Public Works Payroll Reporting Form 2003

What is the Public Works Payroll Reporting Form

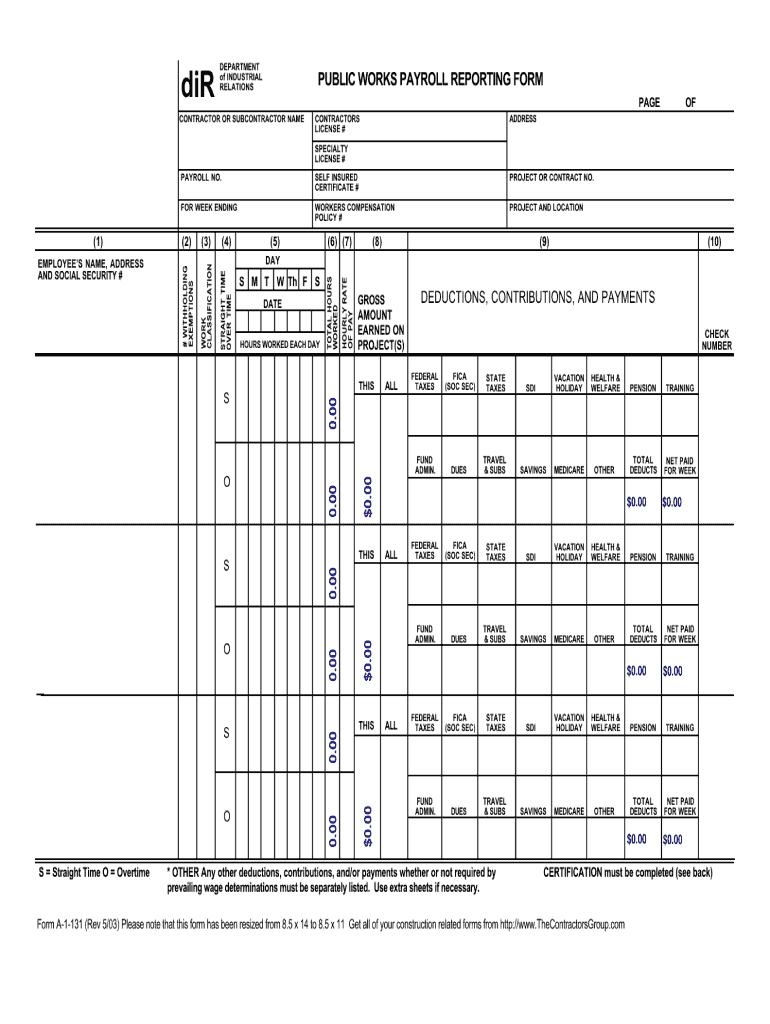

The Public Works Payroll Reporting Form is a crucial document used by contractors and subcontractors engaged in public works projects in the United States. This form is designed to ensure compliance with labor laws and regulations, particularly regarding the payment of wages to workers. It provides detailed information about the employees working on a project, including their hours worked, wages paid, and classifications. This form helps maintain transparency and accountability in public contracting, ensuring that all workers receive fair compensation for their labor.

How to use the Public Works Payroll Reporting Form

Using the Public Works Payroll Reporting Form involves several steps to ensure accurate and compliant reporting. First, gather all necessary employee information, including names, job classifications, and hours worked. Next, fill out the form with precise details regarding wages paid and any deductions. It is essential to review the completed form for accuracy before submission. Finally, submit the form according to the guidelines set by the relevant state or local agency overseeing the public works project. This may involve electronic submission or mailing a physical copy, depending on the requirements.

Steps to complete the Public Works Payroll Reporting Form

Completing the Public Works Payroll Reporting Form requires attention to detail. Follow these steps for accurate completion:

- Collect employee data, including names, job titles, and hours worked.

- Document wages paid for each employee, ensuring compliance with prevailing wage laws.

- Include any deductions, such as taxes or benefits, as required.

- Double-check all entries for accuracy before finalizing the form.

- Submit the form to the appropriate agency by the specified deadline.

Legal use of the Public Works Payroll Reporting Form

The legal use of the Public Works Payroll Reporting Form is vital for compliance with federal and state labor laws. This form must be filled out accurately to reflect the wages and hours worked by employees on public projects. Failing to use this form correctly can lead to penalties, including fines or disqualification from future public contracts. It is essential to ensure that all information is truthful and complete, as inaccuracies can result in legal repercussions for both contractors and subcontractors.

Key elements of the Public Works Payroll Reporting Form

Key elements of the Public Works Payroll Reporting Form include:

- Employee names and identification numbers.

- Job classifications and wage rates.

- Total hours worked during the reporting period.

- Details of any deductions or withholdings.

- Certification statement signed by the contractor or authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the Public Works Payroll Reporting Form vary by state and project. It is essential to be aware of these deadlines to avoid penalties. Generally, forms must be submitted weekly or bi-weekly, depending on the contract terms and local regulations. Contractors should consult the specific guidelines provided by the overseeing agency to ensure timely submission and compliance with all reporting requirements.

Quick guide on how to complete public works payroll reporting form 2003 2019

Simplify your HR workflows with Public Works Payroll Reporting Form Template

Every HR expert recognizes the importance of keeping employee records organized and neat. With airSlate SignNow, you gain access to a vast collection of state-specific employment documents that signNowly enhance the organization, management, and preservation of all job-related files in a single location. airSlate SignNow aids you in overseeing Public Works Payroll Reporting Form management from start to finish, with comprehensive editing and eSignature features available whenever you need them. Improve your precision, document safety, and eliminate minor manual errors in just a few clicks.

The optimal method to modify and eSign Public Works Payroll Reporting Form:

- Select the relevant state and search for the document you require.

- Access the document page and click Get Form to begin utilizing it.

- Allow Public Works Payroll Reporting Form to upload in the editor and adhere to the prompts indicating necessary fields.

- Input your details or insert additional fillable fields into the document.

- Utilize our tools and functionalities to alter your document as needed: annotate, redact sensitive data, and create an eSignature.

- Review your document for errors before proceeding to submit it.

- Just click Done to save changes and download your document.

- Alternatively, send your files directly to your recipients and gather signatures and data.

- Safely store completed forms within your airSlate SignNow account and retrieve them whenever needed.

Using a versatile eSignature solution is essential when managing Public Works Payroll Reporting Form. Simplify even the most intricate workflows with airSlate SignNow. Start your free trial today to explore what you can achieve with your team.

Create this form in 5 minutes or less

Find and fill out the correct public works payroll reporting form 2003 2019

FAQs

-

How do I fill out the Rai Publication Scholarship Form 2019?

Rai Publication Scholarship Exam 2019- Rai Publication Scholarship Form 5th, 8th, 10th & 12th.Rai Publication Scholarship Examination 2019 is going to held in 2019 for various standards 5th, 8th, 10th & 12th in which interested candidates can apply for the following scholarship examination going to held in 2019. This scholarship exam is organized by the Rai Publication which will held only in Rajasthan in the year 2019. Students can apply for the following scholarship examination 2019 before the last date of application that is 15 January 2019. The exam will be conducted district wise in Rajasthan State by the Rai Publication before June 2019.Students of class 5th, 8th, 10th and 12th can fill online registration for Rai Publication scholarship exam 2019. Exam is held in February in all districts of Rajasthan. Open registration form using link given below.In the scholarship examination, the scholarship will be given to the 20 topper students from each standard of 5th, 8th, 10th & 12th on the basis of lottery which will be equally distributed among all 20 students. The declaration of the prize will be announced by July 2019.राय पब्लिकेशन छात्रव्रत्ति परीक्षा का आयोजन सत्र 2019 में किया जाएगा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए, इच्छुक अभ्यार्थी आवेदन कर सकते है इस छात्रव्रत्ति परीक्षा 2019 के लिए | यह छात्रव्रत्ति परीक्षा राजस्थान में राइ पब्लिकेशन के दवारा की जयगी सत्र 2019 में | इच्छुक अभ्यार्थी एक परीक्षा कर सकते है आखरी तारीख 15 जनवरी 2019 से पहले | यह परिखा राजस्थान छेत्र में जिला स्तर पर कराई जाएगी राइ पब्लिकेशन के दवारा जून 2019 से पहले |इस छात्रव्रत्ति परीक्षा में, छात्रव्रत्ति 20 विजेता छात्र छात्राओं दो दी जयेगी जिसमे हर कक्षा के 20 छात्र होंगे जिन्हे बराबरी में बाटा जयेगा। पुरस्कार की घोसणा जुलाई 2019 में की जयेगी |Rai Publication Scholarship Exam 2019 information :This scholarship examination is conducted for 5th, 8th, 10th & 12th standard for which interested candidates can apply which a great opportunity for the students. The exam syllabus will be based according to the standards of their exam which might help them in scoring in the Rai Publication Scholarship Examination 2019. The question in the exam will be multiple choice questions (MCQ’s) and there will be 100 multiple choice questions. To apply for the above scholarship students must have to fill the application form but the 15 January 2019.यह छात्रव्रत्ति परीक्षा कक्षा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए आयोजित है जिसमे इच्छुक अभ्यार्थी पंजीकरण करा सकते है जोकि छात्र छात्राओं के लिए एक बड़ा अवसर होगा | राय पब्लिकेशन छात्रव्रत्ति परीक्षा 2019 परीक्षा का पाठ्यक्रम कक्षा अनुसार ही होगा जोकि उन्हें प्राथम आने में सहयोग प्रदान करेगा | परीक्षा के प्रश्न-पत्र में सारे प्रश्न बहुविकल्पीय प्रश्न होंगे एवं प्रश्न-पत्र में कुल 100 प्रश्न दिए जायेंगे | इस छात्रव्रत्ति परीक्षा को देने क लिए अभयार्थियो को पहले पंजीकरण करना अनिवार्य होगा जोकि ऑनलाइन होगा जिसकी आखरी तारीख 15 जनवरी 2019 है |Distribution of Rai Publication Deskwork Scholarship Exam 2019:5th Class Topper Prize Money:- 4 Lakh Rupees8th Class Topper Prize Money:- 11 Lakh Rupees10th Class Topper Prize Money:- 51 Lakh Rupees12thClass Topper Prize Money:- 39 Lakh RupeesHow to fill Rai Publication Scholarship Form 2019 :Follow the above steps to register for the for Rai Publication Scholarship Examination 2019:Candidates can follow these below given instructions to apply for the scholarship exam of Rai Publication.The Rai Publication Scholarship application form is available in the news paper (Rajasthan Patrika.) You can also download it from this page. It also can be downloaded from the last page of your desk work.Application form is also given on the official website of Rai Publication: Rai Publication - Online Book Store for REET RPSC RAS SSC Constable Patwar 1st 2nd Grade TeacherNow fill the details correctly in the application form.Now send the application form to the head office of Rai Publication.Rai Publication Website Link Click HereHead Office Address of Rai PublicationShop No: -24 & 25, Bhagwan Das Market, Chaura Rasta, Jaipur, RajasthanPIN Code:- 302003Contact No.- 0141 232 1136Source : Rai Publication Scholarship Exam 2019

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

What form do I fill out, a W9 or a W8-BEN? I am a US citizen living in Canada as a permanent resident. I am a freelancer (not an employee on a payroll) working for someone in the US, but I will be reporting my earnings to Canada Revenue, not the IRS.

You fill out a W-9. As a US citizen, you are taxed on your worldwide income. It doesn't matter if you don't even set foot in the US.You will however receive a foreign tax credit on your US return equal to the tax paid in Canada or the US tax on the same income, whichever is lower.You also must file an FBAR each year with the US Treasury if you have non-US financial accounts totalling $10K or more. This is measured by finding the highest balance at any time of year for each account and adding up those numbers. Failure to file carries signNow penalties.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

How do I fill out Form 16 if I'm not eligible for IT returns and just want to receive the TDS cut for the 6 months that I've worked?

use File Income Tax Return Online in India: ClearTax | e-Filing Income Tax in 15 minutes | Tax filing | Income Tax Returns | E-file Tax Returns for 2014-15It is free and simple.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

Create this form in 5 minutes!

How to create an eSignature for the public works payroll reporting form 2003 2019

How to generate an eSignature for the Public Works Payroll Reporting Form 2003 2019 online

How to create an electronic signature for your Public Works Payroll Reporting Form 2003 2019 in Google Chrome

How to generate an eSignature for signing the Public Works Payroll Reporting Form 2003 2019 in Gmail

How to create an eSignature for the Public Works Payroll Reporting Form 2003 2019 from your smart phone

How to generate an electronic signature for the Public Works Payroll Reporting Form 2003 2019 on iOS devices

How to create an eSignature for the Public Works Payroll Reporting Form 2003 2019 on Android

People also ask

-

What is the Public Works Payroll Reporting Form?

The Public Works Payroll Reporting Form is a crucial document used by employers to report hours worked and wages paid to workers on public works projects. This form ensures compliance with labor laws and regulations, making it essential for businesses involved in public construction projects. airSlate SignNow provides a streamlined solution for filling out and submitting this form electronically.

-

How can airSlate SignNow help with the Public Works Payroll Reporting Form?

airSlate SignNow simplifies the process of completing the Public Works Payroll Reporting Form by allowing users to create, edit, and eSign the document online. This not only saves time but also reduces the potential for errors that can occur with paper forms. Our platform ensures that your submissions meet compliance requirements seamlessly.

-

Is there a cost associated with using airSlate SignNow for the Public Works Payroll Reporting Form?

Yes, airSlate SignNow offers competitive pricing tailored to fit the needs of any business utilizing the Public Works Payroll Reporting Form. We provide various subscription plans that include options for additional features and services. You can choose a plan that best suits your budget and requirements.

-

Can I integrate airSlate SignNow with other applications for the Public Works Payroll Reporting Form?

Absolutely! airSlate SignNow easily integrates with various applications, allowing for a seamless experience when managing the Public Works Payroll Reporting Form. Popular integrations include project management software and accounting tools, enabling you to streamline workflows and keep all your documents in one place.

-

What features does airSlate SignNow offer for the Public Works Payroll Reporting Form?

airSlate SignNow provides several features specifically designed to enhance the experience of working with the Public Works Payroll Reporting Form. These features include templates for quick document creation, eSignature capabilities for swift approvals, and tracking options to monitor submission status. This ensures a hassle-free process from start to finish.

-

How does eSigning the Public Works Payroll Reporting Form work?

eSigning the Public Works Payroll Reporting Form through airSlate SignNow is simple and secure. Users can electronically sign the document directly within the platform, eliminating the need for printouts. Once signed, the form can be securely shared and stored, ensuring that all signatures are legally binding.

-

What are the benefits of using airSlate SignNow for Public Works Payroll Reporting?

Using airSlate SignNow for your Public Works Payroll Reporting enables faster turnaround times and increased accuracy in document management. The platform reduces paperwork and enhances collaboration among team members working on public projects. Additionally, our solution is cost-effective, allowing you to focus more on your core tasks and less on administrative burdens.

Get more for Public Works Payroll Reporting Form

- Ca 540nr instructions 2015 form

- 2013 ca instructions form

- 540nr instructions 2016 form

- 2018 form 3885 l depreciation and amortization 2018 california form 3885 l depreciation and amortization

- 2017 form 3885 l depreciation and amortization

- Form 592 v 2016

- Form 592 v 2019

- 2018 form 592 v payment voucher for resident and nonresident withholding 2018 form 592 v payment voucher for resident and

Find out other Public Works Payroll Reporting Form

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement