FORM NO 16 See Rule 311a Certificate under Section 203

Understanding FORM NO 16 See Rule 311a Certificate Under Section 203

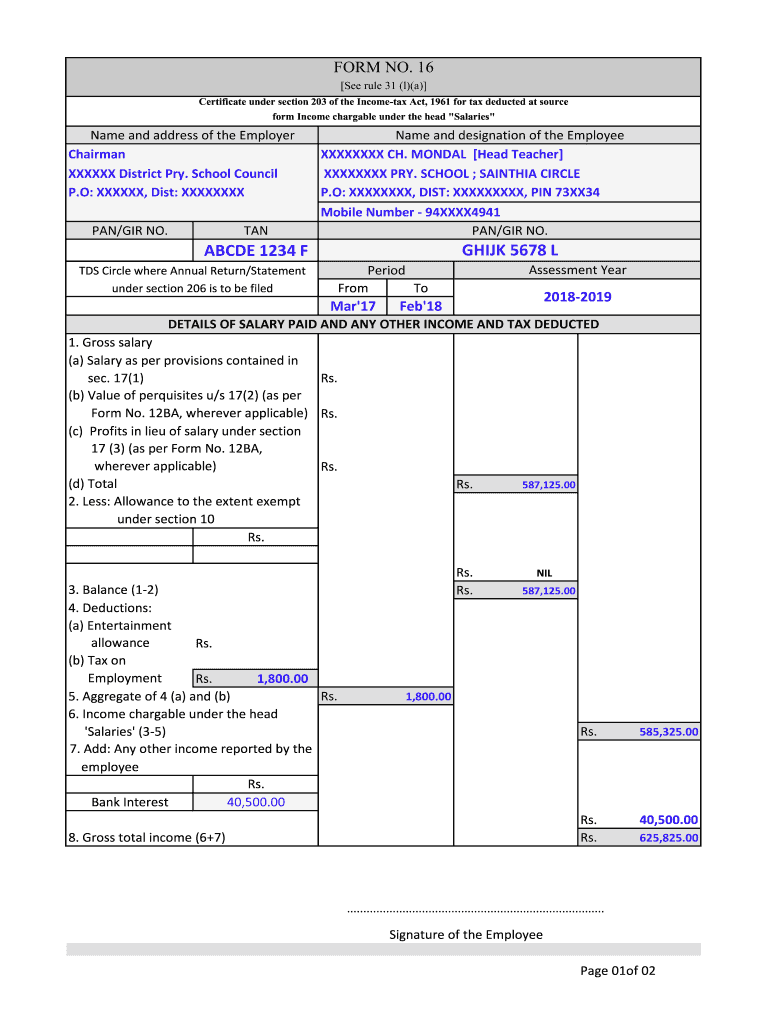

The FORM NO 16 See Rule 311a Certificate Under Section 203 is a crucial document in the U.S. tax system, primarily used to certify the deduction of tax at source. This form is issued by employers to their employees, detailing the income earned and the tax deducted during a financial year. It serves as proof of income and tax payment, which is essential for filing annual tax returns. The form includes specific details such as the employee's name, the amount of salary paid, and the tax deducted, ensuring transparency in the taxation process.

How to Obtain FORM NO 16 See Rule 311a Certificate Under Section 203

To obtain the FORM NO 16 See Rule 311a Certificate Under Section 203, employees should request it from their employer. Employers are required to issue this certificate after the end of the financial year, typically by May 31 of the following year. If an employee does not receive the form, they can approach the human resources or payroll department for assistance. It is important for employees to keep this document for their records, as it is necessary for filing tax returns and may be required for loan applications or other financial transactions.

Steps to Complete FORM NO 16 See Rule 311a Certificate Under Section 203

Completing the FORM NO 16 See Rule 311a Certificate Under Section 203 involves several key steps:

- Gather necessary information, including personal details such as name, address, and Social Security number.

- Collect details of income earned during the financial year, including salary, bonuses, and other compensations.

- Calculate the total tax deducted at source, which should be reflected in the form.

- Ensure all information is accurate and matches with the employer's records before submission.

Key Elements of FORM NO 16 See Rule 311a Certificate Under Section 203

The FORM NO 16 See Rule 311a Certificate Under Section 203 contains several important elements:

- Employer's name and address

- Employee's name and address

- Financial year for which the certificate is issued

- Total salary paid during the year

- Total tax deducted at source

- Details of any other deductions claimed

Legal Use of FORM NO 16 See Rule 311a Certificate Under Section 203

The FORM NO 16 See Rule 311a Certificate Under Section 203 is legally recognized as a valid document for tax purposes. It is essential for employees to use this form when filing their income tax returns, as it provides evidence of income and tax paid. The form can also be used in legal situations, such as loan applications, where proof of income is required. Failure to provide this certificate when necessary may result in complications during tax assessments or financial transactions.

Filing Deadlines for FORM NO 16 See Rule 311a Certificate Under Section 203

Filing deadlines associated with the FORM NO 16 See Rule 311a Certificate Under Section 203 are critical for compliance. Employers must issue this certificate to employees by May 31 of the year following the financial year. Employees should ensure they have received their certificate in a timely manner to facilitate their tax return filing, which is generally due by April 15 of the following year. Staying aware of these deadlines helps avoid penalties and ensures proper tax compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 16 see rule 311a certificate under section 203

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FORM NO 16 See Rule 311a Certificate Under Section 203?

The FORM NO 16 See Rule 311a Certificate Under Section 203 is a tax certificate issued by employers to their employees, detailing the tax deducted at source (TDS) on salary. This certificate is essential for employees to file their income tax returns accurately. It provides a summary of the salary paid and the TDS deducted, ensuring compliance with tax regulations.

-

How can airSlate SignNow help with the FORM NO 16 See Rule 311a Certificate Under Section 203?

airSlate SignNow simplifies the process of generating and sending the FORM NO 16 See Rule 311a Certificate Under Section 203. With our platform, businesses can easily create, eSign, and distribute this certificate to employees, ensuring timely compliance with tax requirements. Our user-friendly interface makes it easy for HR departments to manage these documents efficiently.

-

What are the pricing options for using airSlate SignNow for FORM NO 16 See Rule 311a Certificate Under Section 203?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that allow for the efficient management of documents like the FORM NO 16 See Rule 311a Certificate Under Section 203. You can choose a plan that fits your budget while ensuring compliance and ease of use.

-

What features does airSlate SignNow provide for managing FORM NO 16 See Rule 311a Certificate Under Section 203?

airSlate SignNow provides a range of features for managing the FORM NO 16 See Rule 311a Certificate Under Section 203, including customizable templates, secure eSigning, and automated workflows. These features streamline the document management process, making it easier for businesses to handle tax certificates efficiently. Additionally, our platform ensures that all documents are stored securely and are easily accessible.

-

Can airSlate SignNow integrate with other software for handling FORM NO 16 See Rule 311a Certificate Under Section 203?

Yes, airSlate SignNow offers integrations with various software solutions, enhancing your ability to manage the FORM NO 16 See Rule 311a Certificate Under Section 203. Whether you use HR management systems or accounting software, our platform can seamlessly connect to streamline your document workflows. This integration helps ensure that all relevant data is synchronized and up-to-date.

-

What are the benefits of using airSlate SignNow for FORM NO 16 See Rule 311a Certificate Under Section 203?

Using airSlate SignNow for the FORM NO 16 See Rule 311a Certificate Under Section 203 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform allows for quick document creation and distribution, saving time for HR teams. Additionally, the secure eSigning feature ensures that all certificates are legally binding and compliant with regulations.

-

Is airSlate SignNow secure for handling sensitive documents like FORM NO 16 See Rule 311a Certificate Under Section 203?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents like the FORM NO 16 See Rule 311a Certificate Under Section 203. Our platform is designed to safeguard your data, ensuring that only authorized users have access to critical information. You can trust us to handle your documents securely.

Get more for FORM NO 16 See Rule 311a Certificate Under Section 203

Find out other FORM NO 16 See Rule 311a Certificate Under Section 203

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free