Form 15227 En Sp Rev 1 Application for an Identity Protection Personal Identification Number IP PIN English Spanish Version 2024

Understanding IRS Form 15227

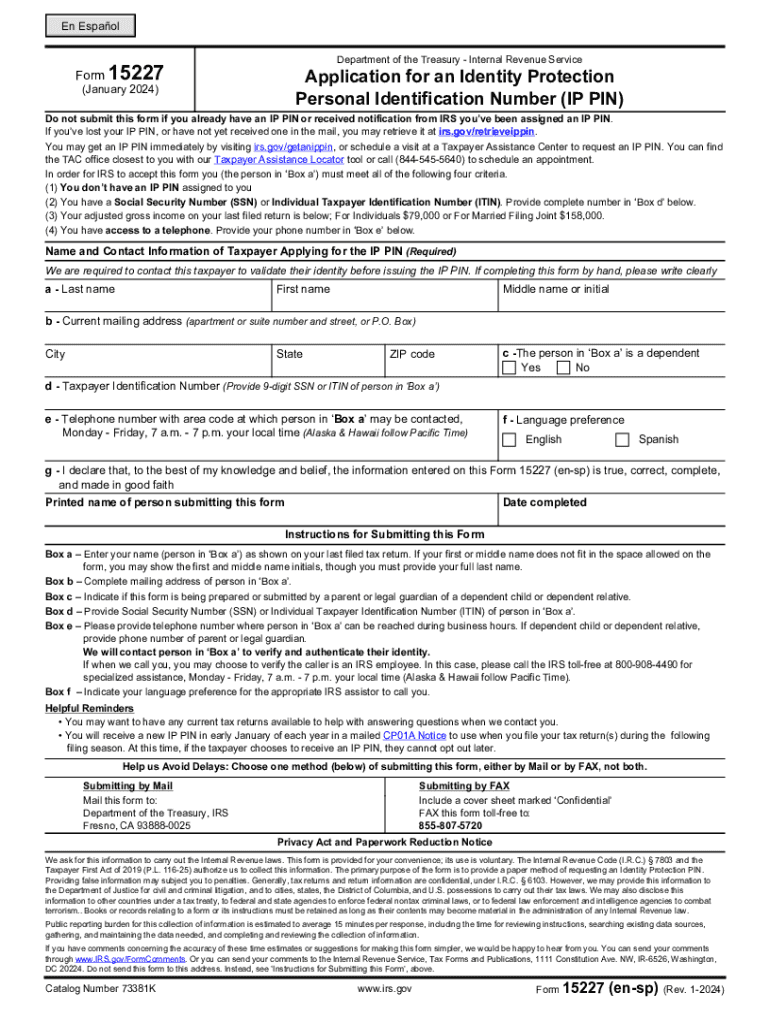

The IRS Form 15227, also known as the Application for an Identity Protection Personal Identification Number (IP PIN), is designed to help taxpayers protect themselves against identity theft. This form allows eligible individuals to request an IP PIN, which is a six-digit number that must be included on their tax returns. The IP PIN serves as an additional layer of security, ensuring that only the rightful taxpayer can file a return using their Social Security number. This form is available in both English and Spanish versions, making it accessible to a wider audience.

How to Complete IRS Form 15227

Filling out IRS Form 15227 involves several key steps. First, gather necessary personal information, including your name, Social Security number, and address. Next, ensure you have documentation that verifies your identity, such as a driver's license or utility bill. The form requires you to provide details about any previous tax returns filed, which helps the IRS verify your identity. After completing the form, review all entries for accuracy before submission. This careful approach minimizes the risk of delays in processing your application.

Obtaining IRS Form 15227

IRS Form 15227 can be obtained directly from the IRS website or through various tax preparation services. The form is available as a fillable PDF, allowing you to complete it electronically before printing. If you prefer a paper version, you can print it out and fill it in by hand. Ensure you are using the most current version of the form to avoid any potential issues during the application process.

Eligibility Criteria for IRS Form 15227

To be eligible for an IP PIN through IRS Form 15227, you must have experienced identity theft or be a victim of a data breach that compromises your personal information. Additionally, you must be able to provide sufficient documentation to verify your identity. This includes having a valid Social Security number and being able to provide personal information from your most recent tax return. Understanding these criteria is crucial for successfully obtaining your IP PIN.

Submitting IRS Form 15227

IRS Form 15227 can be submitted either online or by mail. If you choose to submit it online, you will typically need to use the IRS’s secure online portal. For those opting to mail the form, ensure it is sent to the correct address specified in the form instructions. It is advisable to keep a copy of the completed form for your records. Tracking your submission can also help you confirm that it has been received and processed by the IRS.

Key Elements of IRS Form 15227

Several key elements are essential to understand when working with IRS Form 15227. The form requires personal identification details, including your full name, Social Security number, and address. Additionally, you must provide information regarding your previous tax filings. The form also includes sections for documenting any identity theft incidents you have experienced. Understanding these elements ensures that you provide complete and accurate information, which is critical for a successful application.

Handy tips for filling out Form 15227 en sp Rev 1 Application For An Identity Protection Personal Identification Number IP PIN English Spanish Version online

Quick steps to complete and e-sign Form 15227 en sp Rev 1 Application For An Identity Protection Personal Identification Number IP PIN English Spanish Version online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant service for maximum simplicity. Use signNow to electronically sign and share Form 15227 en sp Rev 1 Application For An Identity Protection Personal Identification Number IP PIN English Spanish Version for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 15227 en sp rev 1 application for an identity protection personal identification number ip pin english spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 15227 en sp rev 1 application for an identity protection personal identification number ip pin english spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 15227 and how can airSlate SignNow help?

IRS Form 15227 is used for requesting a tax return transcript. With airSlate SignNow, you can easily eSign and send this form securely, ensuring that your sensitive information is protected while streamlining the submission process.

-

How does airSlate SignNow ensure compliance with IRS Form 15227?

airSlate SignNow is designed with compliance in mind, providing features that meet IRS standards for electronic signatures. This ensures that when you eSign IRS Form 15227, your submission is legally binding and accepted by the IRS.

-

What are the pricing options for using airSlate SignNow for IRS Form 15227?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that fits your needs, allowing you to efficiently manage documents like IRS Form 15227 without breaking the bank.

-

Can I integrate airSlate SignNow with other software for IRS Form 15227?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. This means you can easily manage IRS Form 15227 alongside your existing tools, improving efficiency and productivity.

-

What features does airSlate SignNow offer for managing IRS Form 15227?

airSlate SignNow provides a range of features including customizable templates, secure storage, and real-time tracking. These tools make it easier to manage IRS Form 15227 and ensure that all necessary steps are completed efficiently.

-

Is airSlate SignNow suitable for small businesses handling IRS Form 15227?

Absolutely! airSlate SignNow is an ideal solution for small businesses looking to manage IRS Form 15227 efficiently. Its user-friendly interface and cost-effective pricing make it accessible for businesses of all sizes.

-

How can airSlate SignNow improve the process of submitting IRS Form 15227?

By using airSlate SignNow, you can streamline the submission process of IRS Form 15227. The platform allows for quick eSigning, secure document sharing, and easy tracking, which signNowly reduces the time and effort involved.

Get more for Form 15227 en sp Rev 1 Application For An Identity Protection Personal Identification Number IP PIN English Spanish Version

Find out other Form 15227 en sp Rev 1 Application For An Identity Protection Personal Identification Number IP PIN English Spanish Version

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors