Form CT 19IT CT GOV Connecticut's Official State 2021

What is the Form CT 19IT CT GOV Connecticut's Official State

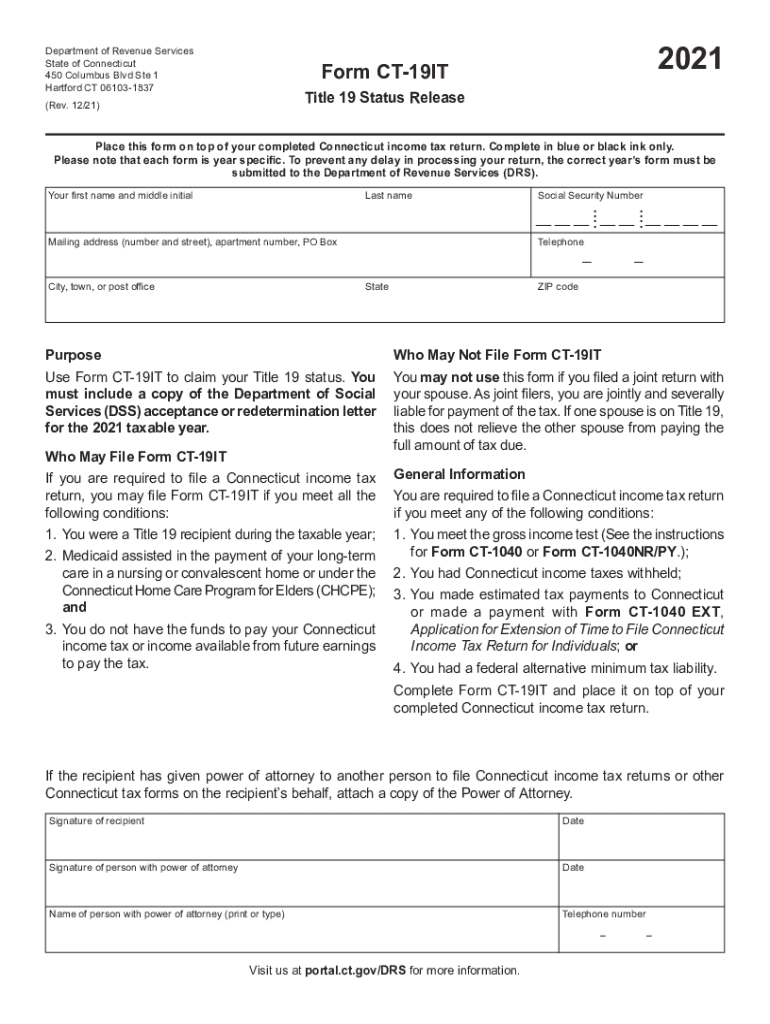

The Form CT 19IT is a tax form used by residents of Connecticut to report their income tax information to the state government. This form is specifically designed for individuals who are required to file an income tax return in Connecticut. It captures essential financial details, including income sources, deductions, and credits applicable to the taxpayer. Understanding this form is crucial for compliance with state tax laws and ensuring accurate tax reporting.

How to use the Form CT 19IT CT GOV Connecticut's Official State

Using the Form CT 19IT involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as W-2s, 1099s, and any records of deductions. Next, carefully fill out the form by entering your personal information, income details, and applicable deductions. It is important to double-check all entries for accuracy to avoid errors that could lead to penalties. Finally, submit the completed form by the designated deadline to ensure compliance with Connecticut tax regulations.

Steps to complete the Form CT 19IT CT GOV Connecticut's Official State

Completing the Form CT 19IT requires a systematic approach:

- Collect all relevant financial documents, including income statements and deduction records.

- Fill in your personal information accurately, including your name, address, and Social Security number.

- Report all sources of income, ensuring that you include wages, interest, dividends, and any other income.

- Calculate your total deductions and credits, applying any applicable state-specific deductions.

- Review the form for any errors or omissions before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Form CT 19IT. Typically, the deadline for submitting this form aligns with the federal tax return deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply and ensure timely submission to avoid penalties.

Required Documents

To accurately complete the Form CT 19IT, several documents are necessary:

- W-2 forms from employers, detailing wages and tax withheld.

- 1099 forms for any freelance or contract work, reporting income received.

- Records of any deductions, such as mortgage interest statements or medical expenses.

- Proof of any tax credits that may apply, such as education credits or child tax credits.

Legal use of the Form CT 19IT CT GOV Connecticut's Official State

The Form CT 19IT serves a legal purpose, as it is mandated by the state of Connecticut for income tax reporting. Filing this form accurately ensures compliance with state tax laws and helps avoid potential legal consequences, such as fines or audits. It is important for taxpayers to understand their obligations under Connecticut law and to use the form correctly to meet these requirements.

Quick guide on how to complete form ct 19it ct gov connecticuts official state

Prepare Form CT 19IT CT GOV Connecticut's Official State effortlessly on any device

Web-based document management has become widely embraced by businesses and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without delays. Manage Form CT 19IT CT GOV Connecticut's Official State on any device using airSlate SignNow’s Android or iOS applications and simplify any document-based process today.

The simplest way to edit and eSign Form CT 19IT CT GOV Connecticut's Official State with ease

- Find Form CT 19IT CT GOV Connecticut's Official State and click Get Form to initiate.

- Utilize the tools we offer to finish your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Produce your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, either by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form CT 19IT CT GOV Connecticut's Official State to ensure streamlined communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 19it ct gov connecticuts official state

Create this form in 5 minutes!

How to create an eSignature for the form ct 19it ct gov connecticuts official state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 19IT CT GOV Connecticut's Official State?

Form CT 19IT CT GOV Connecticut's Official State is a tax form used by residents of Connecticut to report income and calculate their tax liabilities. It is essential for ensuring compliance with state tax regulations and can be easily completed using airSlate SignNow's eSigning features.

-

How can airSlate SignNow help with Form CT 19IT CT GOV Connecticut's Official State?

airSlate SignNow streamlines the process of completing and submitting Form CT 19IT CT GOV Connecticut's Official State by allowing users to fill out, sign, and send the document electronically. This saves time and reduces the risk of errors, ensuring a smooth filing experience.

-

Is there a cost associated with using airSlate SignNow for Form CT 19IT CT GOV Connecticut's Official State?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that simplify the completion of Form CT 19IT CT GOV Connecticut's Official State, making it a cost-effective solution for document management.

-

What features does airSlate SignNow offer for managing Form CT 19IT CT GOV Connecticut's Official State?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of Form CT 19IT CT GOV Connecticut's Official State. These tools help users efficiently handle their tax documents while ensuring compliance.

-

Can I integrate airSlate SignNow with other software for Form CT 19IT CT GOV Connecticut's Official State?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing users to seamlessly connect their workflows when managing Form CT 19IT CT GOV Connecticut's Official State. This enhances productivity and ensures that all necessary data is easily accessible.

-

What are the benefits of using airSlate SignNow for Form CT 19IT CT GOV Connecticut's Official State?

Using airSlate SignNow for Form CT 19IT CT GOV Connecticut's Official State provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform's user-friendly interface makes it easy for anyone to navigate the eSigning process.

-

Is airSlate SignNow secure for handling Form CT 19IT CT GOV Connecticut's Official State?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all documents, including Form CT 19IT CT GOV Connecticut's Official State, are protected with advanced encryption and secure storage. Users can trust that their sensitive information is safe.

Get more for Form CT 19IT CT GOV Connecticut's Official State

Find out other Form CT 19IT CT GOV Connecticut's Official State

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple