Form 5082 2015

What is the Form 5082

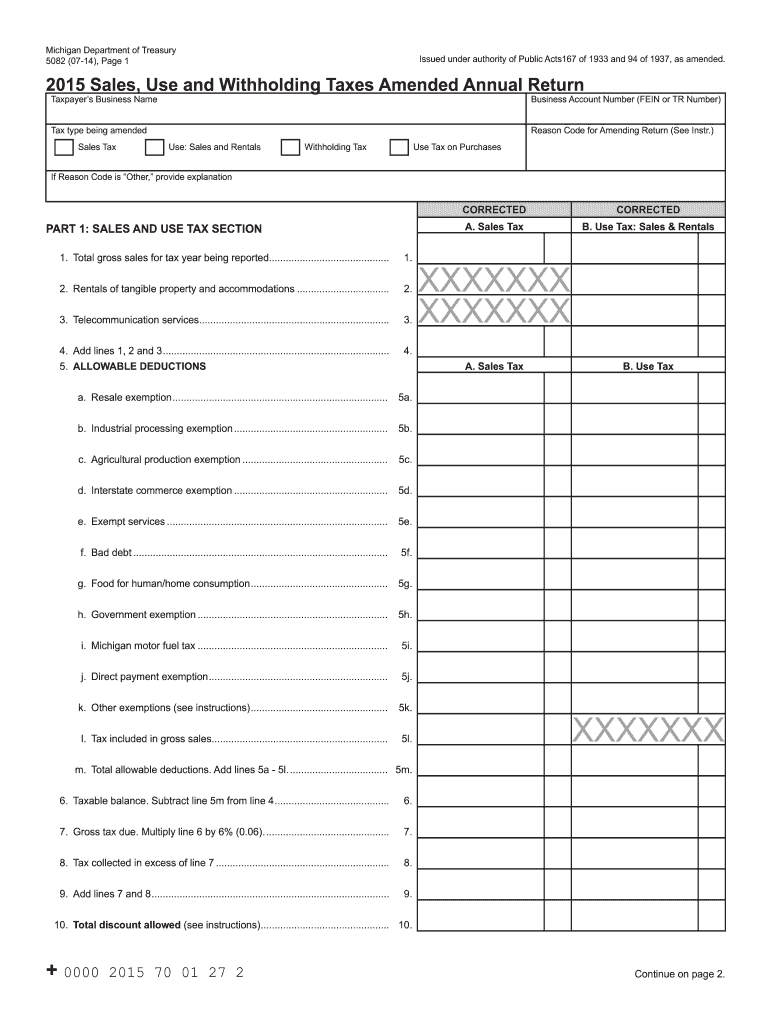

The Michigan Form 5082, also known as the Michigan Annual Return for Sales Use and Withholding Taxes, is a tax form required for businesses operating within the state of Michigan. This form is essential for reporting the sales use and withholding taxes collected during a specific tax year. By submitting Form 5082, businesses ensure compliance with state tax regulations and contribute to the state's revenue system.

How to use the Form 5082

To effectively use the Michigan Form 5082, businesses must accurately report their sales and withholding tax amounts. This involves compiling data on all taxable sales, exemptions, and any tax collected throughout the year. The completed form must be submitted to the Michigan Department of Treasury, ensuring that all figures are correct to avoid penalties or audits. Utilizing digital solutions can streamline this process, allowing for easier data entry and submission.

Steps to complete the Form 5082

Completing the Michigan Form 5082 involves several key steps:

- Gather all necessary financial records, including sales receipts and tax collected.

- Fill in the business information section, including name, address, and tax identification number.

- Report total sales, exempt sales, and the total tax collected.

- Calculate any adjustments or credits that apply to your business.

- Sign and date the form to certify that the information provided is accurate.

Once completed, the form can be submitted electronically or via mail to the appropriate state department.

Legal use of the Form 5082

The Michigan Form 5082 is legally binding when completed and submitted according to state regulations. To ensure its legal validity, businesses must comply with the requirements set forth by the Michigan Department of Treasury. This includes accurate reporting of tax obligations and adherence to submission deadlines. Electronic signatures are accepted, provided they meet the standards outlined in the ESIGN and UETA Acts, ensuring the form's authenticity and integrity.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Form 5082 are crucial for maintaining compliance. Typically, the form must be filed annually, with the deadline falling on the last day of the month following the end of the tax year. For businesses operating on a calendar year, this means the form is due by January thirty-first. It is important to stay informed about any changes to these deadlines, as late submissions may incur penalties.

Form Submission Methods (Online / Mail / In-Person)

The Michigan Form 5082 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Businesses can file electronically through the Michigan Department of Treasury's online portal, ensuring a faster processing time.

- Mail Submission: The form can be printed and mailed to the designated address provided by the state, though this may result in longer processing times.

- In-Person Submission: Businesses may also choose to deliver the form in person to their local treasury office for immediate confirmation of receipt.

Quick guide on how to complete 5082 sales use and withholding taxes amended annual return 5082 sales use and withholding taxes amended annual return michigan

Effortlessly manage Form 5082 on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, amend, and eSign your documents quickly and without complications. Handle Form 5082 across any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to amend and eSign Form 5082 effortlessly

- Obtain Form 5082 and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or mask sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details carefully and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it directly to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Form 5082 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5082 sales use and withholding taxes amended annual return 5082 sales use and withholding taxes amended annual return michigan

Create this form in 5 minutes!

How to create an eSignature for the 5082 sales use and withholding taxes amended annual return 5082 sales use and withholding taxes amended annual return michigan

How to generate an eSignature for your 5082 Sales Use And Withholding Taxes Amended Annual Return 5082 Sales Use And Withholding Taxes Amended Annual Return Michigan online

How to create an electronic signature for your 5082 Sales Use And Withholding Taxes Amended Annual Return 5082 Sales Use And Withholding Taxes Amended Annual Return Michigan in Google Chrome

How to generate an electronic signature for signing the 5082 Sales Use And Withholding Taxes Amended Annual Return 5082 Sales Use And Withholding Taxes Amended Annual Return Michigan in Gmail

How to create an eSignature for the 5082 Sales Use And Withholding Taxes Amended Annual Return 5082 Sales Use And Withholding Taxes Amended Annual Return Michigan straight from your mobile device

How to generate an eSignature for the 5082 Sales Use And Withholding Taxes Amended Annual Return 5082 Sales Use And Withholding Taxes Amended Annual Return Michigan on iOS devices

How to create an electronic signature for the 5082 Sales Use And Withholding Taxes Amended Annual Return 5082 Sales Use And Withholding Taxes Amended Annual Return Michigan on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to rm50822023?

airSlate SignNow is an innovative solution that enables businesses to send and eSign documents seamlessly. The rm50822023 keyword is associated with our dedicated landing page, providing detailed information about our functionalities, pricing, and features. This makes it easier for potential customers to navigate their options.

-

What pricing plans does airSlate SignNow offer under rm50822023?

Under the rm50822023 offering, airSlate SignNow provides various pricing plans designed to cater to diverse business needs. These plans range from basic options for small startups to advanced features for enterprise-level clients. Our tiered pricing allows you to choose a plan that best suits your document signing and workflow processes.

-

What key features can be found in airSlate SignNow associated with rm50822023?

The rm50822023 section of airSlate SignNow highlights numerous features, including customizable templates, in-app notifications, and secure cloud storage. These features facilitate a streamlined signing process, ensuring that users can efficiently manage documents. Furthermore, the platform is designed to enhance user experience and overall productivity.

-

How can airSlate SignNow improve my business efficiency as suggested by rm50822023?

By utilizing airSlate SignNow as indicated by rm50822023, businesses can greatly enhance their efficiency through automated workflows and real-time collaboration. This tool minimizes the time spent on paperwork, allows for quick approvals, and helps maintain compliance with electronic signature regulations. Ultimately, it enables teams to focus on more strategic tasks.

-

Is airSlate SignNow mobile-friendly when engaging with rm50822023?

Absolutely! The airSlate SignNow application is fully optimized for mobile devices, making it easy for users to access the rm50822023 platform on-the-go. This ensures that signing documents can happen anytime and anywhere, providing ultimate convenience for users who need flexibility in their operations.

-

What integrations are available with airSlate SignNow as highlighted in rm50822023?

airSlate SignNow integrates seamlessly with various third-party applications like Google Workspace, Microsoft Office, and CRM systems, as referenced in rm50822023. These integrations allow users to streamline their workflows and improve data management, enhancing overall productivity and user satisfaction.

-

What are the security features of airSlate SignNow in relation to rm50822023?

Security is a top priority for airSlate SignNow, and under the rm50822023 umbrella, we offer robust protection for all documents. Features like two-factor authentication, encryption, and secure cloud storage ensure that sensitive information remains confidential and protected from unauthorized access.

Get more for Form 5082

Find out other Form 5082

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors