State and Local Income Tax Refund WorksheetSchedule 2017-2026

What is the State And Local Income Tax Refund WorksheetSchedule

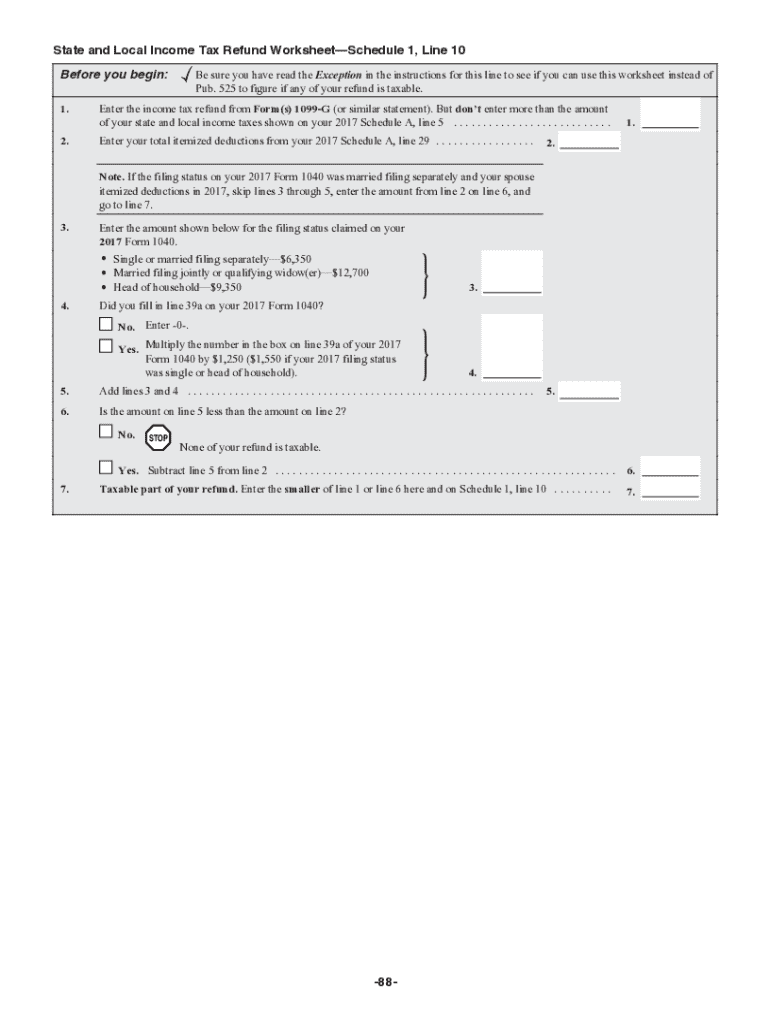

The State And Local Income Tax Refund WorksheetSchedule is a tax form used by individuals to calculate and report refunds received from state and local income taxes. This worksheet helps taxpayers determine the amount they need to report as income on their federal tax returns. It is particularly relevant for those who itemized their deductions in the previous year and received a refund for state or local taxes. Understanding this form is essential for accurate tax reporting and compliance with IRS regulations.

How to use the State And Local Income Tax Refund WorksheetSchedule

Using the State And Local Income Tax Refund WorksheetSchedule involves several steps. First, gather all relevant tax documents, including your previous year's state tax return and any refund statements. Next, follow the instructions on the worksheet to input your information accurately. The form will guide you through calculating the taxable portion of your refund based on the amount of state and local taxes you deducted in the prior year. Ensure that you complete the worksheet before filing your federal tax return to avoid discrepancies.

Steps to complete the State And Local Income Tax Refund WorksheetSchedule

Completing the State And Local Income Tax Refund WorksheetSchedule requires careful attention to detail. Begin by entering your total state and local tax refund amount. Then, identify the amount of state and local taxes you deducted on your federal return last year. The worksheet will include calculations to help you determine how much of your refund is taxable. Follow each step methodically, and double-check your figures to ensure accuracy. Once completed, keep a copy for your records and include any necessary information when filing your federal taxes.

Key elements of the State And Local Income Tax Refund WorksheetSchedule

Several key elements are essential for understanding the State And Local Income Tax Refund WorksheetSchedule. These include:

- Refund Amount: The total amount refunded by the state or local government.

- Deductions Taken: The amount of state and local taxes deducted in the previous year.

- Taxable Portion: The calculated amount of the refund that must be reported as income.

- Filing Information: Instructions on how to report the refund on your federal tax return.

State-specific rules for the State And Local Income Tax Refund WorksheetSchedule

State-specific rules can significantly impact how the State And Local Income Tax Refund WorksheetSchedule is completed. Each state may have unique regulations regarding tax refunds and their treatment at the federal level. It is crucial to review the specific rules applicable to your state to ensure compliance. Some states may have different refund reporting requirements or may not require taxpayers to report certain refunds. Always consult your state’s tax authority or a tax professional for guidance tailored to your situation.

Filing Deadlines / Important Dates

Filing deadlines for the State And Local Income Tax Refund WorksheetSchedule align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must file their federal tax returns by April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these dates and to file your taxes promptly to avoid penalties. Mark your calendar with important dates to ensure you meet all filing requirements.

Create this form in 5 minutes or less

Find and fill out the correct state and local income tax refund worksheetschedule

Create this form in 5 minutes!

How to create an eSignature for the state and local income tax refund worksheetschedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the State And Local Income Tax Refund WorksheetSchedule?

The State And Local Income Tax Refund WorksheetSchedule is a tool designed to help individuals and businesses accurately calculate their state and local income tax refunds. It simplifies the process by providing a structured format to track and report relevant tax information, ensuring compliance and maximizing potential refunds.

-

How can airSlate SignNow assist with the State And Local Income Tax Refund WorksheetSchedule?

airSlate SignNow offers a seamless platform for eSigning and sending documents related to the State And Local Income Tax Refund WorksheetSchedule. With its user-friendly interface, you can easily manage your tax documents, ensuring they are signed and submitted on time, which can help expedite your refund process.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of individuals and businesses. Whether you require basic features for personal use or advanced functionalities for a team, you can choose a plan that includes access to tools for managing the State And Local Income Tax Refund WorksheetSchedule efficiently.

-

Are there any integrations available for the State And Local Income Tax Refund WorksheetSchedule?

Yes, airSlate SignNow integrates with various accounting and tax software, allowing you to streamline your workflow when handling the State And Local Income Tax Refund WorksheetSchedule. These integrations help ensure that your tax data is synchronized and easily accessible, enhancing your overall efficiency.

-

What benefits does airSlate SignNow provide for managing tax documents?

Using airSlate SignNow for your tax documents, including the State And Local Income Tax Refund WorksheetSchedule, offers numerous benefits such as enhanced security, ease of use, and time savings. The platform allows for quick eSigning and document sharing, reducing the hassle of traditional paper processes.

-

Can I use airSlate SignNow on mobile devices for tax-related documents?

Absolutely! airSlate SignNow is fully optimized for mobile devices, enabling you to manage your State And Local Income Tax Refund WorksheetSchedule on the go. Whether you need to sign documents or send them for signatures, you can do it conveniently from your smartphone or tablet.

-

Is there customer support available for users of the State And Local Income Tax Refund WorksheetSchedule?

Yes, airSlate SignNow provides dedicated customer support to assist users with any questions or issues related to the State And Local Income Tax Refund WorksheetSchedule. Our support team is available through various channels to ensure you receive timely assistance whenever needed.

Get more for State And Local Income Tax Refund WorksheetSchedule

- Services agreement between telamon ims inc and telocity corporation form

- Services agreement group form

- Sample employment agreement form

- Sample technical form

- Agreement chief officer 497336469 form

- Sample employment agreement 497336470 form

- Sample employment agreement between telocity inc and customer care officer form

- Sample communications form

Find out other State And Local Income Tax Refund WorksheetSchedule

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure