5082, Sales, Use and Withholding Taxes Amended Annual Return 2016-2026

Understanding the 5082, Sales, Use And Withholding Taxes Amended Annual Return

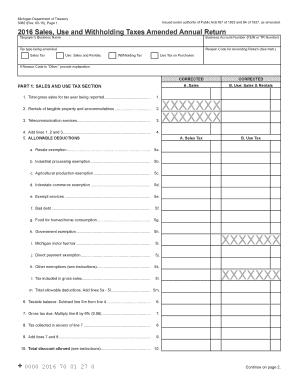

The 5082 form is a crucial document for businesses in the United States that need to report sales, use, and withholding taxes. It serves as an amended annual return, allowing taxpayers to correct previously filed returns. This form ensures compliance with state tax regulations and helps maintain accurate financial records. Businesses must be aware of the specific requirements and implications of filing this form to avoid penalties and ensure smooth operations.

Steps to Complete the 5082, Sales, Use And Withholding Taxes Amended Annual Return

Completing the 5082 form involves several key steps:

- Gather necessary financial records, including previous tax returns and supporting documentation.

- Carefully review the original return for any errors or omissions that need correction.

- Fill out the 5082 form accurately, ensuring all information is current and reflects the necessary changes.

- Double-check calculations, especially for tax amounts owed or refunds due.

- Submit the completed form by the designated deadline to avoid penalties.

Legal Use of the 5082, Sales, Use And Withholding Taxes Amended Annual Return

The 5082 form is legally recognized for amending previously filed sales, use, and withholding tax returns. It is essential for businesses to use this form correctly to ensure compliance with state tax laws. Filing the amended return not only corrects past errors but also protects the business from potential legal repercussions associated with inaccurate tax reporting.

Filing Deadlines and Important Dates

Timely filing of the 5082 form is critical. Each state may have different deadlines for submitting amended returns. Typically, businesses should file the amended return within a specific period after discovering an error, often within three years from the original filing date. It is crucial to consult state tax guidelines to ensure compliance with the correct timelines.

Required Documents for the 5082, Sales, Use And Withholding Taxes Amended Annual Return

When preparing to file the 5082 form, businesses should gather the following documents:

- Previous tax returns that need amending.

- Supporting documentation for any adjustments made, such as receipts or invoices.

- Records of any payments made towards the originally filed tax return.

- Any correspondence with tax authorities regarding the original return.

Examples of Using the 5082, Sales, Use And Withholding Taxes Amended Annual Return

Businesses may find themselves needing to file the 5082 form in various scenarios, such as:

- Correcting an error in reported sales figures that affects tax liability.

- Adjusting withholding amounts due to changes in employee status or earnings.

- Updating exemptions or deductions that were incorrectly claimed in the original return.

Who Issues the 5082, Sales, Use And Withholding Taxes Amended Annual Return

The 5082 form is typically issued by state tax authorities. Each state has its own tax department responsible for administering tax laws and regulations. Businesses must ensure they are using the correct version of the form as issued by their respective state to ensure compliance and avoid issues with tax filings.

Create this form in 5 minutes or less

Find and fill out the correct 5082 sales use and withholding taxes amended annual return

Create this form in 5 minutes!

How to create an eSignature for the 5082 sales use and withholding taxes amended annual return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5082, Sales, Use And Withholding Taxes Amended Annual Return?

The 5082, Sales, Use And Withholding Taxes Amended Annual Return is a form used by businesses to report and amend their sales, use, and withholding tax obligations. This return allows companies to correct any errors from previous filings and ensure compliance with tax regulations. Understanding this form is crucial for maintaining accurate tax records and avoiding penalties.

-

How can airSlate SignNow help with the 5082, Sales, Use And Withholding Taxes Amended Annual Return?

airSlate SignNow simplifies the process of preparing and submitting the 5082, Sales, Use And Withholding Taxes Amended Annual Return by providing an easy-to-use platform for document management. Users can create, send, and eSign necessary documents quickly, ensuring that all tax returns are filed accurately and on time. This efficiency helps businesses stay compliant with tax laws.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and larger organizations. Each plan provides access to features that streamline the preparation and submission of forms like the 5082, Sales, Use And Withholding Taxes Amended Annual Return. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the 5082, Sales, Use And Withholding Taxes Amended Annual Return. These tools enhance productivity and ensure that all necessary documents are completed and submitted correctly. Additionally, users can collaborate in real-time, making the process more efficient.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with various tax regulations, ensuring that your documents, including the 5082, Sales, Use And Withholding Taxes Amended Annual Return, are handled securely and in accordance with legal standards. The platform employs advanced security measures to protect sensitive information, giving users peace of mind when managing their tax documents.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing for seamless data transfer and management of tax documents like the 5082, Sales, Use And Withholding Taxes Amended Annual Return. This integration helps streamline your workflow, making it easier to keep track of your tax obligations and financial records.

-

What are the benefits of using airSlate SignNow for tax returns?

Using airSlate SignNow for tax returns, including the 5082, Sales, Use And Withholding Taxes Amended Annual Return, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced accuracy. The platform's user-friendly interface allows for quick document preparation and eSigning, which saves time and minimizes errors. Additionally, businesses can maintain better compliance with tax regulations.

Get more for 5082, Sales, Use And Withholding Taxes Amended Annual Return

- Field examiner application national labor relations board nlrb form

- Laser procedure consent form tucson eye care

- Form hfwh 50 1220mr 0707

- Virginia association of realtors exclusive authorization to sell this is a legally binding contract if not understood seek form

- Bd211 general betting duty bookmakers return you use this form to submit your bookmakers return hmrc gov

- This independent contractor agreement this quotagreementquot is made as of this 22 day of january form

- League identification number littleleague form

- Empower retirement 401k rollover form

Find out other 5082, Sales, Use And Withholding Taxes Amended Annual Return

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document