Printable Connecticut Form CT 19 it Title 19 Status 2024-2026

What is the Printable Connecticut Form CT 19 IT Title 19 Status

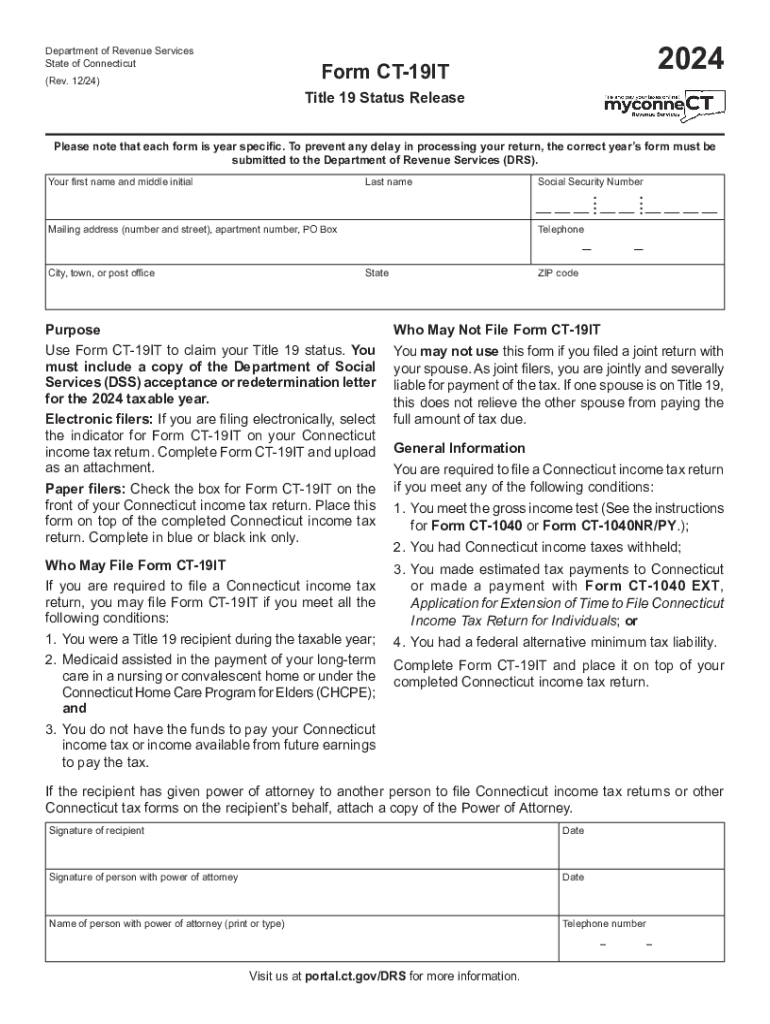

The Printable Connecticut Form CT 19 IT Title 19 Status is a document used to determine eligibility for Title 19 benefits in Connecticut. This form is essential for individuals seeking assistance under the state's Medicaid program, which provides health coverage for low-income residents. The CT 19 IT form collects necessary information regarding an applicant's financial status, household composition, and other relevant details to assess eligibility for medical assistance.

How to use the Printable Connecticut Form CT 19 IT Title 19 Status

To effectively use the Printable Connecticut Form CT 19 IT Title 19 Status, individuals should first gather all required information, including income details, asset information, and household size. The form must be filled out accurately, ensuring that all sections are completed to avoid delays in processing. Once completed, the form can be submitted to the appropriate state agency for review. It is advisable to keep a copy of the submitted form for personal records.

Steps to complete the Printable Connecticut Form CT 19 IT Title 19 Status

Completing the Printable Connecticut Form CT 19 IT Title 19 Status involves several key steps:

- Gather necessary documents, including proof of income, identification, and any relevant financial statements.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form completely, ensuring all information is accurate and up-to-date.

- Review the completed form for any errors or omissions.

- Submit the form to the designated agency, either online, by mail, or in person, depending on the submission guidelines.

Eligibility Criteria

Eligibility for the benefits associated with the Printable Connecticut Form CT 19 IT Title 19 Status is determined based on several criteria, including income level, household size, and residency status. Applicants must meet specific income thresholds relative to the Federal Poverty Level to qualify for Medicaid. Additionally, certain categories of individuals, such as children, pregnant women, and the elderly, may have different eligibility requirements.

Required Documents

When completing the Printable Connecticut Form CT 19 IT Title 19 Status, several documents are typically required to support the application. These may include:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, including a driver's license or Social Security card.

- Financial statements, such as bank statements or asset documentation.

- Any other relevant documentation that supports the information provided on the form.

Form Submission Methods

The Printable Connecticut Form CT 19 IT Title 19 Status can be submitted through various methods to accommodate applicants' preferences. These methods include:

- Online submission through the state’s designated portal.

- Mailing the completed form to the appropriate agency address.

- In-person submission at local offices or designated service centers.

Create this form in 5 minutes or less

Find and fill out the correct printable connecticut form ct 19 it title 19 status

Create this form in 5 minutes!

How to create an eSignature for the printable connecticut form ct 19 it title 19 status

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 19it and how does it relate to airSlate SignNow?

ct 19it refers to a specific tax form that businesses may need to manage. airSlate SignNow provides an efficient platform for sending and eSigning documents like ct 19it, ensuring compliance and ease of use for all users.

-

How can airSlate SignNow help with the completion of ct 19it forms?

With airSlate SignNow, users can easily upload, fill out, and eSign ct 19it forms online. The platform streamlines the process, allowing for quick completion and submission, which is essential for timely tax filings.

-

What are the pricing options for using airSlate SignNow for ct 19it?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, you can find a cost-effective solution that includes features for managing documents like ct 19it.

-

What features does airSlate SignNow offer for managing ct 19it documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for forms like ct 19it. These tools enhance productivity and ensure that your documents are handled efficiently.

-

Can airSlate SignNow integrate with other software for managing ct 19it?

Yes, airSlate SignNow integrates seamlessly with various software applications, allowing for a smooth workflow when managing ct 19it and other documents. This integration helps businesses streamline their processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for ct 19it?

Using airSlate SignNow for ct 19it offers numerous benefits, including reduced paperwork, faster processing times, and enhanced security. These advantages help businesses save time and resources while ensuring compliance with tax regulations.

-

Is airSlate SignNow user-friendly for completing ct 19it forms?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete ct 19it forms. The intuitive interface allows users to navigate the platform effortlessly, even if they are not tech-savvy.

Get more for Printable Connecticut Form CT 19 IT Title 19 Status

- Justice court henderson township clark county neva form

- Certificate of fictitious name for individual b form

- Dmv49rev 0717west virginia department of transpo form

- Collector license plate application form

- Inspection and maintenance record modot form

- Georgia department of driver services bulk mvr user form

- Important tax updatesgeorgia department of revenue form

- Ohio 614695357 form

Find out other Printable Connecticut Form CT 19 IT Title 19 Status

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form