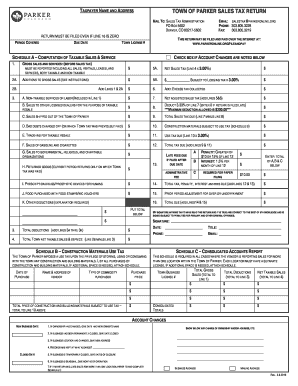

TOWN of PARKER SALES TAX RETURN 2016-2026

Understanding the Colorado Sales Tax Return Form

The Colorado sales tax return form is a crucial document for businesses operating within the state. It is used to report sales tax collected from customers and remit it to the state government. This form ensures compliance with state tax laws and helps maintain transparency in business operations. Understanding the specifics of this form is essential for accurate reporting and avoiding potential penalties.

Steps to Complete the Colorado Sales Tax Return Form

Completing the Colorado sales tax return form involves several key steps:

- Gather necessary sales records: Collect all sales data for the reporting period, including gross sales, exempt sales, and any sales tax collected.

- Fill out the form: Input the required information, including your business name, address, and sales figures.

- Calculate the total sales tax due: Use the applicable tax rates to determine the total amount of sales tax owed.

- Review your entries: Double-check all information for accuracy to prevent errors that could lead to penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Filing Deadlines and Important Dates

It is vital to be aware of the filing deadlines for the Colorado sales tax return form. Typically, businesses must file their returns on a monthly, quarterly, or annual basis, depending on their sales volume. Missing a deadline can result in penalties and interest on unpaid taxes. Keeping a calendar of these important dates ensures timely compliance.

Form Submission Methods

The Colorado sales tax return form can be submitted through various methods to accommodate different business needs:

- Online Submission: Many businesses prefer to file electronically through the Colorado Department of Revenue's online portal, which offers a streamlined process.

- Mail: Businesses can also print the completed form and send it via postal service to the designated address.

- In-Person: For those who prefer face-to-face interactions, submitting the form at local tax offices is an option.

Required Documents for Filing

When preparing to file the Colorado sales tax return form, certain documents are necessary to ensure accuracy:

- Sales records, including invoices and receipts

- Previous sales tax returns for reference

- Any exemption certificates for tax-exempt sales

Penalties for Non-Compliance

Failure to file the Colorado sales tax return form on time can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate filing.

Create this form in 5 minutes or less

Find and fill out the correct town of parker sales tax return

Create this form in 5 minutes!

How to create an eSignature for the town of parker sales tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the colorado sales tax return form?

The colorado sales tax return form is a document that businesses in Colorado must complete to report and pay sales tax to the state. This form includes details about the total sales, taxable sales, and the amount of tax collected. Properly filling out this form is essential for compliance with state tax regulations.

-

How can airSlate SignNow help with the colorado sales tax return form?

airSlate SignNow simplifies the process of completing and submitting the colorado sales tax return form by allowing users to eSign and send documents securely. Our platform provides templates and tools that streamline the preparation of tax forms, ensuring accuracy and efficiency. This helps businesses save time and reduce errors in their tax submissions.

-

Is there a cost associated with using airSlate SignNow for the colorado sales tax return form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that facilitate the completion of the colorado sales tax return form, including eSigning and document management. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the colorado sales tax return form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking to help manage the colorado sales tax return form efficiently. Users can easily create, edit, and send forms while keeping track of their status. These features enhance productivity and ensure timely submissions.

-

Can I integrate airSlate SignNow with other software for the colorado sales tax return form?

Yes, airSlate SignNow supports integrations with various software applications, making it easy to manage the colorado sales tax return form alongside your existing tools. Whether you use accounting software or CRM systems, our platform can connect seamlessly to streamline your workflow. This integration helps maintain consistency and accuracy in your tax reporting.

-

What are the benefits of using airSlate SignNow for the colorado sales tax return form?

Using airSlate SignNow for the colorado sales tax return form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and document sharing, which speeds up the filing process. Additionally, the secure environment ensures that sensitive tax information is protected.

-

How do I get started with airSlate SignNow for the colorado sales tax return form?

Getting started with airSlate SignNow for the colorado sales tax return form is easy. Simply sign up for an account on our website, choose a pricing plan, and start creating your tax forms using our templates. Our user-friendly interface guides you through the process, making it accessible for everyone.

Get more for TOWN OF PARKER SALES TAX RETURN

Find out other TOWN OF PARKER SALES TAX RETURN

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free