California Tax Forms H&R Block 2022

Understanding California Form 3526

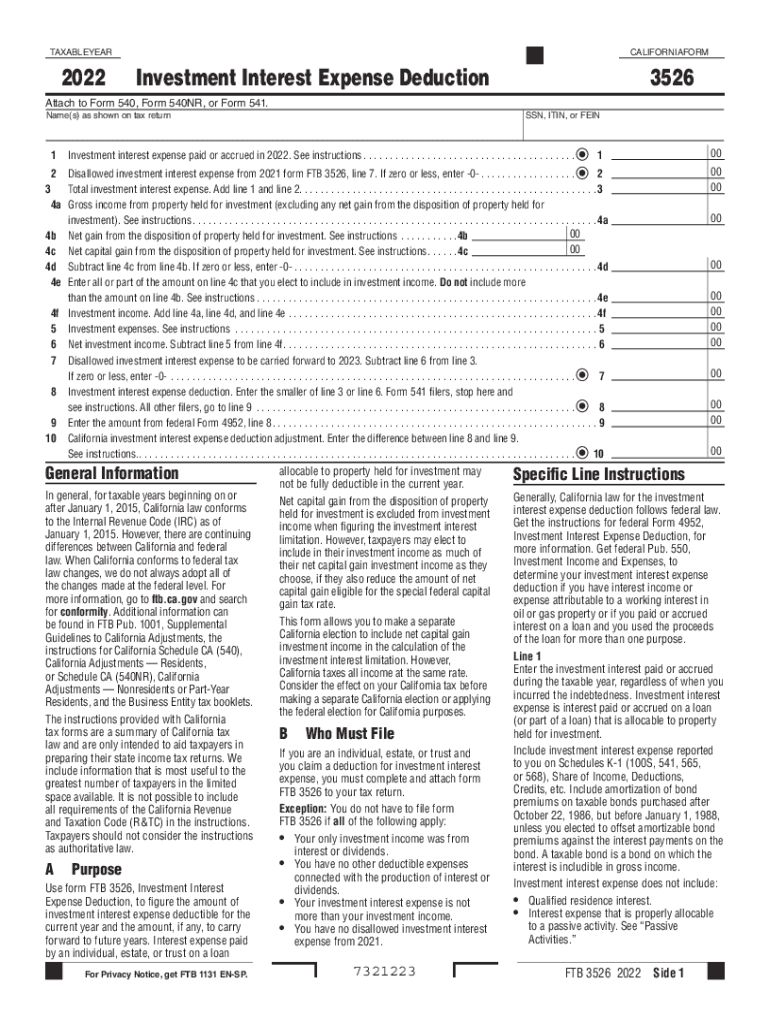

The California Form 3526, also known as the FTB 3526, is essential for taxpayers seeking to claim the investment interest expense deduction. This form is specifically designed for individuals and entities that have incurred interest expenses related to investments. Understanding its purpose is crucial for accurate tax reporting and compliance with California tax regulations.

Steps to Complete California Form 3526

Filling out the California Form 3526 involves several key steps:

- Gather all necessary financial documents, including records of your investment interest expenses and any related income.

- Begin by entering your personal information, such as your name, address, and Social Security number.

- Complete the sections related to your investment interest expenses, ensuring you provide accurate figures for each line item.

- Review the form for accuracy, ensuring all calculations are correct and that you have included all required documentation.

- Sign and date the form before submission to confirm the information is true and accurate.

Key Elements of California Form 3526

Several key elements are essential to understand when working with California Form 3526:

- Line 4e: This line specifically addresses the amount of investment interest expense you are claiming for the deduction.

- Documentation: It is crucial to maintain accurate records of your investment transactions and interest payments to support your claims.

- Compliance: Ensure that your submission adheres to California tax laws and guidelines to avoid penalties.

Legal Use of California Form 3526

The legal validity of California Form 3526 hinges on compliance with state tax regulations. When completed accurately, this form allows taxpayers to claim deductions legally, which can significantly impact their overall tax liability. It is important to understand that electronic submissions must meet specific legal standards to be considered valid.

Filing Deadlines for California Form 3526

Timely filing of California Form 3526 is crucial to avoid penalties. The deadline typically aligns with the federal tax filing date, which is usually April 15. However, if you are unable to meet this deadline, consider filing for an extension. Be aware that extensions do not extend the time to pay any taxes owed.

Form Submission Methods for California Form 3526

California Form 3526 can be submitted through various methods:

- Online: Utilize the California Franchise Tax Board's online services for electronic submission.

- Mail: Print the completed form and send it to the appropriate address as indicated on the form.

- In-Person: Visit a local Franchise Tax Board office to submit your form directly.

Quick guide on how to complete california tax forms hampampr block

Effortlessly prepare California Tax Forms H&R Block on any device

The management of online documents has gained signNow traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute to conventional printed and signed documents, allowing you to easily locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without delays. Manage California Tax Forms H&R Block on any device through airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign California Tax Forms H&R Block with minimal effort

- Obtain California Tax Forms H&R Block and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to secure your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Alter and eSign California Tax Forms H&R Block to maintain excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california tax forms hampampr block

Create this form in 5 minutes!

How to create an eSignature for the california tax forms hampampr block

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California Form 3526 and how can airSlate SignNow assist with it?

California Form 3526 is a critical document for tax purposes, and airSlate SignNow can simplify the process of preparing and signing it. With our intuitive platform, users can easily import, fill out, and eSign California Form 3526, ensuring compliance and accuracy with every submission. This helps reduce errors and speeds up the filing process for individuals and businesses alike.

-

What are the pricing options for using airSlate SignNow for California Form 3526?

AirSlate SignNow offers competitive pricing plans to fit various needs, whether you're an individual or a business handling California Form 3526. Our flexible subscription plans ensure you pay only for the features you use, making it a cost-effective solution. Additionally, we provide a free trial so you can explore our services before committing.

-

Are there any special features in airSlate SignNow for handling California Form 3526?

Yes, airSlate SignNow includes features specifically designed for California Form 3526, such as templates for easy setup, automated reminders, and tracking tools. These features help streamline the eSigning process and ensure that all necessary parties can quickly finalize the document. Plus, our platform allows for integration with various tools to further enhance your workflow.

-

How does airSlate SignNow ensure the security of California Form 3526 during transmission?

Security is a top priority for airSlate SignNow, especially when handling important documents like California Form 3526. We use industry-standard encryption protocols to protect your data during transmission and storage. Additionally, our authentication processes ensure that only authorized individuals can access and sign your documents.

-

Can I easily integrate airSlate SignNow with other applications for California Form 3526?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage California Form 3526 alongside your existing tools. This means you can connect with platforms like CRM systems, project management tools, and cloud storage services, enhancing your overall productivity. Our robust API also enables custom integrations for more specific needs.

-

What benefits does airSlate SignNow provide for businesses filing California Form 3526?

Using airSlate SignNow for California Form 3526 provides numerous benefits, including improved efficiency, reduced paperwork, and faster turnaround times. Businesses can eliminate the hassle of traditional signing methods, allowing for quicker processing and filing. Additionally, our solution is designed to be user-friendly, minimizing training time for new users.

-

Is it easy to edit and update California Form 3526 with airSlate SignNow?

Yes, airSlate SignNow makes it simple to edit and update California Form 3526. You can easily modify fields, add signatures, and make adjustments as necessary, all within our user-friendly interface. This flexibility ensures that your documents are always up-to-date, which is crucial for compliance and accuracy.

Get more for California Tax Forms H&R Block

- Site work contract for contractor minnesota form

- Siding contract for contractor minnesota form

- Refrigeration contract for contractor minnesota form

- Drainage contract for contractor minnesota form

- Foundation contract for contractor minnesota form

- Plumbing contract for contractor minnesota form

- Brick mason contract for contractor minnesota form

- Minnesota contractor form

Find out other California Tax Forms H&R Block

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation