Sales and Use Tax Return Form Town of Parker Parkeronline 2015

What is the Sales And Use Tax Return Form Town Of Parker Parkeronline

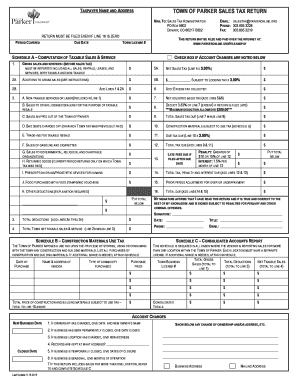

The Sales And Use Tax Return Form for the Town of Parker, accessible via Parkeronline, is a crucial document for businesses operating within the town. This form is used to report sales and use tax collected from customers and to remit the appropriate amount to the local government. It ensures compliance with local tax regulations and helps maintain the financial integrity of the community. The form captures essential information about the business, including sales figures, tax collected, and any exemptions that may apply.

Steps to complete the Sales And Use Tax Return Form Town Of Parker Parkeronline

Completing the Sales And Use Tax Return Form online involves several straightforward steps. First, access the form through the Parkeronline portal. Next, gather all necessary documentation, including sales records and tax rates applicable to your transactions. Fill out the form by entering your business information, total sales, and the amount of tax collected. Review the entries for accuracy to avoid errors. Finally, submit the form electronically, ensuring you receive confirmation of your submission for your records.

Legal use of the Sales And Use Tax Return Form Town Of Parker Parkeronline

The legal validity of the Sales And Use Tax Return Form when submitted online is supported by compliance with established eSignature laws such as ESIGN and UETA. These regulations ensure that electronic signatures are recognized as legally binding, provided that the signer's identity is verified and the process is secure. Using a trusted platform like signNow enhances the legal standing of your submission, as it provides digital certificates and maintains an audit trail for accountability.

Required Documents for the Sales And Use Tax Return Form Town Of Parker Parkeronline

To successfully complete the Sales And Use Tax Return Form, businesses should prepare specific documents. These typically include sales records that detail all transactions during the reporting period, proof of any tax exemptions, and previous tax returns if applicable. Having these documents readily available will facilitate accurate reporting and help avoid potential discrepancies during the filing process.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Sales And Use Tax Return Form is essential for compliance. The Town of Parker typically requires businesses to submit their returns quarterly or annually, depending on their sales volume. Key dates include the end of each reporting period and the due date for submission. Businesses should mark these dates on their calendars to ensure timely filing and avoid penalties for late submissions.

Form Submission Methods

The Sales And Use Tax Return Form can be submitted through various methods to accommodate different preferences. Businesses may file the form online via the Parkeronline portal, which is the most efficient option. Alternatively, the form can be printed and mailed to the appropriate tax office or submitted in person. Each method has its own processing times, so businesses should choose the one that best fits their needs.

Penalties for Non-Compliance

Failure to file the Sales And Use Tax Return Form on time or inaccuracies in reporting can result in significant penalties. The Town of Parker may impose fines based on the amount of tax owed, and interest may accrue on unpaid taxes. It is crucial for businesses to understand these consequences and prioritize compliance to avoid financial repercussions.

Quick guide on how to complete sales and use tax return form town of parker parkeronline

Effortlessly Prepare Sales And Use Tax Return Form Town Of Parker Parkeronline on Any Device

The management of digital documents has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents rapidly without any delays. Manage Sales And Use Tax Return Form Town Of Parker Parkeronline on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The Easiest Method to Edit and eSign Sales And Use Tax Return Form Town Of Parker Parkeronline with Ease

- Obtain Sales And Use Tax Return Form Town Of Parker Parkeronline and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether it be via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, cumbersome form navigation, or mistakes necessitating the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Sales And Use Tax Return Form Town Of Parker Parkeronline and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales and use tax return form town of parker parkeronline

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax return form town of parker parkeronline

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sales And Use Tax Return Form Town Of Parker Parkeronline?

The Sales And Use Tax Return Form Town Of Parker Parkeronline is an official document required for businesses operating in Parker to report and pay sales tax. This online form simplifies the filing process, ensuring accurate calculations and compliance with local tax regulations.

-

How can airSlate SignNow help with the Sales And Use Tax Return Form Town Of Parker Parkeronline?

airSlate SignNow allows users to easily eSign and send the Sales And Use Tax Return Form Town Of Parker Parkeronline securely. Our platform streamlines the document workflow, making it convenient for businesses to complete their tax filings efficiently.

-

Is there a cost associated with using the Sales And Use Tax Return Form Town Of Parker Parkeronline through airSlate SignNow?

Yes, while airSlate SignNow offers a cost-effective solution for document management, users may incur fees associated with advanced features or additional services. We recommend reviewing our pricing plans to find the best fit for your needs regarding the Sales And Use Tax Return Form Town Of Parker Parkeronline.

-

What are the key features of airSlate SignNow that support the Sales And Use Tax Return Form Town Of Parker Parkeronline?

Key features of airSlate SignNow include customizable templates, secure eSignatures, and robust integrations with various business applications. These features enhance your experience while managing the Sales And Use Tax Return Form Town Of Parker Parkeronline, ensuring a smooth and compliant filing process.

-

Are there any benefits of using airSlate SignNow for the Sales And Use Tax Return Form Town Of Parker Parkeronline?

Using airSlate SignNow for the Sales And Use Tax Return Form Town Of Parker Parkeronline provides several benefits, such as time savings and improved accuracy. Our intuitive platform helps minimize errors and accelerates the submission process, ultimately benefiting your business operations.

-

Can airSlate SignNow integrate with other tools for the Sales And Use Tax Return Form Town Of Parker Parkeronline?

Yes, airSlate SignNow offers integrations with various tools and software to facilitate the filing of the Sales And Use Tax Return Form Town Of Parker Parkeronline. These integrations allow seamless data transfer, enhancing efficiency and ensuring a smooth workflow.

-

What steps should I follow to complete the Sales And Use Tax Return Form Town Of Parker Parkeronline on airSlate SignNow?

To complete the Sales And Use Tax Return Form Town Of Parker Parkeronline using airSlate SignNow, create an account, select the form from our templates, fill in the necessary information, and eSign the document. Finally, submit the completed form directly to the Town of Parker through our platform.

Get more for Sales And Use Tax Return Form Town Of Parker Parkeronline

- Illinois state archives land sale records genealogical research pamphlet no 1 form

- Request for authorization form use for department of music

- Illinois patriot information form

- Illinois state archives prairie pioneer certificate genealogical research pamphlet no9 form

- State form 4162 r19 7 18

- Electrical application updated january 2019 form

- Illinois state archives state census records genealogical research pamphlet no 5 form

- Request for due process hearing form

Find out other Sales And Use Tax Return Form Town Of Parker Parkeronline

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple