Form it 635 New York Youth Jobs Program Tax Credit Tax Year 2024-2026

What is the Form IT 635 New York Youth Jobs Program Tax Credit Tax Year

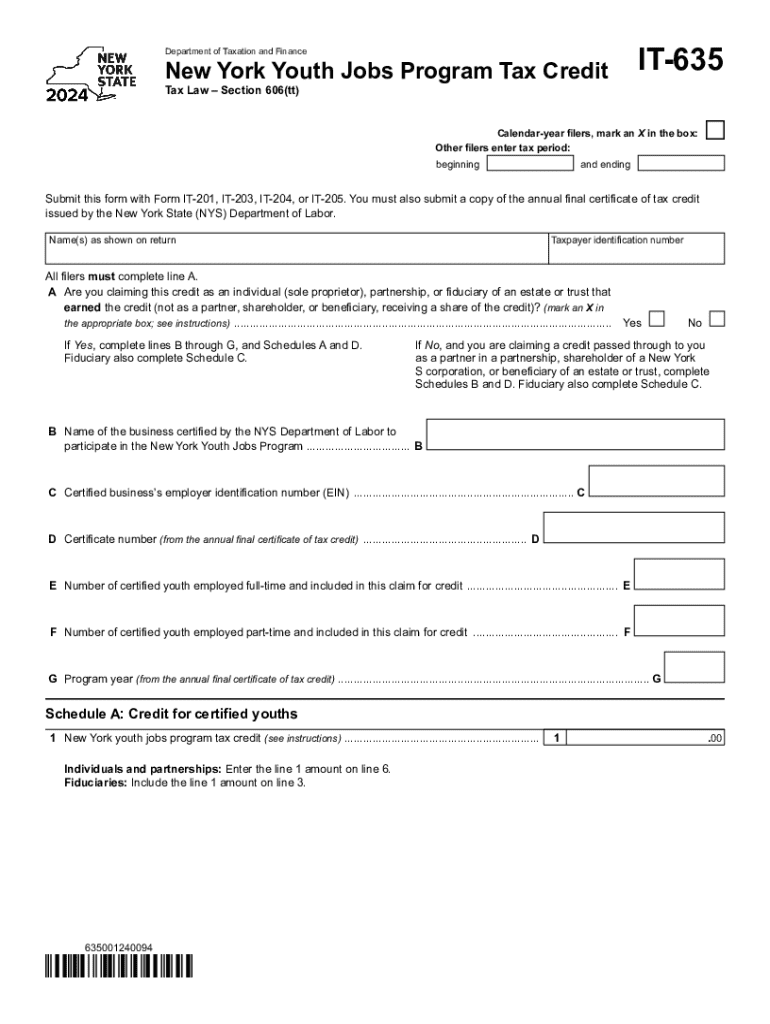

The Form IT 635 is a tax credit application used in New York State, specifically designed for employers who hire eligible youth under the Youth Jobs Program. This program aims to encourage businesses to provide job opportunities for young individuals, helping them gain valuable work experience while reducing the financial burden on employers. The tax credit allows businesses to receive a credit against their New York State income tax liability for hiring qualified youth during the specified tax year.

Eligibility Criteria for the Form IT 635

To qualify for the credit, employers must meet specific criteria. Eligible youth must be between the ages of 16 and 24 and must be residents of New York State. Additionally, the youth must be hired for a minimum period, typically at least six months, and work a certain number of hours per week. Employers must also demonstrate that the job created is a new position and not a replacement for an existing employee. Compliance with these criteria is essential for successfully claiming the tax credit.

Steps to Complete the Form IT 635

Completing the Form IT 635 involves several key steps:

- Gather necessary information about the youth employees, including their names, Social Security numbers, and employment start dates.

- Calculate the total number of eligible youth hired during the tax year.

- Determine the amount of the tax credit based on the wages paid to the eligible youth.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach any supporting documentation, such as payroll records or proof of residency for the youth employees.

How to Obtain the Form IT 635

The Form IT 635 can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing employers to print and complete it manually. Additionally, the form may be accessible through various tax preparation software that supports New York State tax filings. Employers should ensure they have the most current version of the form to comply with any updates or changes in the tax credit program.

Form Submission Methods

Employers can submit the completed Form IT 635 through various methods. The form can be filed electronically if using compatible tax preparation software. Alternatively, employers may choose to mail the completed form to the appropriate address provided by the New York State Department of Taxation and Finance. In-person submissions may also be possible at designated tax offices, depending on local regulations and procedures.

Filing Deadlines and Important Dates

It is crucial for employers to be aware of the filing deadlines associated with the Form IT 635. Typically, the form must be submitted by the due date of the employer's income tax return for the year in which the youth were hired. Employers should keep track of these dates to ensure they do not miss out on claiming the tax credit. Checking the New York State Department of Taxation and Finance website for any updates on deadlines is advisable.

Create this form in 5 minutes or less

Find and fill out the correct form it 635 new york youth jobs program tax credit tax year 772088893

Create this form in 5 minutes!

How to create an eSignature for the form it 635 new york youth jobs program tax credit tax year 772088893

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 635 New York Youth Jobs Program Tax Credit Tax Year?

Form IT 635 New York Youth Jobs Program Tax Credit Tax Year is a tax form used by employers in New York to claim a tax credit for hiring eligible youth. This form helps businesses reduce their tax liability while supporting youth employment initiatives. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with Form IT 635 New York Youth Jobs Program Tax Credit Tax Year?

airSlate SignNow simplifies the process of completing and submitting Form IT 635 New York Youth Jobs Program Tax Credit Tax Year by providing an easy-to-use platform for eSigning and document management. With our solution, you can ensure that all necessary signatures are collected quickly and securely, streamlining your tax credit application process.

-

What are the pricing options for using airSlate SignNow for Form IT 635?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution ensures that you can manage your documents, including Form IT 635 New York Youth Jobs Program Tax Credit Tax Year, without breaking the bank. Visit our pricing page for detailed information on our plans.

-

What features does airSlate SignNow offer for managing Form IT 635?

With airSlate SignNow, you can enjoy features such as customizable templates, secure eSigning, and real-time document tracking. These features make it easier to manage Form IT 635 New York Youth Jobs Program Tax Credit Tax Year efficiently. Our platform is designed to enhance your workflow and ensure compliance with tax regulations.

-

Are there any benefits to using airSlate SignNow for tax credit forms?

Using airSlate SignNow for tax credit forms like Form IT 635 New York Youth Jobs Program Tax Credit Tax Year offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform helps you save time and resources while ensuring that your documents are handled with care and precision.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow can be easily integrated with various accounting and tax management software. This integration allows you to streamline your workflow when handling Form IT 635 New York Youth Jobs Program Tax Credit Tax Year and other tax-related documents. Check our integrations page for a list of compatible applications.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes the security of your documents, including Form IT 635 New York Youth Jobs Program Tax Credit Tax Year. We use advanced encryption and security protocols to ensure that your sensitive information remains protected throughout the signing process.

Get more for Form IT 635 New York Youth Jobs Program Tax Credit Tax Year

- Umyu form

- Section 6 2 covalent bonding answer key pdf form

- Realcheck form

- Icsa crematorium form

- Dmv colorado govesnodecolorado division of motor vehicles department of revenue form

- Commercial application form commercial application form

- Scrum team working agreement template form

- Scrum working agreement template form

Find out other Form IT 635 New York Youth Jobs Program Tax Credit Tax Year

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple