Form 15227 En Sp Rev 1 2025-2026

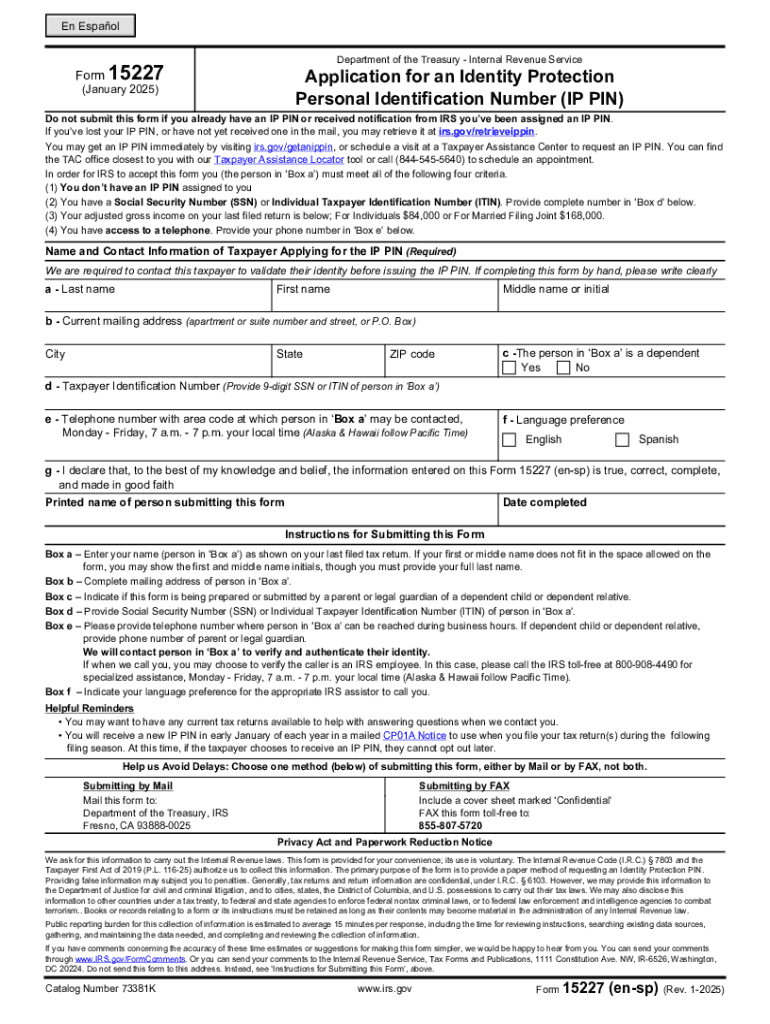

What is IRS Form 15227?

IRS Form 15227 is an application used by taxpayers to request an Identity Protection Personal Identification Number (IP PIN) from the Internal Revenue Service. This form is particularly important for individuals who have been victims of identity theft or who believe they may be at risk of identity theft. The IP PIN serves as an additional layer of security, helping to protect against fraudulent tax returns filed in the taxpayer's name.

How to Use IRS Form 15227

To use IRS Form 15227 effectively, taxpayers must complete the application accurately. The form requires personal information, including the taxpayer's name, Social Security number, and address. Once filled out, the form should be submitted to the IRS through the specified methods. After processing, the IRS will issue an IP PIN, which must be used when filing future tax returns to verify the taxpayer's identity.

Steps to Complete IRS Form 15227

Completing IRS Form 15227 involves several key steps:

- Gather necessary personal information, including your Social Security number and address.

- Download the form from the IRS website or obtain a printed copy.

- Fill out the form carefully, ensuring all information is accurate and complete.

- Review the form for any errors before submission.

- Submit the completed form to the IRS using the designated submission methods.

Eligibility Criteria for IRS Form 15227

Eligibility for IRS Form 15227 primarily includes individuals who have experienced identity theft or who have been notified by the IRS of potential identity theft issues. Taxpayers must provide evidence of their identity theft experience, which may include documentation from the IRS or law enforcement. Additionally, individuals must have a valid Social Security number to apply for an IP PIN.

Form Submission Methods

IRS Form 15227 can be submitted through various methods. Taxpayers can choose to mail the completed form to the appropriate IRS address or submit it electronically through the IRS e-Services platform, if eligible. It is essential to follow the instructions provided on the form to ensure proper submission and processing by the IRS.

Required Documents for IRS Form 15227

When submitting IRS Form 15227, taxpayers may need to provide supporting documents to verify their identity. This may include a copy of a government-issued ID, such as a driver's license or passport, and any correspondence from the IRS regarding identity theft. Having these documents ready can help streamline the application process and improve the chances of a successful request for an IP PIN.

Handy tips for filling out Form 15227 en sp Rev 1 online

Quick steps to complete and e-sign Form 15227 en sp Rev 1 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Get access to a HIPAA and GDPR compliant service for maximum straightforwardness. Use signNow to electronically sign and send Form 15227 en sp Rev 1 for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 15227 en sp rev 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 15227?

IRS Form 15227 is a form used by taxpayers to request a waiver for certain penalties related to late filing or payment. Understanding how to properly fill out and submit IRS Form 15227 can help you avoid unnecessary penalties and streamline your tax process.

-

How can airSlate SignNow assist with IRS Form 15227?

airSlate SignNow provides a user-friendly platform that allows you to easily eSign and send IRS Form 15227 securely. With our solution, you can ensure that your form is completed accurately and submitted on time, reducing the risk of penalties.

-

Is there a cost associated with using airSlate SignNow for IRS Form 15227?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution ensures that you can manage documents like IRS Form 15227 without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing IRS Form 15227?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing IRS Form 15227. These features help streamline the process, making it easier to handle your tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for IRS Form 15227?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage IRS Form 15227 alongside your existing tools. This integration capability enhances your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for IRS Form 15227?

Using airSlate SignNow for IRS Form 15227 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the eSigning process, ensuring that you can focus on what matters most—your business.

-

How secure is airSlate SignNow when handling IRS Form 15227?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive information, including IRS Form 15227, ensuring that your documents are safe from unauthorized access.

Get more for Form 15227 en sp Rev 1

Find out other Form 15227 en sp Rev 1

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template