California Public Works Payroll Reporting Form Instructions 1980 1980

What is the California Public Works Payroll Reporting Form Instructions 1980

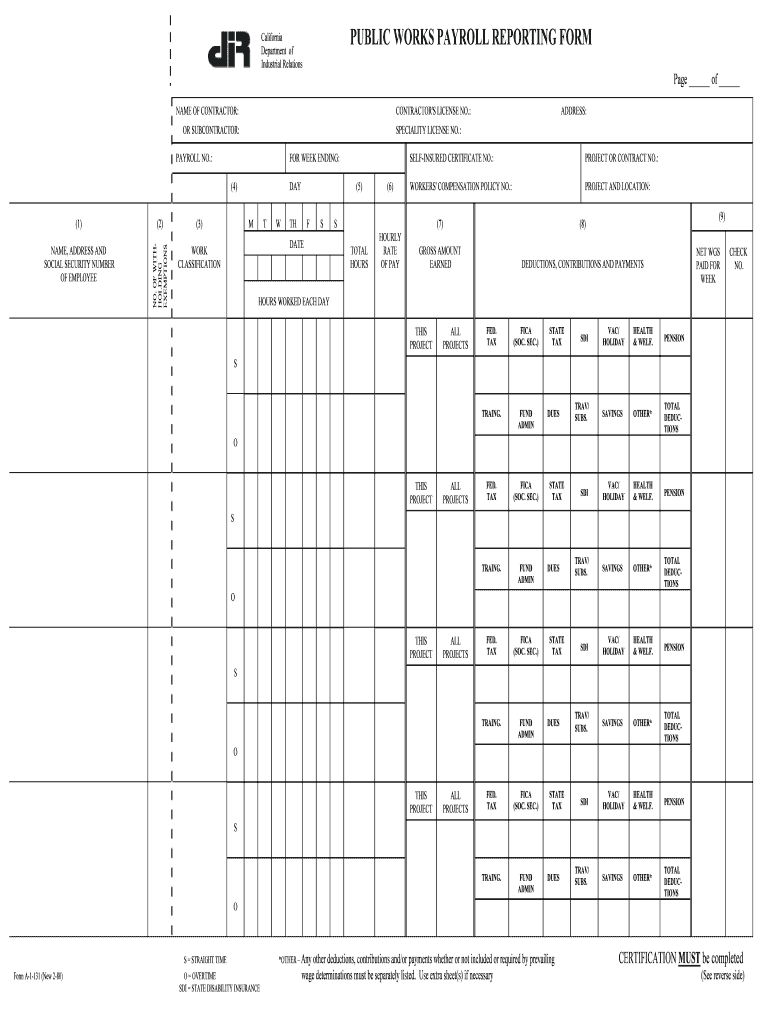

The California Public Works Payroll Reporting Form Instructions 1980 provide essential guidelines for contractors and subcontractors involved in public works projects in California. This form is crucial for ensuring compliance with state labor laws, particularly those concerning the payment of prevailing wages. The instructions outline the necessary steps to accurately report payroll information, ensuring that all workers are compensated fairly according to state regulations.

Steps to complete the California Public Works Payroll Reporting Form Instructions 1980

Completing the California Public Works Payroll Reporting Form requires careful attention to detail. Begin by gathering all relevant payroll data, including employee names, job classifications, hours worked, and wages paid. Follow these steps:

- Fill in the project details, including the project name and location.

- List all employees working on the project, ensuring accurate job classifications.

- Document the hours worked by each employee, specifying regular and overtime hours.

- Calculate total wages paid, ensuring compliance with prevailing wage rates.

- Review the form for completeness and accuracy before submission.

Legal use of the California Public Works Payroll Reporting Form Instructions 1980

The legal use of the California Public Works Payroll Reporting Form is vital for maintaining compliance with state labor laws. Accurate reporting helps prevent disputes and potential legal issues between contractors and workers. It is essential to ensure that all information is truthful and complete, as inaccuracies can lead to penalties or audits. Utilizing the form correctly supports transparency and accountability in public works projects.

Key elements of the California Public Works Payroll Reporting Form Instructions 1980

Several key elements are critical to the California Public Works Payroll Reporting Form. These include:

- Employee Information: Accurate names, addresses, and social security numbers.

- Job Classifications: Proper categorization of work performed to match state requirements.

- Hours Worked: Detailed recording of hours, including regular and overtime.

- Wages Paid: Clear documentation of wages that meet or exceed prevailing wage rates.

- Signatures: Required signatures from authorized representatives to validate the form.

Form Submission Methods

The California Public Works Payroll Reporting Form can be submitted through various methods, ensuring flexibility for contractors. Options include:

- Online Submission: Utilizing compliant electronic platforms for digital filing.

- Mail Submission: Sending completed forms to the appropriate state agency via postal service.

- In-Person Submission: Delivering forms directly to designated offices for immediate processing.

Penalties for Non-Compliance

Failure to comply with the California Public Works Payroll Reporting requirements can result in significant penalties. These may include:

- Monetary fines for inaccurate reporting or late submissions.

- Potential disqualification from future public works projects.

- Legal action initiated by workers for unpaid wages or misclassification.

Quick guide on how to complete california public works payroll reporting form instructions 1980

Simplify your HR workflows with California Public Works Payroll Reporting Form Instructions 1980 Template

Every HR professional recognizes the importance of maintaining employees' data organized and structured. With airSlate SignNow, you obtain access to a comprehensive array of state-specific labor documents that greatly streamline the organization, administration, and storage of all employment-related files in one location. airSlate SignNow supports you in overseeing California Public Works Payroll Reporting Form Instructions 1980 management from start to finish, with robust editing and electronic signature features available whenever you need them. Enhance your accuracy, document protection, and eliminate minor manual inaccuracies in just a few clicks.

The optimal way to edit and eSign California Public Works Payroll Reporting Form Instructions 1980:

- Select the relevant state and search for the document you need.

- Access the document page and then click Get Document to commence working on it.

- Wait for California Public Works Payroll Reporting Form Instructions 1980 to upload in our editor and follow the prompts that highlight mandatory fields.

- Enter your information or insert additional fillable fields into the document.

- Utilize our tools and features to modify your document as needed: annotate, obscure sensitive information, and create an electronic signature.

- Review your document for inaccuracies before proceeding with its submission.

- Click on Done to save changes and download your document.

- Alternatively, send your document directly to your recipients and collect signatures and information.

- Securely store completed documents within your airSlate SignNow account and retrieve them whenever you wish.

Employing a versatile electronic signature solution is crucial when handling California Public Works Payroll Reporting Form Instructions 1980. Make even the most intricate workflow as straightforward as possible with airSlate SignNow. Start your free trial today to discover what you can achieve with your team.

Create this form in 5 minutes or less

Find and fill out the correct california public works payroll reporting form instructions 1980

FAQs

-

What form do I fill out, a W9 or a W8-BEN? I am a US citizen living in Canada as a permanent resident. I am a freelancer (not an employee on a payroll) working for someone in the US, but I will be reporting my earnings to Canada Revenue, not the IRS.

You fill out a W-9. As a US citizen, you are taxed on your worldwide income. It doesn't matter if you don't even set foot in the US.You will however receive a foreign tax credit on your US return equal to the tax paid in Canada or the US tax on the same income, whichever is lower.You also must file an FBAR each year with the US Treasury if you have non-US financial accounts totalling $10K or more. This is measured by finding the highest balance at any time of year for each account and adding up those numbers. Failure to file carries signNow penalties.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

How do I fill out Form 16 if I'm not eligible for IT returns and just want to receive the TDS cut for the 6 months that I've worked?

use File Income Tax Return Online in India: ClearTax | e-Filing Income Tax in 15 minutes | Tax filing | Income Tax Returns | E-file Tax Returns for 2014-15It is free and simple.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

Create this form in 5 minutes!

How to create an eSignature for the california public works payroll reporting form instructions 1980

How to generate an eSignature for the California Public Works Payroll Reporting Form Instructions 1980 in the online mode

How to create an eSignature for the California Public Works Payroll Reporting Form Instructions 1980 in Google Chrome

How to make an electronic signature for signing the California Public Works Payroll Reporting Form Instructions 1980 in Gmail

How to create an eSignature for the California Public Works Payroll Reporting Form Instructions 1980 from your mobile device

How to generate an electronic signature for the California Public Works Payroll Reporting Form Instructions 1980 on iOS

How to create an eSignature for the California Public Works Payroll Reporting Form Instructions 1980 on Android OS

People also ask

-

What are the California Public Works Payroll Reporting Form Instructions 1980?

The California Public Works Payroll Reporting Form Instructions 1980 provide essential guidelines for contractors and subcontractors working on public works projects in California. These instructions ensure compliance with state labor laws and provide clarity on how to report employee payroll accurately.

-

How can airSlate SignNow assist with the California Public Works Payroll Reporting Form Instructions 1980?

AirSlate SignNow streamlines the process of completing and submitting the California Public Works Payroll Reporting Form Instructions 1980. Our platform allows users to easily eSign documents and securely manage payroll reports, saving time and reducing errors during submission.

-

What benefits does airSlate SignNow offer for users managing payroll reports?

By using airSlate SignNow for your payroll management, including the California Public Works Payroll Reporting Form Instructions 1980, you gain access to features such as templates, tracking, and mobile accessibility. These benefits enhance efficiency and ensure that payroll compliance is maintained at all times.

-

Is there a cost associated with using airSlate SignNow for payroll reporting?

AirSlate SignNow offers various pricing plans to cater to businesses of all sizes. This flexibility ensures that you can find a solution that fits your budget while still allowing you to efficiently handle the California Public Works Payroll Reporting Form Instructions 1980 and other documentation needs.

-

Can I integrate airSlate SignNow with other software for better workflow management?

Yes, airSlate SignNow offers numerous integrations with popular software tools that help you manage workflows more effectively. Whether you're using accounting software or project management tools, you can seamlessly incorporate airSlate SignNow to enhance your handling of the California Public Works Payroll Reporting Form Instructions 1980.

-

What features make airSlate SignNow user-friendly for payroll reporting?

AirSlate SignNow provides a straightforward interface, making it easy for users to navigate through the California Public Works Payroll Reporting Form Instructions 1980. Features like drag-and-drop functionality, reusable templates, and status tracking minimize the learning curve and enhance user experience.

-

Are there any tutorials available for completing the California Public Works Payroll Reporting Form Instructions 1980 with airSlate SignNow?

Yes, airSlate SignNow offers a range of tutorials and resources designed to help users complete the California Public Works Payroll Reporting Form Instructions 1980 efficiently. Our dedicated support team is also available to answer any questions you may have throughout the process.

Get more for California Public Works Payroll Reporting Form Instructions 1980

- Application for employment rev 9 13pub harborfields public library harborfieldslibrary form

- Identity theft affidavit form

- Alternative teacher certification application prairie view aampm pvamu form

- Personal information form city of grand rapids grcity

- Petition for grandparent rights superior court amador amadorcourt form

- Usd261 haysville 132 stewart 15 haysville ks 67060 316 usd261 form

- 2016 2017 standard verification worksheet burlington county bb form

- The official girlfriend application form

Find out other California Public Works Payroll Reporting Form Instructions 1980

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile