Florida Dr Sales Tax 2021-2026

What is the Florida Dr Sales Tax

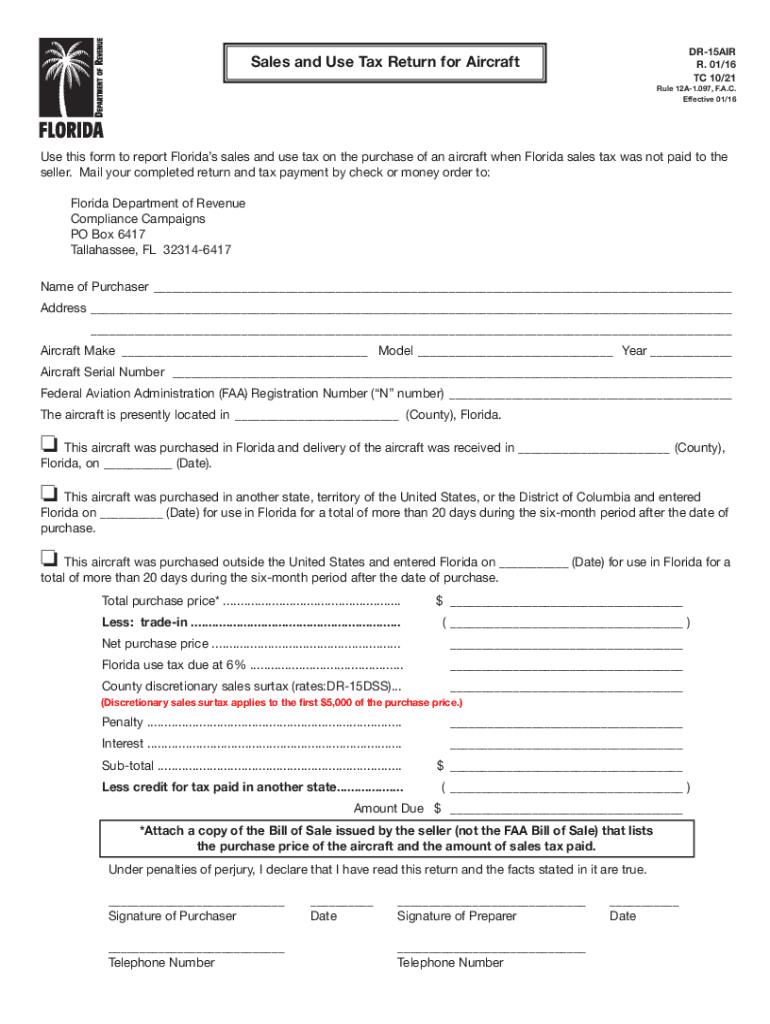

The Florida DR sales tax is a specific tax imposed on the sale or use of tangible personal property within the state. This tax is essential for funding various state services and infrastructure. It applies to businesses and individuals who purchase or use taxable items in Florida. Understanding this tax is crucial for compliance and financial planning.

How to use the Florida Dr Sales Tax

To effectively use the Florida DR sales tax, businesses must first determine if their products or services are subject to this tax. Once confirmed, they need to collect the appropriate tax amount from customers at the point of sale. This collected tax must be reported and remitted to the Florida Department of Revenue on a regular basis, typically monthly or quarterly, depending on the business's tax liability.

Steps to complete the Florida Dr Sales Tax

Completing the Florida DR sales tax involves several key steps:

- Determine if your business activities are taxable under Florida law.

- Register for a sales tax permit with the Florida Department of Revenue.

- Collect the appropriate sales tax from customers during sales transactions.

- Maintain accurate records of all sales and tax collected.

- File the Florida DR sales tax return and remit the collected tax by the due date.

Required Documents

When dealing with the Florida DR sales tax, certain documents are necessary for compliance. These include:

- Sales tax registration certificate.

- Records of sales transactions and tax collected.

- Completed Florida DR sales tax return forms.

- Any relevant exemption certificates for tax-exempt sales.

Penalties for Non-Compliance

Failure to comply with Florida DR sales tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Businesses are encouraged to stay informed about their tax obligations to avoid these consequences.

Form Submission Methods

Businesses can submit their Florida DR sales tax returns through various methods. These include:

- Online submission via the Florida Department of Revenue's e-Services portal.

- Mailing paper forms to the appropriate state office.

- In-person submission at designated state offices.

Create this form in 5 minutes or less

Find and fill out the correct florida dr sales tax

Create this form in 5 minutes!

How to create an eSignature for the florida dr sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the florida dr sales tax rate?

The florida dr sales tax rate is currently set at 6% for most goods and services. However, certain counties may impose additional local sales taxes, which can increase the total rate. It's essential to check the specific county regulations to ensure compliance with the florida dr sales tax.

-

How does airSlate SignNow help with florida dr sales tax documentation?

airSlate SignNow streamlines the process of sending and signing documents related to florida dr sales tax. Our platform allows you to create, send, and eSign tax-related documents quickly and securely, ensuring that you stay compliant with state regulations. This efficiency can save your business time and reduce the risk of errors.

-

Are there any additional fees associated with airSlate SignNow for florida dr sales tax forms?

airSlate SignNow offers transparent pricing with no hidden fees for using our platform to manage florida dr sales tax forms. You can choose from various subscription plans that fit your business needs, ensuring you only pay for the features you require. This cost-effective solution helps you manage your tax documentation efficiently.

-

Can I integrate airSlate SignNow with my accounting software for florida dr sales tax?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your florida dr sales tax documentation. This integration allows you to automate the process of sending and signing tax forms directly from your accounting system. By streamlining these tasks, you can focus more on your business operations.

-

What features does airSlate SignNow offer for managing florida dr sales tax?

airSlate SignNow provides a range of features tailored for managing florida dr sales tax, including customizable templates, secure eSigning, and document tracking. These features ensure that your tax documents are handled efficiently and securely. Additionally, our user-friendly interface makes it easy for anyone to navigate the platform.

-

How can airSlate SignNow benefit my business in relation to florida dr sales tax?

By using airSlate SignNow, your business can benefit from faster document turnaround times and improved compliance with florida dr sales tax regulations. Our platform reduces the need for paper documents, which not only saves time but also minimizes the risk of losing important tax paperwork. This efficiency can lead to better financial management for your business.

-

Is airSlate SignNow suitable for small businesses dealing with florida dr sales tax?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing florida dr sales tax. Our cost-effective solutions and easy-to-use interface make it accessible for small business owners who may not have extensive resources. This allows them to handle their tax documentation efficiently without breaking the bank.

Get more for Florida Dr Sales Tax

Find out other Florida Dr Sales Tax

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure