteria is crucial to ensure compliance with state tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 540 are typically aligned with federal tax deadlines. For most taxpayers, the deadline is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It's important to stay informed about any changes to deadlines, especially in light of potential extensions or adjustments made by the California Franchise Tax Board.

Digital vs. Paper Version

Taxpayers have the option to file their Form 540 either digitally or via paper submission. Filing electronically can streamline the process, reduce errors, and expedite refunds. The California Franchise Tax Board provides online tools for e-filing, making it easier for residents to submit their returns. On the other hand, some individuals may prefer the traditional paper method, which requires mailing the completed form to the appropriate address. Each method has its benefits, and choosing the right one depends on personal preference and comfort with technology.

Create this form in 5 minutes or less

Find and fill out the correct form 540 california resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the form 540 california resident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA investment deduction?

The CA investment deduction allows businesses to deduct certain investments from their taxable income, reducing their overall tax liability. This deduction can signNowly benefit companies looking to invest in growth and development. Understanding how to leverage the CA investment deduction can enhance your financial strategy.

-

How can airSlate SignNow help with CA investment deduction documentation?

airSlate SignNow streamlines the process of sending and eSigning documents related to the CA investment deduction. Our platform ensures that all necessary paperwork is completed efficiently and securely. This can save you time and reduce the hassle of managing your investment documentation.

-

Are there any costs associated with using airSlate SignNow for CA investment deduction forms?

airSlate SignNow offers a cost-effective solution for managing your CA investment deduction forms. Our pricing plans are designed to fit various business needs, ensuring you get the best value for your investment. You can choose a plan that aligns with your budget while still accessing essential features.

-

What features does airSlate SignNow offer for managing CA investment deduction documents?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing CA investment deduction documents. These tools help ensure compliance and streamline your workflow. With airSlate SignNow, you can focus on your business while we handle the paperwork.

-

Can I integrate airSlate SignNow with other tools for CA investment deduction management?

Yes, airSlate SignNow integrates seamlessly with various business tools to enhance your CA investment deduction management. Whether you use accounting software or project management tools, our integrations help centralize your processes. This connectivity ensures that all your investment-related documents are easily accessible.

-

What are the benefits of using airSlate SignNow for CA investment deduction processes?

Using airSlate SignNow for your CA investment deduction processes offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform simplifies document management, allowing you to focus on strategic decisions. Additionally, the ease of eSigning accelerates the approval process, helping you capitalize on investment opportunities faster.

-

Is airSlate SignNow suitable for small businesses looking to utilize CA investment deduction?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses looking to utilize the CA investment deduction. Our user-friendly interface and affordable pricing make it accessible for smaller enterprises. You can efficiently manage your investment documentation without overwhelming your resources.

Get more for Form 540 California Resident Income Tax Return

- Car accident payment contract template form

- Car buy contract template form

- Std 205 payee data record supplement form

- Public housing full app pdf st paul public housing agency stpaulpha form

- Small claims at 52 4 district courtoakland county mi form

- Request and order to seize property form

- Health care proxy blumberg legal forms online

- Order granting petition for concurrent custody by extended family form

Find out other Form 540 California Resident Income Tax Return

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free