it 635 2020

What is the IT 635?

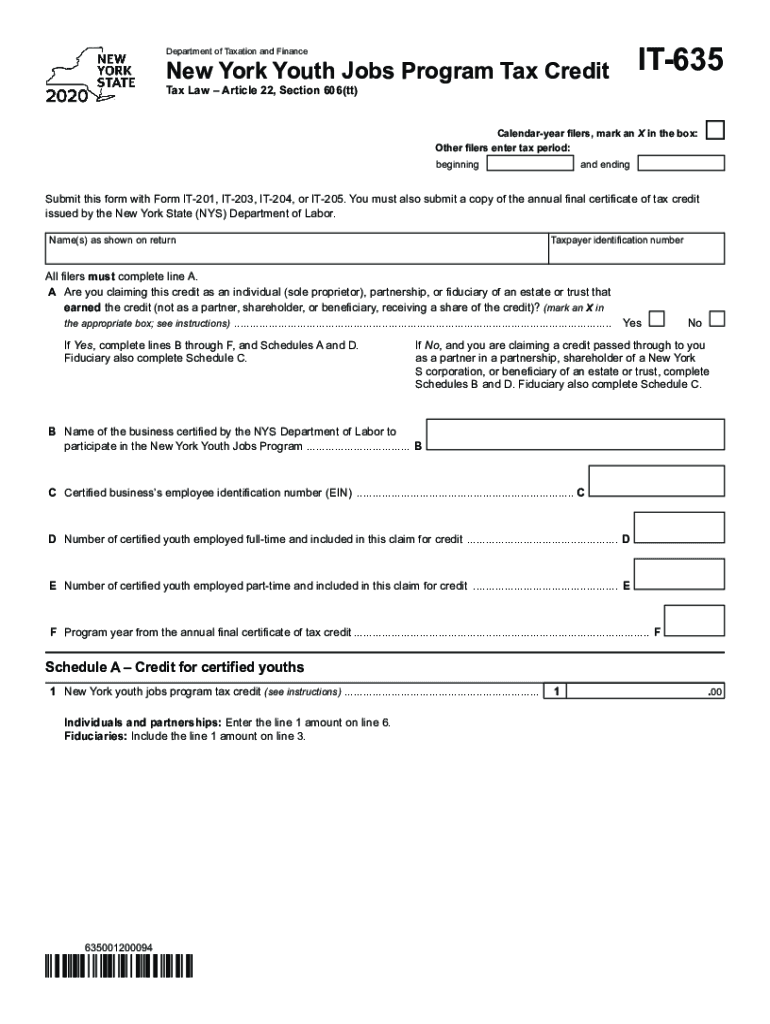

The IT 635 form is a document used primarily for tax purposes in the United States. It serves as a request for an extension of time to file certain tax returns. This form is particularly relevant for individuals and businesses that may need additional time to gather necessary documentation or complete their tax filings accurately. Understanding the purpose of the IT 635 is essential for ensuring compliance with tax regulations and avoiding potential penalties.

How to use the IT 635

Using the IT 635 form involves a few straightforward steps. First, ensure that you have the correct version of the form, which can typically be obtained from the IRS website or authorized tax preparation services. Next, fill out the required sections, including your personal information and the type of tax return for which you are requesting an extension. After completing the form, submit it by the specified deadline, either electronically or via mail, depending on your preference and the instructions provided.

Steps to complete the IT 635

Completing the IT 635 form requires careful attention to detail. Here are the key steps:

- Gather necessary information, such as your Social Security number or Employer Identification Number.

- Indicate the tax year for which you are requesting an extension.

- Provide your estimated tax liability, if applicable.

- Sign and date the form to certify the information is accurate.

- Submit the completed form by the due date to ensure your extension is granted.

Legal use of the IT 635

The IT 635 form is legally recognized when it is filled out correctly and submitted on time. It is essential to adhere to IRS guidelines to ensure that the extension is valid. Failure to comply with the legal requirements can result in penalties, including interest on unpaid taxes. Therefore, understanding the legal implications of using the IT 635 is crucial for taxpayers seeking an extension.

Key elements of the IT 635

Several key elements must be included in the IT 635 form for it to be considered complete:

- Your name and contact information.

- Your tax identification number.

- The specific tax return for which you are requesting an extension.

- The reason for the extension request, if applicable.

- Your signature and the date of submission.

Filing Deadlines / Important Dates

Filing deadlines for the IT 635 form are critical to avoid penalties. Generally, the form must be submitted by the original due date of the tax return for which the extension is requested. It is advisable to check the IRS website for the most current deadlines, as they can vary based on the tax year and specific circumstances. Keeping track of these important dates ensures compliance and helps manage tax obligations effectively.

Quick guide on how to complete it 635

Complete It 635 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage It 635 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign It 635 without hassle

- Find It 635 and then click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced paperwork, laborious form searches, or errors requiring new document prints. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Alter and electronically sign It 635 while ensuring seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 635

Create this form in 5 minutes!

How to create an eSignature for the it 635

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to it 635?

airSlate SignNow is an electronic signature solution that streamlines the process of sending and signing documents. By utilizing it 635, businesses can enhance their document workflows, ensuring quick and secure eSignatures for various applications.

-

How much does airSlate SignNow cost for users interested in it 635?

Pricing for airSlate SignNow varies based on the package selected, catering to different business sizes and needs. For those focused on utilizing it 635 features, we offer competitive pricing models that include essential tools for eSigning and document management.

-

What features should I expect from airSlate SignNow when using it 635?

When using it 635 with airSlate SignNow, you can expect features such as customizable templates, real-time tracking, and secure cloud storage. Additionally, the platform allows for team collaboration, ensuring efficient document handling and signing practices.

-

Can airSlate SignNow integrate with other software using it 635?

Absolutely! airSlate SignNow offers seamless integrations with popular software applications, enhancing the functionality of it 635. Whether you use CRM tools or project management applications, our API allows for smooth integration to optimize your document workflows.

-

What benefits does airSlate SignNow provide with it 635 for businesses?

Using airSlate SignNow with it 635 enables businesses to save time and reduce operational costs associated with traditional document signing. Its user-friendly interface ensures ease of use for all employees while maintaining compliance and security in document management.

-

How does airSlate SignNow ensure the security of documents when using it 635?

Security is a priority for airSlate SignNow, especially when utilizing it 635 for electronic signatures. The platform employs advanced encryption methods and ensures compliance with industry regulations to safeguard all sensitive information during the signing process.

-

Is there a mobile app for airSlate SignNow related to it 635?

Yes, airSlate SignNow offers a mobile app that is compatible with it 635. This allows users to sign documents on-the-go, ensuring that signing and document management are convenient and accessible from anywhere.

Get more for It 635

- San antonio homeless strategic planhomelessness form

- Virginia alcohol safety action program form

- Printable va forms notary public

- 306 cedar road form

- Claim for loda benefits loda 01 virginia line of duty act form

- Prevention program participant eligibility form

- Mits transportation form

- Utility damage report dpcoftexasorg form

Find out other It 635

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure