Form 3526 Investment Interest Expense Deduction Form 3526 Investment Interest Expense Deduction 2020

Understanding the Form 3526 Investment Interest Expense Deduction

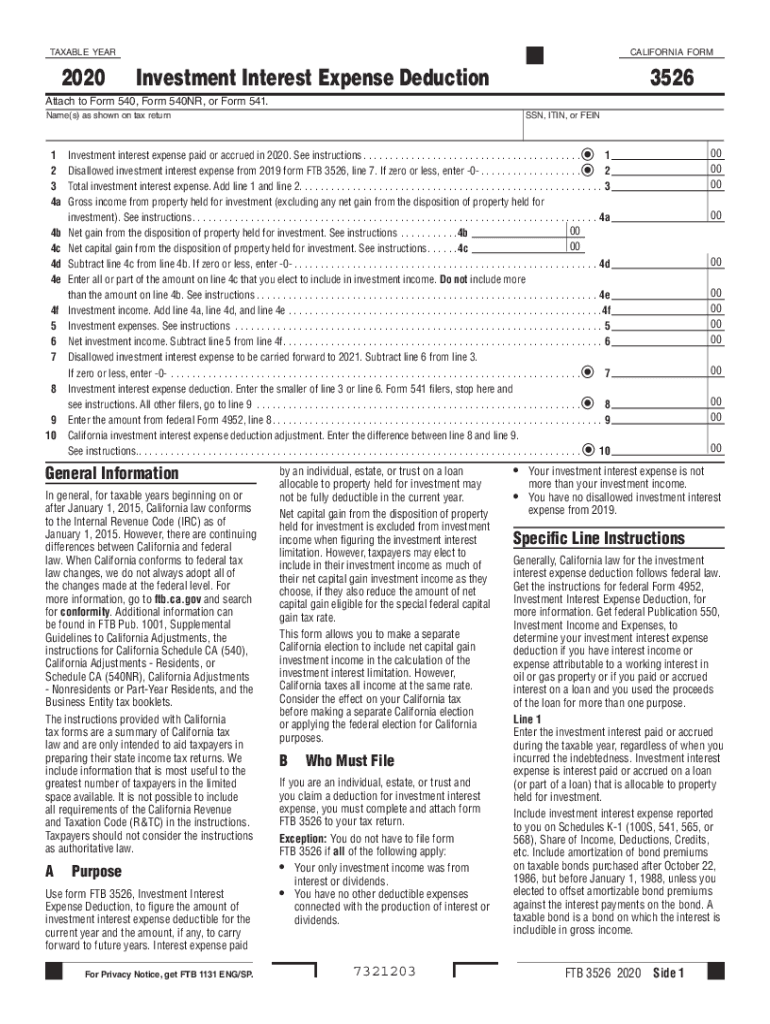

The Form 3526, also known as the California Investment Interest Expense Deduction, allows taxpayers to deduct interest paid on loans used to purchase investments. This deduction is particularly beneficial for individuals who have incurred interest expenses related to investments in stocks, bonds, or other securities. By completing this form, taxpayers can potentially reduce their taxable income, thereby lowering their overall tax liability.

Steps to Complete the Form 3526

Completing the Form 3526 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including records of interest paid and details of the investments. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Then, report the total investment interest expense incurred during the tax year on the appropriate lines. Finally, review the form for accuracy and submit it along with your tax return.

Legal Use of the Form 3526

The legal use of the Form 3526 is governed by IRS regulations and California state tax laws. To ensure that your investment interest expense deduction is valid, it is essential to comply with these regulations. This includes maintaining accurate records of interest payments and ensuring that the loans were indeed used to purchase investments. Failure to adhere to these guidelines may result in disallowance of the deduction and potential penalties.

Key Elements of the Form 3526

Several key elements are crucial for the proper completion of the Form 3526. These include the taxpayer's identification information, the total amount of investment interest expense, and the specific investments related to the interest paid. Additionally, it's important to include any carryover amounts from previous years, as this can affect the current year's deduction. Understanding these elements helps ensure that the form is completed accurately and efficiently.

Filing Deadlines for Form 3526

Filing deadlines for the Form 3526 align with the standard tax return deadlines. Typically, individual taxpayers must submit their forms by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It’s important for taxpayers to be aware of these deadlines to avoid late filing penalties and ensure their deductions are processed in a timely manner.

Examples of Using the Form 3526

Examples of using the Form 3526 can help clarify its application. For instance, if a taxpayer borrows money to invest in real estate or stocks, the interest paid on that loan may be deductible. Another example includes a taxpayer who takes out a margin loan from a brokerage to purchase additional shares. By accurately reporting these expenses on the Form 3526, the taxpayer can potentially lower their taxable income and maximize their tax benefits.

Quick guide on how to complete 2020 form 3526 investment interest expense deduction 2020 form 3526 investment interest expense deduction

Complete Form 3526 Investment Interest Expense Deduction Form 3526 Investment Interest Expense Deduction effortlessly on any device

Digital document management has become widely adopted by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 3526 Investment Interest Expense Deduction Form 3526 Investment Interest Expense Deduction on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form 3526 Investment Interest Expense Deduction Form 3526 Investment Interest Expense Deduction with ease

- Locate Form 3526 Investment Interest Expense Deduction Form 3526 Investment Interest Expense Deduction and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designated by airSlate SignNow for that function.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from your preferred device. Edit and electronically sign Form 3526 Investment Interest Expense Deduction Form 3526 Investment Interest Expense Deduction and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 3526 investment interest expense deduction 2020 form 3526 investment interest expense deduction

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 3526 investment interest expense deduction 2020 form 3526 investment interest expense deduction

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the ftb 3526 form, and why is it important?

The ftb 3526 form is a crucial document for California taxpayers, specifically used to report tax-related information. It's important because it ensures compliance with state tax laws and can affect your tax returns.

-

How does airSlate SignNow simplify the process of completing the ftb 3526?

airSlate SignNow simplifies the ftb 3526 process by offering an intuitive eSigning platform that allows for easy electronic completion and submission of the form. This streamlines your workflow and helps avoid delays.

-

What are the pricing options for using airSlate SignNow for the ftb 3526?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it affordable to electronically sign and submit the ftb 3526. You can choose a plan based on your frequency of use and team size.

-

What features does airSlate SignNow provide for managing the ftb 3526?

airSlate SignNow provides several features for managing the ftb 3526, including easy document upload, customizable templates, and secure electronic signatures. These features enhance efficiency and security in your tax processing.

-

Can I integrate airSlate SignNow with other applications while using the ftb 3526?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM systems and project management tools while processing the ftb 3526. This allows for a more streamlined experience and improved productivity.

-

What are the benefits of using airSlate SignNow for the ftb 3526 compared to traditional methods?

Using airSlate SignNow for the ftb 3526 offers numerous benefits over traditional methods, such as reduced paperwork, faster processing times, and enhanced security. This digital solution saves time and minimizes the risk of errors.

-

Is airSlate SignNow secure for handling sensitive information like the ftb 3526?

Absolutely, airSlate SignNow employs advanced encryption and security protocols to protect sensitive information, including details on the ftb 3526. You can confidently use the platform knowing your data is safe.

Get more for Form 3526 Investment Interest Expense Deduction Form 3526 Investment Interest Expense Deduction

Find out other Form 3526 Investment Interest Expense Deduction Form 3526 Investment Interest Expense Deduction

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer