Form 15227 2021

What is the Form 15227

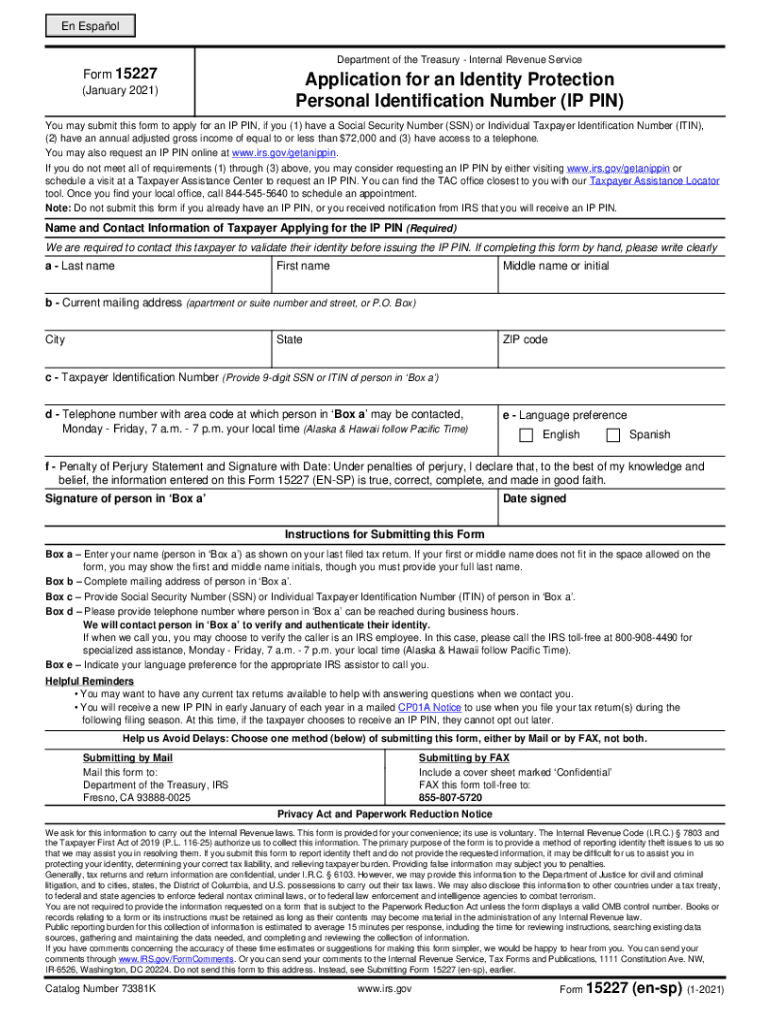

The Form 15227 is a document used by taxpayers to apply for an Identity Protection Personal Identification Number (IP PIN) from the IRS. This form is essential for individuals who have been victims of identity theft or who wish to enhance their security when filing taxes. By obtaining an IP PIN, taxpayers can help prevent unauthorized use of their Social Security number for fraudulent tax returns.

How to use the Form 15227

Using the Form 15227 involves a straightforward process. Taxpayers must complete the form with accurate personal information, including their name, Social Security number, and contact details. After filling out the form, it should be submitted to the IRS, either electronically or through the mail. Once processed, the IRS will issue an IP PIN, which must be used in future tax filings to verify the taxpayer's identity.

Steps to complete the Form 15227

Completing the Form 15227 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your Social Security number and personal identification details.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the form electronically through the IRS website or mail it to the appropriate address.

Legal use of the Form 15227

The legal use of the Form 15227 is governed by IRS regulations. It is crucial for taxpayers to ensure that the information provided is truthful and accurate. Misrepresentation or fraudulent information can lead to penalties or legal consequences. The form serves as a protective measure, allowing individuals to secure their tax filings and prevent identity theft.

Required Documents

When submitting the Form 15227, certain documents may be required to verify identity and support the application. These may include:

- A valid government-issued photo ID, such as a driver's license or passport.

- Proof of identity theft, such as a police report or IRS correspondence.

- Any additional documentation that may support your claim for an IP PIN.

Form Submission Methods

The Form 15227 can be submitted through various methods. Taxpayers have the option to:

- File online via the IRS website for faster processing.

- Mail the completed form to the designated IRS address.

- Visit a local IRS office for in-person assistance, if needed.

Eligibility Criteria

To be eligible for the Form 15227, individuals must meet specific criteria. Generally, this includes:

- Having been a victim of identity theft.

- Desiring to enhance security for future tax filings.

- Providing valid identification and supporting documentation as required by the IRS.

Quick guide on how to complete form 15227

Effortlessly prepare Form 15227 on any device

Online document management has gained traction among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Form 15227 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to edit and eSign Form 15227 with ease

- Find Form 15227 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize substantial parts of the documents or obscure sensitive details with tools specifically designed for that by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 15227 to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 15227

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The way to create an e-signature right from your smart phone

How to create an e-signature for a PDF on iOS devices

The way to create an e-signature for a PDF on Android OS

People also ask

-

What is form 15227 and why is it important?

Form 15227 is a crucial document used by businesses for various compliance and regulatory needs. It helps ensure that electronic signatures are compliant with legal standards, making it essential for any organization looking to modernize its document workflows.

-

How does airSlate SignNow handle form 15227?

airSlate SignNow provides a seamless platform for businesses to manage form 15227 effortlessly. Our solution allows users to easily upload, edit, and eSign this form, ensuring a smooth process while maintaining compliance and security.

-

What are the pricing options for using airSlate SignNow for form 15227?

Our pricing plans for airSlate SignNow are designed to be budget-friendly while meeting the needs of different businesses. By subscribing, you can access features that specifically support the handling of form 15227, with plans that scale according to your volume of usage.

-

Can I integrate airSlate SignNow with other tools for form 15227?

Yes, airSlate SignNow offers robust integrations with various third-party applications to enhance the workflow of form 15227. Whether you use CRM systems or document management platforms, our integrations ensure that you can manage your forms efficiently.

-

What features does airSlate SignNow offer for managing form 15227?

airSlate SignNow includes features such as customizable templates, real-time tracking, and multi-user collaboration, specifically designed for form 15227. These tools streamline the eSigning process, allowing you to gather and manage signatures with ease.

-

How secure is airSlate SignNow for handling form 15227?

Security is a top priority at airSlate SignNow, especially for sensitive documents like form 15227. Our platform employs industry-standard encryption and compliance measures to safeguard your data, providing peace of mind while you eSign and manage important documents.

-

What benefits does airSlate SignNow provide when using form 15227?

Using airSlate SignNow for form 15227 can signNowly reduce turnaround times and improve efficiency. The digital solution not only speeds up the signing process but also minimizes errors and allows easy access to completed forms anytime, anywhere.

Get more for Form 15227

- Tenant consent to background and reference check kansas form

- Kansas month form

- Residential rental lease agreement kansas form

- Tenant welcome letter kansas form

- Warning of default on commercial lease kansas form

- Warning of default on residential lease kansas form

- Landlord tenant closing statement to reconcile security deposit kansas form

- Ks name change form

Find out other Form 15227

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT