Life Insurance Fact Finder Worksheet Form

What is the Life Insurance Fact Finder Worksheet

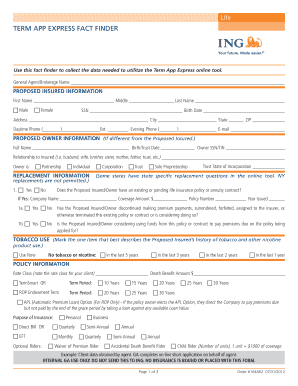

The Life Insurance Fact Finder Worksheet is a comprehensive tool designed to gather essential information about an individual's financial situation and insurance needs. This worksheet helps insurance agents and clients identify the appropriate coverage amounts and types of life insurance that best suit the client's circumstances. It typically includes sections for personal details, financial assets, liabilities, income, and specific insurance goals. By systematically organizing this information, the worksheet facilitates informed decision-making regarding life insurance policies.

How to use the Life Insurance Fact Finder Worksheet

Using the Life Insurance Fact Finder Worksheet involves several straightforward steps. First, the individual or family seeking life insurance should fill out their personal information, including names, ages, and health statuses. Next, they should list their financial assets, such as savings accounts, real estate, and investments, alongside any outstanding debts like mortgages or loans. This information allows for a clearer understanding of the financial landscape. Finally, the worksheet should include specific goals, such as desired coverage amounts and any particular beneficiaries. This structured approach ensures that all relevant details are considered when selecting a life insurance policy.

Key elements of the Life Insurance Fact Finder Worksheet

The Life Insurance Fact Finder Worksheet contains several key elements that are crucial for assessing life insurance needs. These elements typically include:

- Personal Information: Details about the individual, including age, health status, and lifestyle choices.

- Financial Overview: A summary of assets, liabilities, and income sources.

- Insurance Goals: Specific objectives regarding coverage amounts and beneficiaries.

- Existing Coverage: Information about any current life insurance policies or other relevant insurance.

- Dependents: Details about dependents who may rely on the individual’s income.

These elements work together to provide a comprehensive view of the individual's insurance needs, helping to tailor the life insurance policy accordingly.

Steps to complete the Life Insurance Fact Finder Worksheet

Completing the Life Insurance Fact Finder Worksheet involves a series of organized steps. Start by gathering all necessary documents and information, including financial statements and existing insurance policies. Next, follow these steps:

- Fill in Personal Details: Enter names, ages, and health information.

- List Financial Assets: Document savings, investments, and properties.

- Detail Liabilities: Include any debts or financial obligations.

- Define Insurance Goals: Specify desired coverage amounts and beneficiaries.

- Review and Finalize: Ensure all information is accurate and complete.

By following these steps, individuals can effectively utilize the worksheet to assess their life insurance needs.

Legal use of the Life Insurance Fact Finder Worksheet

The Life Insurance Fact Finder Worksheet is legally used as a preliminary document in the life insurance application process. It serves as a record of the information provided by the applicant, which can be referenced during the underwriting process. While the worksheet itself does not constitute a binding agreement, it is essential for ensuring compliance with insurance regulations and guidelines. It is important that the information recorded is accurate and truthful to avoid complications during the policy issuance.

How to obtain the Life Insurance Fact Finder Worksheet

The Life Insurance Fact Finder Worksheet can typically be obtained through various channels. Many insurance agents provide this worksheet directly to their clients as part of the initial consultation process. Additionally, it may be available on insurance company websites or through financial planning resources. Individuals can also create their own version of the worksheet by compiling the necessary sections based on their specific needs. It is advisable to use a structured format to ensure all relevant information is captured.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the life insurance fact finder worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a life insurance fact finder worksheet?

A life insurance fact finder worksheet is a tool designed to help individuals gather essential information about their financial situation and insurance needs. It assists in identifying the right coverage options and ensures that all relevant details are considered when selecting a life insurance policy.

-

How can the life insurance fact finder worksheet benefit me?

Using a life insurance fact finder worksheet can streamline the process of assessing your insurance needs. It helps you organize your financial information, making it easier to discuss your options with an insurance agent and ensuring you choose the best policy for your situation.

-

Is the life insurance fact finder worksheet easy to use?

Yes, the life insurance fact finder worksheet is designed to be user-friendly and straightforward. It typically includes clear sections for personal information, financial details, and insurance needs, allowing you to fill it out quickly and efficiently.

-

Are there any costs associated with the life insurance fact finder worksheet?

The life insurance fact finder worksheet is often available for free or at a minimal cost, depending on the provider. airSlate SignNow offers cost-effective solutions that may include access to such worksheets as part of their document management services.

-

Can I integrate the life insurance fact finder worksheet with other tools?

Yes, many platforms, including airSlate SignNow, allow for integration with various tools and software. This means you can easily incorporate the life insurance fact finder worksheet into your existing workflow, enhancing efficiency and collaboration.

-

What features should I look for in a life insurance fact finder worksheet?

When selecting a life insurance fact finder worksheet, look for features such as customizable fields, easy data entry, and the ability to save and share your information. These features will help you create a comprehensive overview of your insurance needs.

-

How does the life insurance fact finder worksheet help in choosing the right policy?

The life insurance fact finder worksheet helps you clarify your financial goals and needs, which is crucial when selecting a policy. By organizing your information, you can make informed decisions and ensure that the policy you choose aligns with your long-term objectives.

Get more for Life Insurance Fact Finder Worksheet

- Due to the severity of these problems your attention form

- In your demand upon me for additional rent form

- If the actual term of this form

- 30 day notice of material non compliance form

- It will not be renewed for an form

- Additional term form

- Assignment of deed of trust page 1 form

- State of delaware landlord tenant code title 25 delaware form

Find out other Life Insurance Fact Finder Worksheet

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple