NY DTF CT 34 I Fill Out Tax Template Online Form

Understanding the NY DTF CT-34 I Tax Template

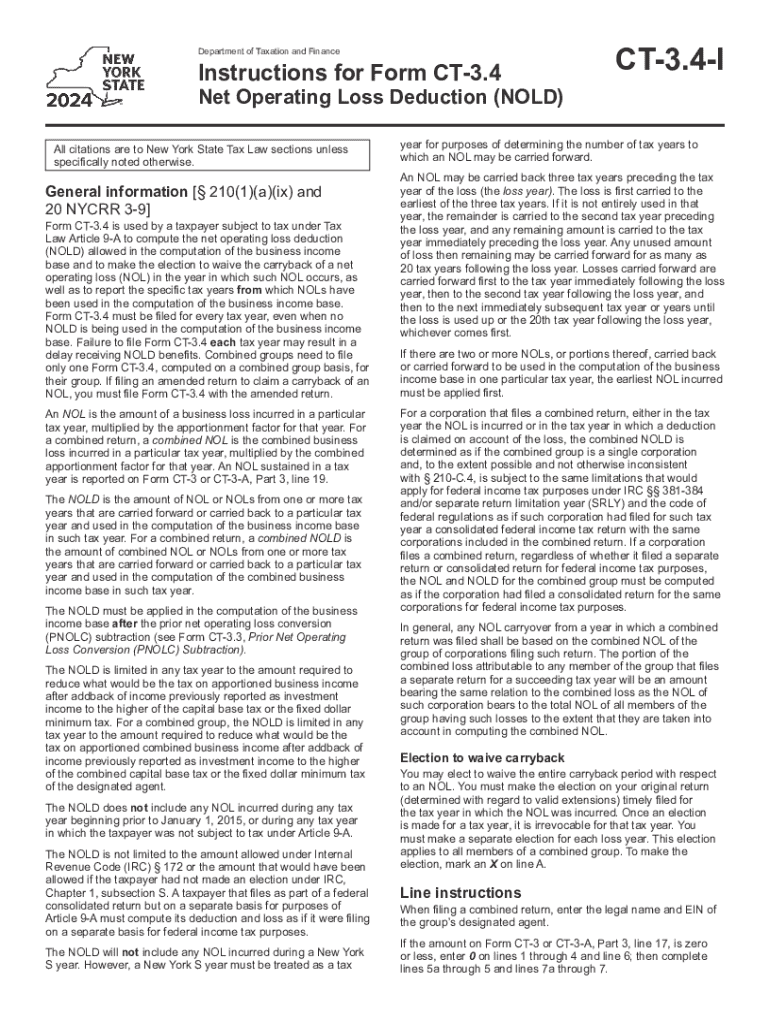

The NY DTF CT-34 I is a tax template used by corporations in New York to report net corporation losses. This form is essential for businesses that have experienced financial losses in a given tax year. By accurately completing this template, corporations can claim their losses, which may help reduce their taxable income in future years. It is important to understand the specific requirements and guidelines associated with this form to ensure compliance with New York tax laws.

Steps to Complete the NY DTF CT-34 I Tax Template

Completing the NY DTF CT-34 I involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and prior year tax returns.

- Fill out the identifying information at the top of the form, including the corporation's name, address, and employer identification number (EIN).

- Report the total income and deductions for the tax year to determine the net corporation loss.

- Complete the sections detailing the loss carryforward and any applicable adjustments.

- Review the form for accuracy before submission.

Legal Use of the NY DTF CT-34 I Tax Template

The NY DTF CT-34 I tax template is legally recognized by the New York State Department of Taxation and Finance. It must be used in accordance with state tax laws to ensure that corporations can properly report their financial losses. Incorrect use of this form may lead to penalties or issues with tax compliance. Corporations should familiarize themselves with the legal requirements surrounding the use of this template to avoid any complications.

Filing Deadlines for the NY DTF CT-34 I Tax Template

Corporations must be aware of the filing deadlines associated with the NY DTF CT-34 I. Typically, the form is due on the same date as the corporation's annual tax return. For most corporations, this is the fifteenth day of the fourth month following the close of the tax year. Missing the deadline may result in penalties and interest on any unpaid taxes. It is advisable to keep track of these important dates to ensure timely submissions.

Required Documents for the NY DTF CT-34 I Tax Template

When completing the NY DTF CT-34 I, corporations should prepare the following documents:

- Financial statements, including profit and loss statements and balance sheets.

- Prior year tax returns to provide context for the current year's losses.

- Any supporting documentation for deductions claimed on the form.

Having these documents readily available will facilitate a smoother completion process and ensure accurate reporting of net corporation losses.

Penalties for Non-Compliance with the NY DTF CT-34 I Tax Template

Failure to comply with the requirements of the NY DTF CT-34 I can result in significant penalties. This may include fines for late filing or inaccuracies in reporting. Additionally, corporations may lose the ability to carry forward their net losses to future tax years if the form is not submitted correctly. Understanding these potential consequences emphasizes the importance of accurate and timely filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ny dtf ct 34 i fill out tax template online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a net corporation loss and how does it affect my business?

A net corporation loss occurs when a company's allowable tax deductions exceed its taxable income. This can signNowly impact your business's tax liabilities, allowing you to carry forward losses to offset future profits. Understanding net corporation loss is crucial for effective tax planning and maximizing your financial strategy.

-

How can airSlate SignNow help in managing documents related to net corporation loss?

airSlate SignNow provides a streamlined platform for managing and eSigning documents related to net corporation loss. With our easy-to-use interface, you can quickly send tax documents, financial statements, and other essential paperwork securely. This ensures that all your documentation is organized and accessible when you need it.

-

What features does airSlate SignNow offer for businesses dealing with net corporation loss?

Our platform offers features such as customizable templates, secure eSigning, and document tracking, which are essential for businesses managing net corporation loss. These tools help you efficiently handle tax-related documents and ensure compliance with regulations. Additionally, our integration capabilities allow for seamless workflows with your existing accounting software.

-

Is airSlate SignNow cost-effective for small businesses facing net corporation loss?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses, especially those dealing with net corporation loss. Our pricing plans are flexible and cater to various business sizes, ensuring you get the best value for your investment. By reducing paperwork and streamlining processes, you can save both time and money.

-

Can I integrate airSlate SignNow with my accounting software to manage net corporation loss?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easier to manage documents related to net corporation loss. This integration allows for seamless data transfer and ensures that all your financial records are up-to-date and accurate. You can focus on your business while we handle the paperwork.

-

What are the benefits of using airSlate SignNow for tax-related documents concerning net corporation loss?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, faster processing times, and improved organization. By digitizing your paperwork, you can easily track and manage documents related to net corporation loss, ensuring you never miss a deadline. This efficiency can lead to better financial outcomes for your business.

-

How does airSlate SignNow ensure the security of documents related to net corporation loss?

airSlate SignNow prioritizes the security of your documents, especially those concerning net corporation loss. We utilize advanced encryption methods and secure cloud storage to protect your sensitive information. Additionally, our platform complies with industry standards to ensure that your data remains confidential and secure.

Get more for NY DTF CT 34 I Fill Out Tax Template Online

Find out other NY DTF CT 34 I Fill Out Tax Template Online

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple