Form 1099 PATR Rev April

What is the Form 1099 PATR Rev April

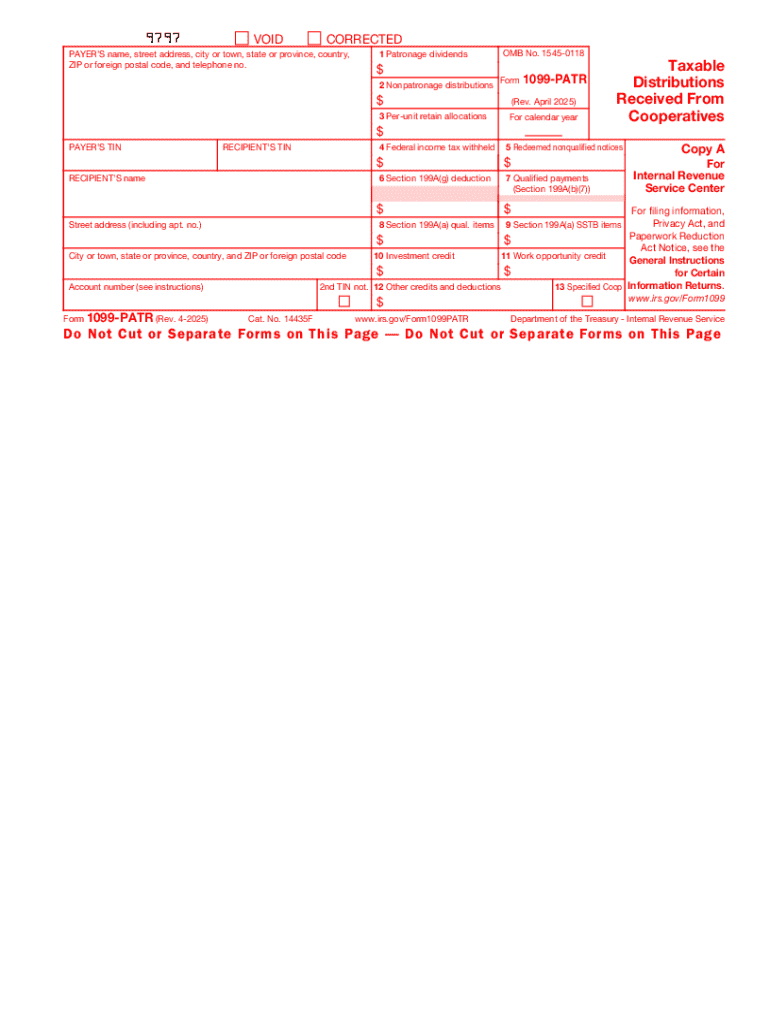

The Form 1099 PATR Rev April is a tax form used in the United States to report patronage dividends received by members of cooperatives. This form is particularly relevant for individuals and businesses that are part of agricultural or other types of cooperatives. It provides essential information regarding the amount of patronage dividends distributed, which may be taxable income for the recipients. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Form 1099 PATR Rev April

The Form 1099 PATR Rev April is used to report patronage dividends to the IRS and the recipients. Recipients must include the amounts reported on this form when filing their tax returns. It is important to review the information carefully to ensure accuracy. This form is typically issued by cooperatives to their members and should be retained for tax records. Proper use of this form helps in maintaining compliance with tax obligations and ensures that recipients report their income correctly.

Steps to complete the Form 1099 PATR Rev April

Completing the Form 1099 PATR Rev April involves several steps:

- Gather necessary information, including the recipient's name, address, and taxpayer identification number (TIN).

- Enter the total amount of patronage dividends paid to the recipient in the appropriate box.

- Include any other relevant details, such as the cooperative's name and address.

- Review the completed form for accuracy before submission.

- Distribute copies to the recipient and submit the form to the IRS as required.

Key elements of the Form 1099 PATR Rev April

The Form 1099 PATR Rev April includes several key elements that are essential for accurate reporting:

- Recipient Information: This section includes the name, address, and TIN of the recipient.

- Cooperative Information: The name and address of the cooperative issuing the form.

- Patronage Dividends: The total amount of patronage dividends paid to the recipient during the tax year.

- Tax Reporting Requirements: Information on how the recipient should report the income on their tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 PATR Rev April are crucial for compliance. Generally, the form must be provided to recipients by January 31 of the year following the tax year in which the patronage dividends were paid. Additionally, the form must be submitted to the IRS by the end of February if filed on paper, or by March 31 if filed electronically. Adhering to these deadlines helps avoid penalties and ensures that all tax obligations are met in a timely manner.

Penalties for Non-Compliance

Failure to file the Form 1099 PATR Rev April or providing incorrect information can lead to penalties imposed by the IRS. These penalties vary based on the severity and timing of the non-compliance. For instance, if the form is filed late, the penalties can increase depending on how delayed the submission is. It is important for cooperatives to ensure accurate and timely filing to avoid these financial repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099 patr rev april

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1099 PATR Rev April?

Form 1099 PATR Rev April is a tax form used to report patronage dividends and other distributions from cooperatives. It is essential for businesses and individuals who receive such payments to accurately report them to the IRS. Understanding this form is crucial for compliance and tax reporting.

-

How can airSlate SignNow help with Form 1099 PATR Rev April?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign Form 1099 PATR Rev April. With its user-friendly interface, you can easily manage your tax documents and ensure they are signed and submitted on time. This streamlines your workflow and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for Form 1099 PATR Rev April?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for those specifically handling Form 1099 PATR Rev April. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need. Additionally, there are often promotional discounts available for new users.

-

What features does airSlate SignNow offer for managing Form 1099 PATR Rev April?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities for Form 1099 PATR Rev April. These tools help you streamline the document management process, making it easier to handle tax forms efficiently. The platform also offers tracking and reminders to ensure timely submissions.

-

Is airSlate SignNow secure for handling Form 1099 PATR Rev April?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling Form 1099 PATR Rev April. The platform uses advanced encryption and secure data storage to protect sensitive information. Additionally, it complies with industry standards to ensure your documents are handled securely.

-

Can I integrate airSlate SignNow with other software for Form 1099 PATR Rev April?

Absolutely! airSlate SignNow offers integrations with various software solutions, allowing you to seamlessly manage Form 1099 PATR Rev April alongside your existing tools. This integration capability enhances your workflow and ensures that all your documents are in sync across platforms.

-

What are the benefits of using airSlate SignNow for Form 1099 PATR Rev April?

Using airSlate SignNow for Form 1099 PATR Rev April provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. The platform simplifies the eSigning process, allowing you to focus on your core business activities. Additionally, it helps ensure compliance with tax regulations.

Get more for Form 1099 PATR Rev April

Find out other Form 1099 PATR Rev April

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy