Form 5500 EZ Annual Return of a One Participant Owners

What is the Form 5500 EZ Annual Return Of A One Participant Owners

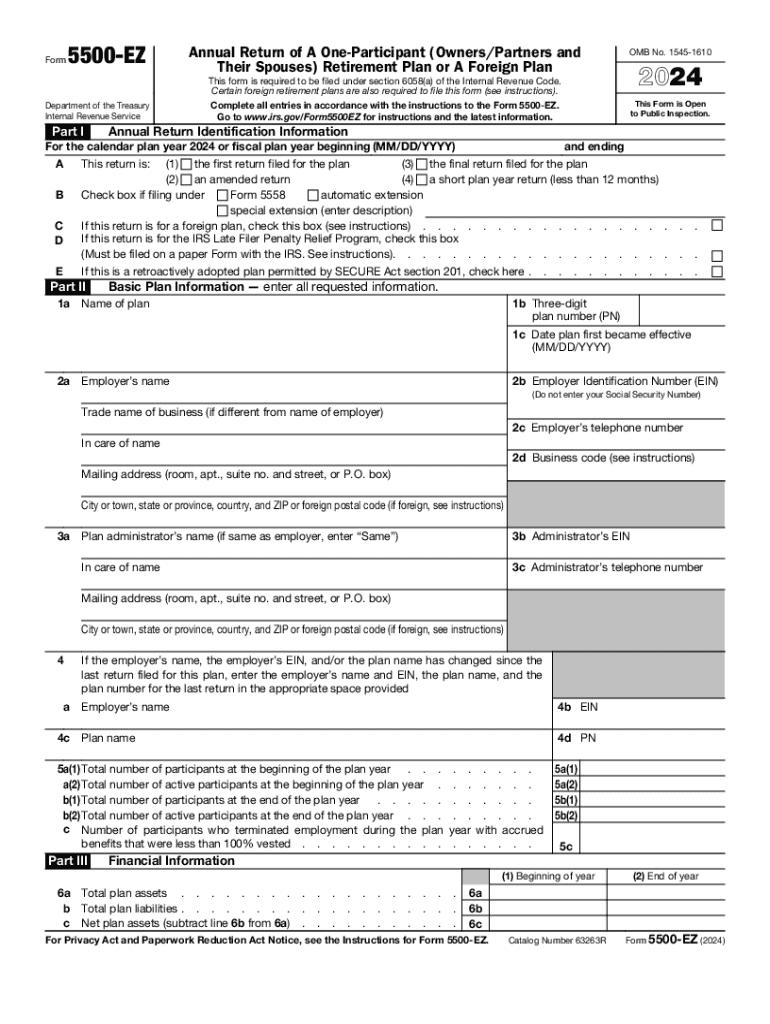

The Form 5500 EZ is an annual return specifically designed for one-participant retirement plans. This form is essential for individuals who operate a solo 401(k) or similar retirement plan without any additional participants. It allows these plan owners to report their plan's financial condition, investments, and operations to the Internal Revenue Service (IRS). Filing this form ensures compliance with federal regulations and helps maintain the tax-advantaged status of the retirement plan.

How to use the Form 5500 EZ Annual Return Of A One Participant Owners

Using the Form 5500 EZ is straightforward. First, gather all necessary financial information regarding the retirement plan, including assets, liabilities, and income. Next, complete the form accurately, ensuring that all required fields are filled out. The form can be filed electronically through the IRS e-filing system or submitted via mail. It is important to keep a copy of the completed form for your records, as it may be needed for future reference or audits.

Steps to complete the Form 5500 EZ Annual Return Of A One Participant Owners

Completing the Form 5500 EZ involves several key steps:

- Collect financial statements and records related to the retirement plan.

- Fill out the form with accurate information regarding the plan's financial status.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail to the appropriate address.

- Retain a copy of the filed form for your records.

Filing Deadlines / Important Dates

The filing deadline for the Form 5500 EZ is typically the last day of the seventh month after the end of the plan year. If the plan year ends on December 31, the form must be filed by July 31 of the following year. It is advisable to check the IRS website for any updates or changes to these deadlines, as timely filing is crucial to avoid penalties.

Penalties for Non-Compliance

Failure to file the Form 5500 EZ can result in significant penalties. The IRS may impose fines for late or non-filing, which can accumulate quickly. Additionally, non-compliance can jeopardize the tax-advantaged status of the retirement plan, leading to potential tax liabilities for the plan owner. It is essential to adhere to all filing requirements to avoid these consequences.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 5500 EZ. These guidelines outline the information required, the filing process, and the consequences of non-compliance. It is important for plan owners to familiarize themselves with these guidelines to ensure accurate and timely submissions. Consulting the IRS website or a tax professional can provide valuable insights into the requirements and best practices for filing.

Handy tips for filling out Form 5500 EZ Annual Return Of A One Participant Owners online

Quick steps to complete and e-sign Form 5500 EZ Annual Return Of A One Participant Owners online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Gain access to a GDPR and HIPAA compliant solution for maximum simplicity. Use signNow to e-sign and share Form 5500 EZ Annual Return Of A One Participant Owners for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5500 ez annual return of a one participant owners

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5500 form and why is it important?

The 5500 form is a crucial document that employee benefit plans must file annually with the Department of Labor. It provides important information about the plan's financial condition, investments, and operations. Understanding the 5500 form is essential for compliance and helps ensure that your business meets federal regulations.

-

How can airSlate SignNow help with the 5500 form?

airSlate SignNow streamlines the process of preparing and signing the 5500 form by providing an easy-to-use platform for electronic signatures. This ensures that your documents are signed quickly and securely, reducing the time spent on paperwork. With airSlate SignNow, you can manage your 5500 form submissions efficiently.

-

What features does airSlate SignNow offer for managing the 5500 form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the 5500 form. These tools help you create, send, and store your forms in a compliant manner. Additionally, you can easily collaborate with team members to ensure accuracy.

-

Is airSlate SignNow cost-effective for filing the 5500 form?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to file the 5500 form. With flexible pricing plans, you can choose the option that best fits your budget and needs. This affordability, combined with its robust features, makes it an ideal choice for managing your compliance documents.

-

Can I integrate airSlate SignNow with other software for the 5500 form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate the 5500 form into your existing workflows. Whether you use accounting software or HR management tools, these integrations enhance efficiency and ensure seamless document handling.

-

What are the benefits of using airSlate SignNow for the 5500 form?

Using airSlate SignNow for the 5500 form provides numerous benefits, including improved compliance, faster processing times, and enhanced security. The platform's user-friendly interface allows for quick document preparation and signing, which can signNowly reduce administrative burdens. Additionally, you can track the status of your forms in real-time.

-

How secure is airSlate SignNow when handling the 5500 form?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents, including the 5500 form. This ensures that sensitive information remains confidential and secure throughout the signing process. You can trust airSlate SignNow to safeguard your compliance documents.

Get more for Form 5500 EZ Annual Return Of A One Participant Owners

- Georgia warranty deed from individual to individual form

- Lavcafaxk12com form

- In what year was fccla known then as fha born form

- Adultery in the court system form

- Hs 7 nhtsa form

- Dtt affidavit county of san mateo transfer tax form

- Clearly print or type all information

- St 108 indiana department of revenue certificate of form

Find out other Form 5500 EZ Annual Return Of A One Participant Owners

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure